Year End Review 2024

&

Outlook 2025

31 DECEMBER 2024

OVERVIEW

As one year draws to a close, and another commences, Ireland’s tourism industry continues to show resilience despite being buffeted by challenges at home and facing an increasingly uncertain geopolitical context abroad. Once again the sector underpinned its role as Ireland’s largest indigenous industry and biggest regional employer with 257,900 people working in tourism and hospitality businesses nationwide.

The Irish Tourism Industry Confederation (ITIC) estimates that €6.2 billion, excluding fares, was spent by international visitors to the country this year, up 13% on last year, with North America the biggest single source market. The number of nights spent by tourists in the country, a key metric, was down 3%. CSO data for the domestic market showed strong growth for the first half of the year although sentiment and industry intelligence suggest a softer second 6 months.

With a new Government about to be formed ITIC believe that the incoming administration need to focus on improving competitiveness, mitigating against cost of business pressures and relieving capacity pressures, most notably by lifting the passenger cap at Dublin Airport. Ireland’s tourism industry must be viewed as an engine for growth and the sector should be represented by a Minister within an economic portfolio.

Despite cost and competitiveness challenges ITIC believes tourism revenue can grow by between 5%-7% in 2025 although volume growth will be at a lower rate due to capacity blockages. Industry is up for delivering this level of growth whilst also meeting climate action obligations however it must be enabled by pro-tourism and pro-enterprise policies from the new Government.

2024 REVIEW

Ireland earns €6.2 billion from overseas tourists in 2024 although number of bed-nights down 3%

Ireland’s tourism industry demonstrated remarkable resilience again in 2024. Despite competitiveness pressures and capacity constraints, recovery continued and the number of overseas visitors grew by 6.7% to 6.6 million although the number of nights visitors stayed in the country was down 3%. Expenditure by overseas tourists in the country in 2024 is projected at €6.2 billion excluding fares (figures based on CSO data for the period January to November).

Summer air capacity into Ireland was 3.5% above 2023 levels while sea access was up 7%. However ‘on the ground’ capacity was constrained with most recent figures from Fáilte Ireland showing 77,315 tourism beds still under contract to the State for humanitarian reasons. This represents 10% of all registered tourism bed stock.

Global tourism

According to UN’s latest World Tourism Barometer, an estimated 1.1 billion tourists travelled internationally in the first nine months of 2024. This was +11% more than in the same period of 2023. The growth was driven by strong demand in Europe and robust performance from large source markets globally. Increased air connectivity and visa facilitation also supported international travel. Latest research from the European Travel Commission (ETC) highlighting a 6% rise in foreign arrivals over 2019 levels and a 7% increase in year-on-year growth to the EU.

Irish performance

Overall in 2024 international visitors will have spent €6.2 billion (excluding fares) with the most valuable source market being North America (€2.2bn) followed by Continental Europe (€2.14bn) and Britain (€1.25bn). Domestic demand performed strongly for the first half of the year with CSO reporting trips up 14% and expenditure up 18% although this is expected to soften when H2 figures are published.

The year will be remembered as one where businesses struggled with rising input costs and labour charges on top of the increased VAT rate. While some businesses have enjoyed a good trading year, profit margins are under pressure with the food services sector under particular strain. Fáilte Ireland’s industry barometer over the summer showed that 64% of all respondents expect profit to be down this year compared to last year. The Budget in October did little to alleviate cost pressures although an increase in investment in tourism services was welcomed by industry.

In November the outgoing Government published a 5 year national tourism policy. There are 61 policy recommendations within it and ITIC is keen that the implementation group has strong industry representation. The policy sets a target of 5.6% revenue growth for Irish tourism each year out to 2030 and also set a 60% carbon reduction target over the same period.

2025 OUTLOOK

The ongoing wars in Eastern Europe and the Middle East pose a sobering context for tourism’s performance in 2025. Furthermore, the election of President Trump in the USA adds trade and tariff uncertainty that could depress travel demand from Ireland’s most important source market. Global inflation may have eased, but worldwide GDP growth remains subdued at around 3%. Prosperity in the EU is sluggish in part due to Germany’s under-performance, while the UK’s outlook looks underwhelming. Thankfully the US economy continues to perform well which normally augers positively for travel and tourism.

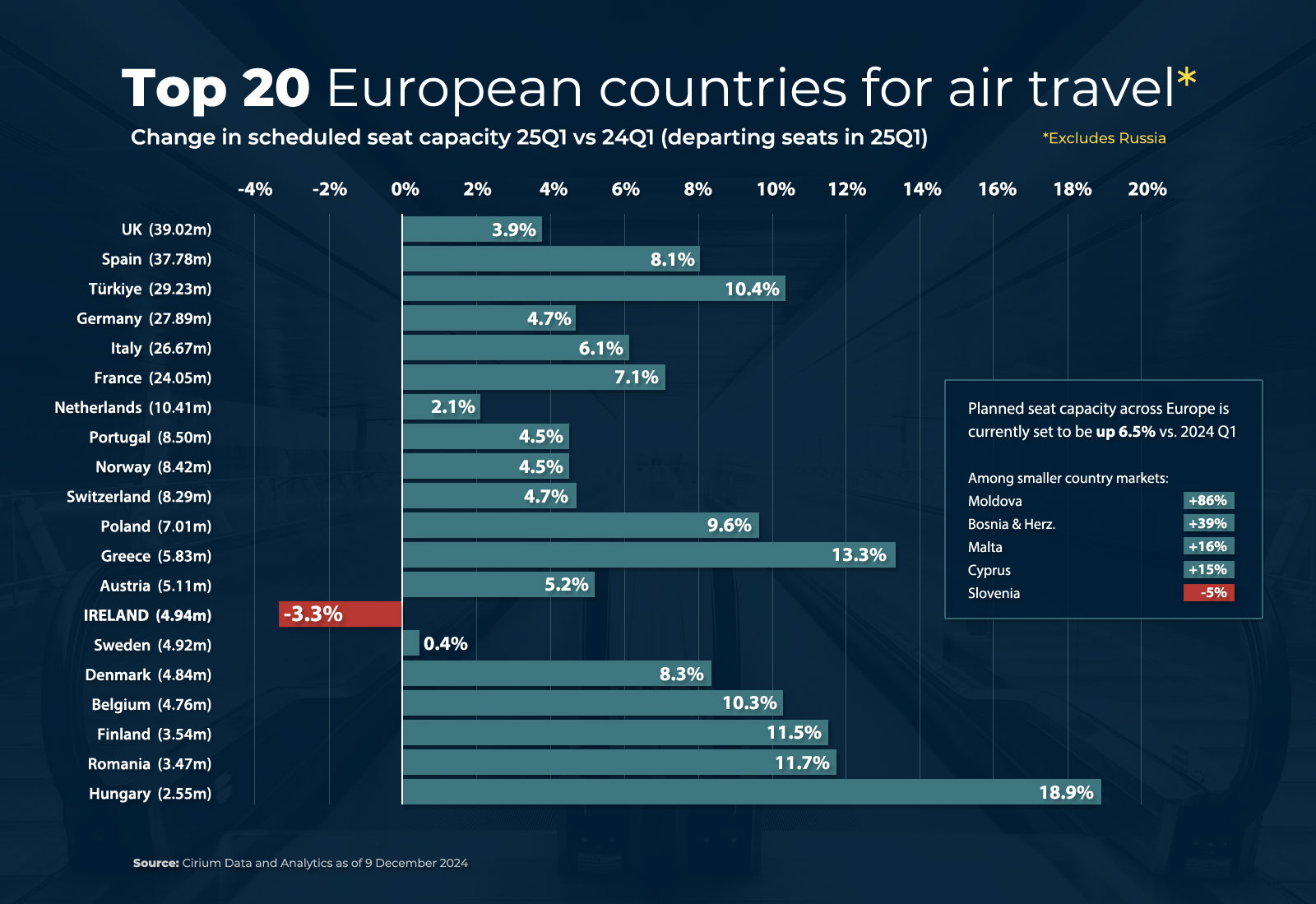

The European Travel Commission forecasts inbound tourism volume to the EU27 is set to increase by 8.1% in 2025, although due to capacity and supply pressures here ITIC anticipates growth in Irish tourism volume to be lower. The main handbrake on growth is the continued passenger cap at Dublin Airport. With 70% of the Irish tourism economy dependent on international visitation, it is vital that the main gateway into the country has headroom to grow. Although there is a court ruling to put a “stay” on the cap for next summer the issue of restrictions at Dublin growth is as pertinent as ever. This has manifested itself this winter with air access into the country being down 3%, the only Top 20 European destination showing a decline.

Growth at Shannon and Cork Airports must be facilitated but this will not compensate for lost business at Dublin.

7,050 hotel bedrooms are under construction which will improve the supply of tourism accommodation and help maintain Ireland’s value for money proposition whilst the State’s dependence on hotels and guesthouses for humanitarian reasons is expected to reduce. ITIC hopes for concerted action from the incoming Government in relation to costs of business including employer PRSI support and a hospitality VAT rate reduction to 11%.

In terms of market outlook the North American market continues to offer best prospects with strong transatlantic air access and the US economy powering ahead fueling a strong dollar. President Trump’s ‘America First’ economic policy will be closely watched by economic commentators.

The GB market could face a tougher year as GDP growth forecasts are at just 1.4% in 2025 and it is expected that there may be weaker consumer spending and business investment which is likely to impact on discretionary travel. France and Germany’s political woes are likely to depress mainland European economies while the Dublin Airport passenger cap means short-haul European routes are not expanding at the pace that they have in recent times.

The UK Government’s implementation of the Electronic Travel Authorisation (ETA) permit for international visitors to the UK risks depressing travel demand to Northern Ireland.

Despite cost, capacity and competitiveness challenges ITIC believes tourism revenue for Ireland can grow by between 5%-7% in 2025 although volume growth will be lower.

CONCLUDING COMMENTS

Irish tourism has a long history of responding positively to crises and this includes the recent Covid-19 pandemic. Tourism showcases the best of Ireland to an international audience and the domestic market – unlike other industries it can’t be outsourced or off-shored and it provides wealth and employment across all parts of Ireland.

ITIC hope that Ireland’s new Government see the potential of the tourism industry, help the sector to decarbonise, and enable it to overcome some of the roadblocks in its way. The risks internationally are significant in 2025 with an over-dependence on the North American market and ITIC would like to see a more balanced portfolio of business from a variety of source markets. Many of the challenges affecting the industry domestically lie in the gift of the new Government and action on ameliorating cost challenges, addressing capacity concerns and improving competitiveness will all help Ireland’s tourism and hospitality industry to continue on its path to recovery.