An Irish Tourism Strategy for Growth

18th September 2023

A Report by the Irish Tourism Industry Confederation

1. Preface

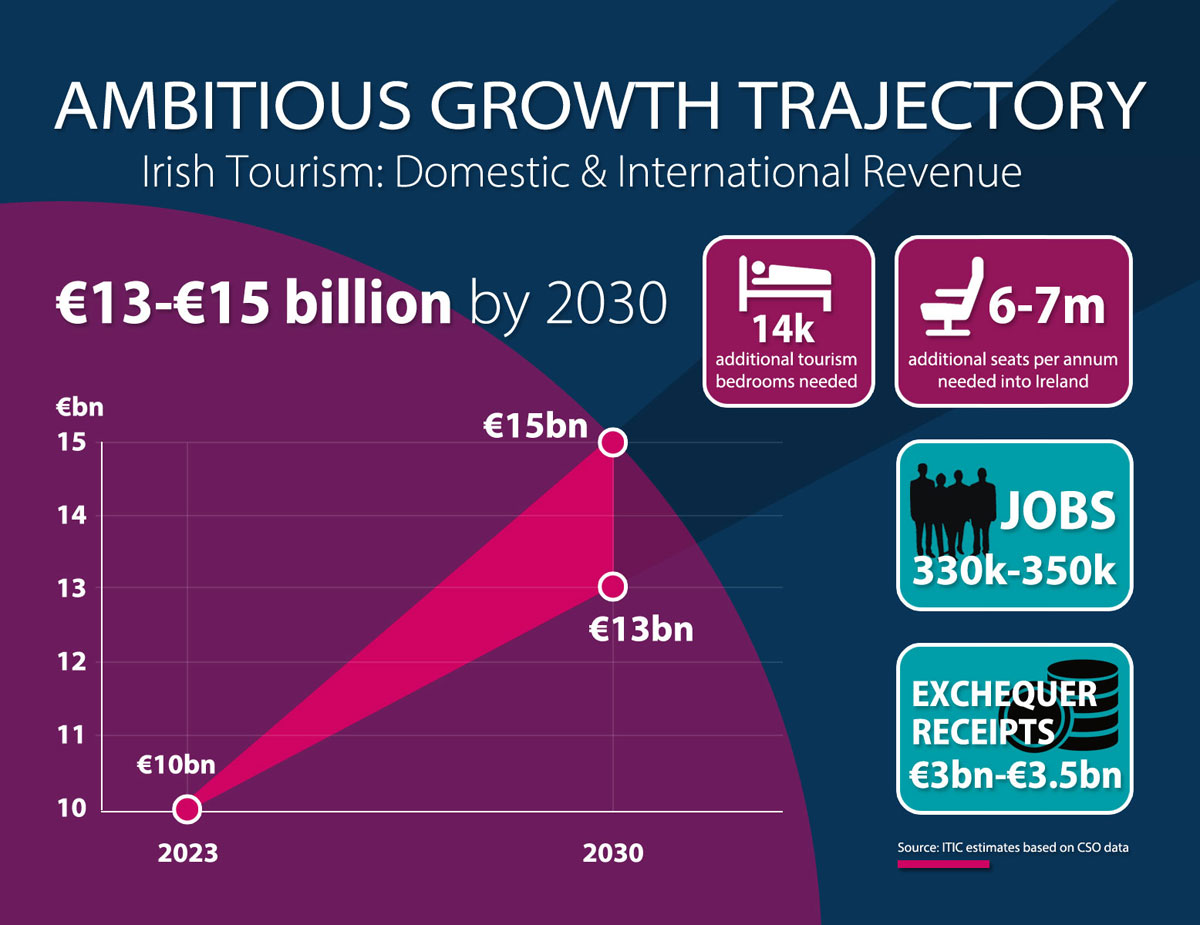

Ireland's tourism industry can be ambitious about its future whilst delivering on its environmental sustainability obligations. That is the vision outlined in this strategy by the Irish Tourism Industry Confederation (ITIC) – by 2030 the industry can be worth €15 billion to the national economy, can employ up to 350,000 people across the country, and will be delivering €3.5 billion tax receipts to the exchequer each year. In parallel to this, the carbon footprint of the sector can be significantly reduced. That is the potential for Irish tourism, the country's largest indigenous industry and biggest regional employer. But to achieve this industry needs to be innovative and dynamic, Government policy needs to be pro-tourism and pro-enterprise, and state agencies will need to provide enabling support and resources.

We are at a critical juncture for Irish tourism. Profoundly damaged by pandemic restrictions, the industry – with generous Government support – survived the crisis and in the last 18 months has made strides of real recovery. However challenges abound, some traditional such as competitiveness and investment, some new such as the impact of artificial intelligence and a war on the European continent.

It is timely that this key report by ITIC, the representative group for the broad tourism and hospitality sector, sets out the business case for the sector out to 2030, identifies opportunities and challenges, and articulates 38 key actions that industry, Government and Agencies need to take responsibility for. This report is the result of extensive consultation with ITIC members, tourism stakeholders, and the broader Irish business community. A full list of ITIC member organisations can be seen at the end of this Preface and this strategic report was steered by the ITIC board and strategy sub-committee, names of whom are also available below.

It is our view that by 2030 Ireland will have become one of Europe's preferred destinations for sustainable nature, culture and hospitality-based tourism experiences; will exceed the expectations of its widening customer visitor base; and will be a destination renowned for its hospitality that is delivered by well trained and rewarded career professionals.

This report is a clear articulation by industry of tourism's potential for the betterment of business, country and society. It is anticipated that Government will publish a new national tourism policy in the coming months and it is ITIC's expressed wish that the sentiments and recommendations within this report are duly reflected.

The size of the prize in terms of tourism's full recovery is significant.

Let's grasp it.

Elaina Fitzgerald Kane

Chairperson

Eoghan O'Mara Walsh

CEO

2. EXECUTIVE SUMMARY

Ireland's tourism industry is currently a €10 billion indigenous industry composed predominantly of regionally dispersed SMEs and employed almost 300,000 pre-pandemic according to the CSO. Up to 2020 tourism had been one of country's best performing sectors, returning eight consecutive years of rapid growth. The Covid crisis hit the industry particularly hard but, with generous Government support, the sector managed its survival and has bounced back from the economic ravages of the pandemic. Demand from overseas and domestic markets is reported as making a resilient recovery in 2023. Tourism has long been one of Ireland's success stories with an established worldwide reputation for hospitality. Forecasts for renewed growth in international travel are positive despite the current geopolitical situation, including the war in Ukraine, and economic headwinds.

Vision 2030: An Industry Strategy for Tourism Growth, prepared by the Irish Tourism Confederation (ITIC) following extensive consultation across the business community, presents a pathway to an exciting and ambitious future for the sector. The industry is confidently positive about the future, as witnessed by the scale on ongoing capital investment commitments by the private sector. This is despite current cost and staffing pressures and significant supply bottlenecks facing businesses. Tourism can positively contribute to meeting Ireland's commitments on climate change and delivering on the UN Sustainable Development Goals.

The Vision

2030 will see Ireland as a leader in sustainable tourism growth, delivering a unique visitor experience which delivers regional economic growth based on value over volume, while respecting environmental, social and community values.

An Ambitious Growth Trajectory

Tourism earnings in 2030 could rise to €15 billion, employing up to 350,000 people, and yielding up to €3.5 billion annually to the Exchequer.

The projection of a 50% increase in the value of the sector with the volume of domestic and international visitors growing by circa 24% with a significant growth in the share of holiday visitors, including new value-added segments to boost revenue, together with an improved spread of demand throughout the year.

It is estimated that increased capacity to cater for the growth in demand would require 14,000 additional tourist accommodation rooms and up 7 million additional seats on air and sea transport. Initiatives by industry, combined with State support in terms of resources and enabling policies, can see tourism's carbon emissions reduce significantly.

The Opportunities

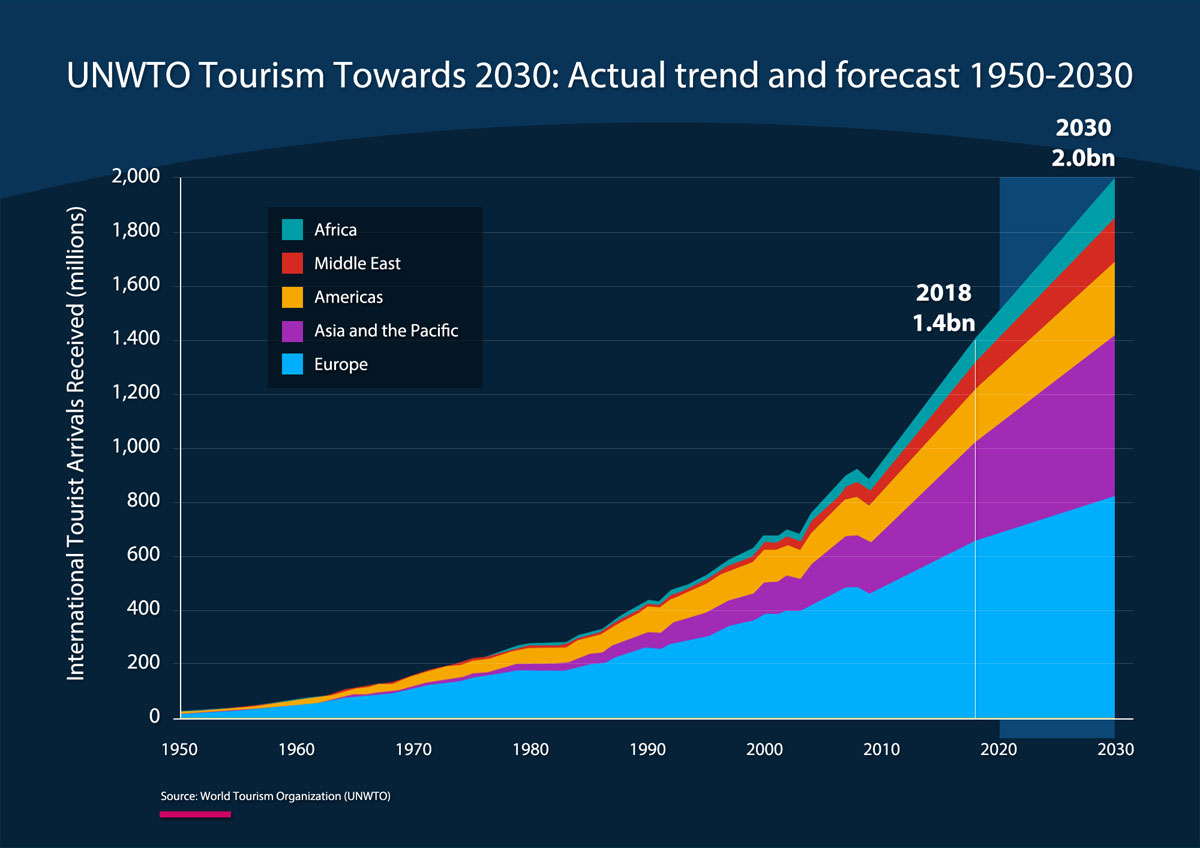

Growth in global international travel is forecast to reach 2 billion trips by 2030, compared to 1.4 billion in 2018, according to the UN World Tourism Organisation (UNWTO), representing over 11% of the global economy. The pandemic has reinforced an enduring desire to travel, with some emerging trends in people's travel motivations and behaviour, despite current cost of living pressures. Greater emphasis on personalised travel experiences is amongst the discernible trends, together with a greater emphasis on value rather than price, in keeping with a growing respect for actions to address environmental issues.

Tech-enabled travel is empowering the consumer, with adaptation levels accelerated by the pandemic. Customisation of the travel experience is being driven by the tech giants delivering more products for frictionless access to personalised options. The evolution of augmented and virtual reality technologies is fast changing the way consumer plan and experience travel.

Ireland is well positioned to successfully exploit the changing market opportunities:

- the appeals and attractions of Ireland are well aligned with the increasing focus on unique immersive experiences based on nature, culture, heritage, and people;

- a highly competitive network of access routes by airlines and ferry companies, led by major Irish carriers;

- a proven broad source market portfolio, together with emerging added value prospects.

The Challenges

Realisation of the tourism opportunities is not without its challenges. The top challenges facing the industry, include:

A threat to competitiveness: Ireland as high cost economy competes on value rather than price in the international marketplace. However, the recent rate of inflation in business input costs, coupled with the high VAT, excise and other tax rates, seriously threatens the competitiveness of the Ireland tourism product and the ability of business to deliver what the overseas visitor rates as good value for money.

A staffing crunch: Tourism and hospitality is a labour intensive business with the quality of personal service a key determinant of value. Ireland's tight labour market has accentuated the recruitment, retention, and skill development of personnel. The result for many businesses has been an enforced limit on trading. The industry is crucially aware of its responsibility to improve the attractiveness and career opportunities on offer.

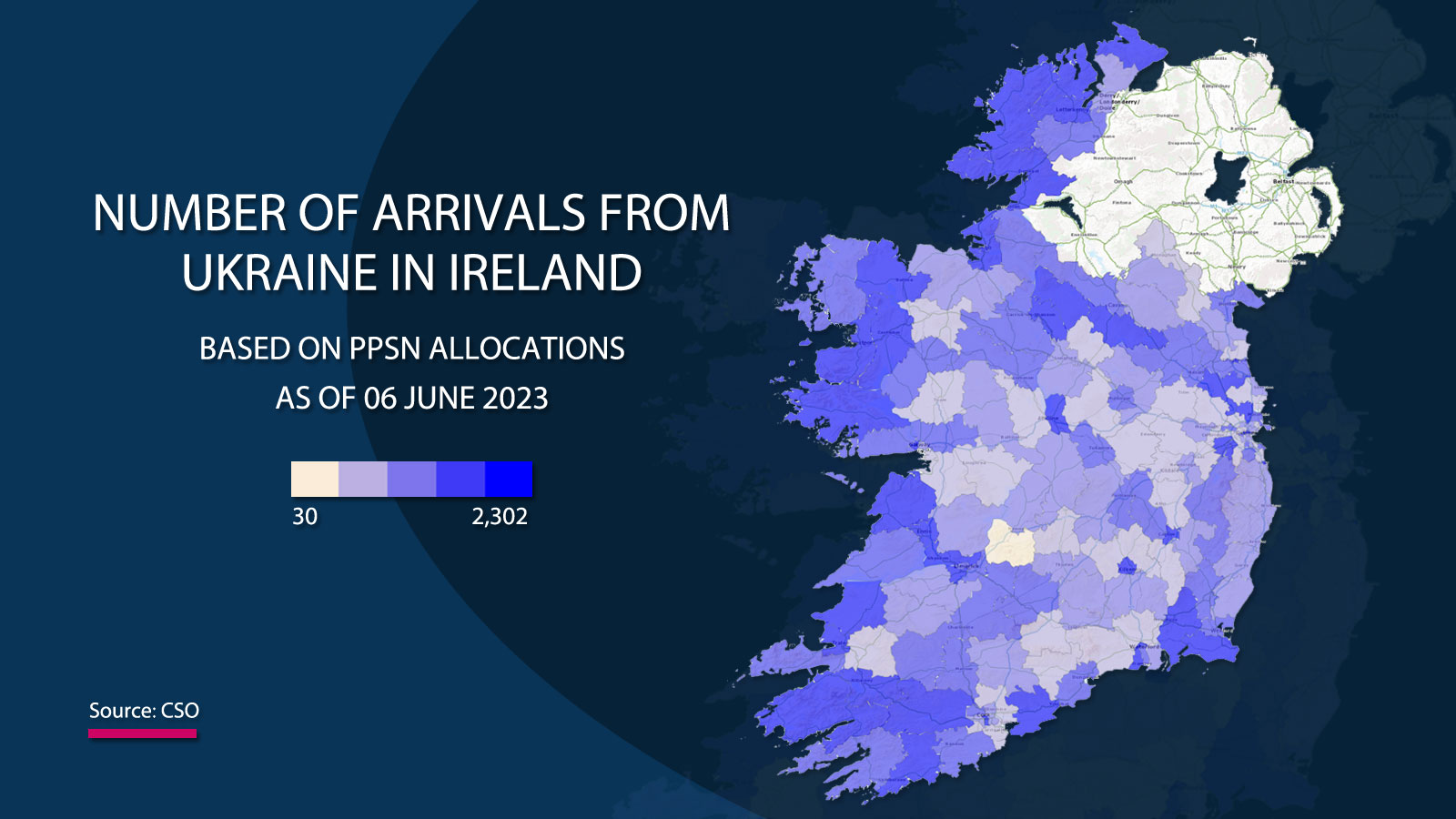

Supply side constraints: The primary constraint is on guest accommodation supply. Latest estimates indicate that at least 20% of the country's tourist accommodation stock is currently under Government contract to provide housing for those seeking refugee from the conflict in Ukraine and arrivals from other troubled areas seeking International Protection. As tourist accommodation is designed or suitable for long stay living, the Governments over reliance on tourist accommodation to meet its humanitarian obligations is not sustainable.

The Sustainability Imperative

The pandemic and global warming are reshaping consumer values with an increasing focus on ensuring the sustainability of the planet. Improving societal and environmental conditions while delivering economic benefits are central to sustainability. Sustainability is forecast to be a big segmentation factor for winner and losers in tourism.

Sustainability is expected to at the core of the Government's new national tourism policy is due by year end. Sustainable tourism, as defined by the UNWTO includes economic, social and environmental sustainability and co-existence of all three pillars can be difficult. The industry is very conscious of its responsibilities in delivering on environmental objectives, with a number of innovations already underway. The challenge is real with many tourism and hospitality enterprises falling under the commercial buildings and built environment sectors which has a 40%-45% target of reduced emissions by 2030.

Action-led Outcomes

An analysis of the challenges leads to a number of conclusions and recommended actions to enable the industry to capitalise on the opportunities to achieve sustainable growth, and to deliver the ambitious economic projections by 2030. The key actions centre around 7 pillars namely: Sustainability, Competitiveness, Connectivity, Skills & Careers, Supply Constraints, Investment, and Policy & Support Framework. The 38 actions within these pillars can be seen here and collaboration across Industry, Government and State Agencies will be key to success.

3. TOURISM IN IRELAND: A Success Story

Tourism – a cornerstone of the economy

Tourism, Ireland's largest indigenous industry, was one of the fastest expanding sectors of the economy pre-pandemic. Tourism spending in 2019 reached €10 billion, on back of 6.8% (CAGR) annually growth over a five year period. The industry is a critically important employer, providing almost 1 in 8 jobs, more than agriculture and construction combined, and almost equal to FDI employment. Tourism is the driver of economic prosperity, jobs, income and well-being of many towns and rural areas across the country. As 70% of tourism expenditure takes place outside of the capital region tourism is a major driver of regional development.

Tourism, an international traded service with a very low import content, sustains over 40,000 locally owned and operated SMEs across the country, has an exciting future as international tourism rebounds and is set for future growth at a rate outpacing economic growth.

€10 billion: Tourist receipts (73% inbound visitors + 27% domestic trips)

285,000 direct jobs*: over 350,000 when non-specific tourism businesses included

46,000 enterprises: predominantly SMEs, spread across all regions

4.4% GVA share: €13.5bn final consumption

€2.3 billion: annual Exchequer receipts

Source: Irish Tourism Sector 2019 (Tourism Satellite Account) CSO publication July23, 2023)

Note: * employment = full time equivalent jobs

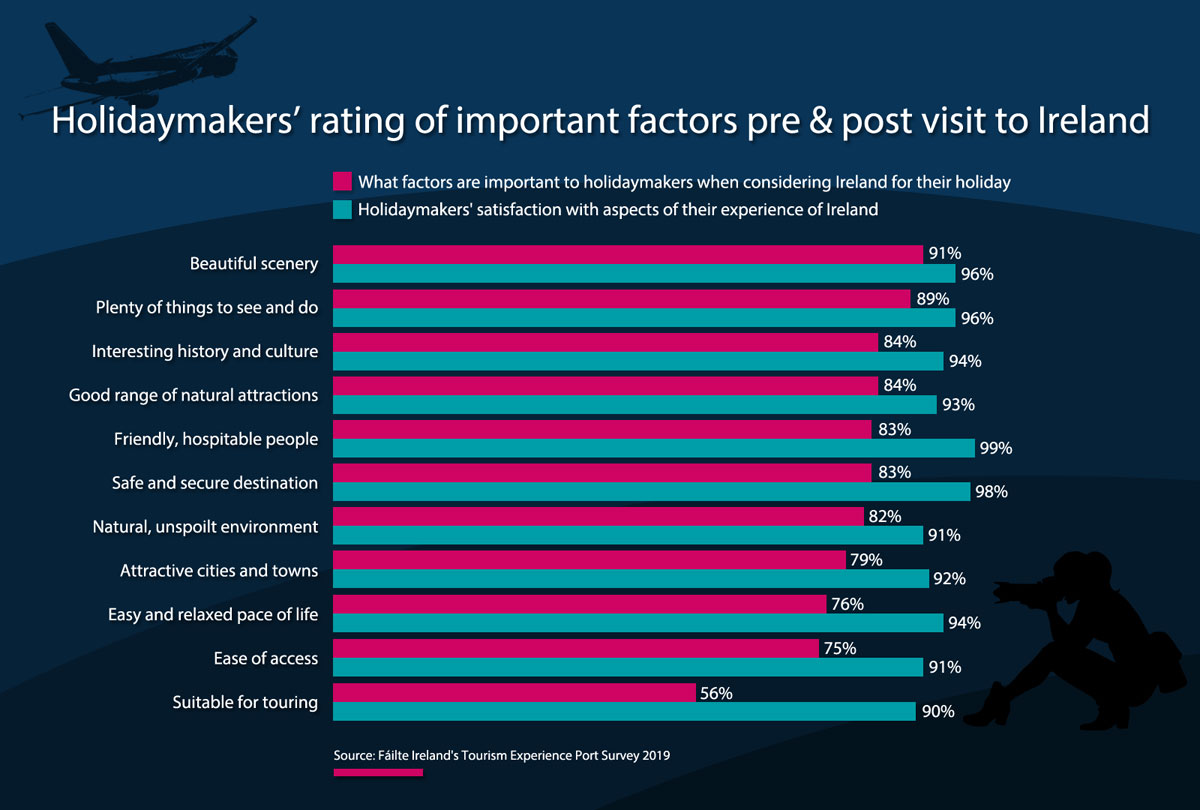

Ireland's strong visitor appeals and reputation

Ireland has established a strong positioning in its main source markets thanks to investment by businesses and the state over many decades. The appeals which draw holiday visitors are primarily scenery and natural attractions, interesting history and culture, with lots "to do and see". Following the experience of a visit to Ireland feedback consistently shows visitor satisfaction is topped by the friendliness and hospitality of the Irish people. Research shows that a holiday in Ireland exceeds expectations on all important factors for visitors. The relaxed pace of life, ease of travel and the range of experiences on offer combine to record a high rating for the holiday experience. Recent in-market surveys confirm that Ireland's appeal remains strong with an encouraging level of intent to visit.

COVID- a disproportionate impact on tourism

Public health and travel restrictions over a two year period brought international travel to a halt and severely curtailed domestic travel. The sector lost an estimated €12 billion in sales between 2020 and 2022. Adjusting for €6 billion in government COVID business supports, the net loss to businesses in the sector was close to €6 billion. Widespread business failures were averted by a unprecedented range of Government financial supports to sustain enterprises and employment – tourism was the single biggest beneficiary of the Employment Wage Subsidy Scheme (EWSS). However, extended closures depleted cash reserves and impaired balance sheets. The sector, characterised by SMEs, saw many businesses emerge with an increased debt burden, having depended on Revenue's warehousing scheme. The impact on the sector was most recently apparent from the business failure data for the 12 months to June 2023, from PWC's Insolvency Barometer. The arts, culture, entertainment and recreation sector had the highest failure rate across the enterprise economy at almost three times the national average, with the hospitality sector, the next highest, at 60% above the national average.

Tourism recovery underway but facing an uncertain future

As the pandemic receded in early 2022, the industry was confronted with the economic and social fall-out from Russia's invasion of Ukraine. International travel has rebounded, driven by pent-up demand and accumulated savings. However, the recovery is uneven across the world as economic slowdown and geopolitical instability slows the pace and scale of a sustainable recovery.

Ireland's tourism industry received a major boost with the speedy reinstatement and expansion of air and ferry services which drove a quicker-than-anticipated recovery of inbound tourism over the past 18 months as travel restrictions were lifted. Tourism businesses have shown exceptional resilience in coping with the post-pandemic reopening.

Visitor arrivals to Ireland suggest that Ireland is on track to recover to pre-pandemic volumes by 2025/26, while domestic trip volumes appear to be close to 2019 levels.

Latest data from the Central Statistics Office (CSO) reports that 619,900 tourists came to Ireland in June with a total of 1.65 million visitors for the 3 months of Q2. The April to June period saw an expenditure of nearly €2 billion by tourists to Ireland with the North American market the most valuable accounting for a spend of €827 million. Q2 traditionally accounts for 30% of annual tourism volume and is a key period of the industry calendar. Unfortunately due to methodology changes in the collection of data by the CSO, direct comparisons with 2019, the last full year pre-pandemic, are difficult to make.

However it is clear that the full recovery of Irish tourism is still well off where it was pre-pandemic and where it needs to be. Airport traffic is inflated by Irish people travelling abroad, hotel occupancy is inflated by Government contracts for refugees and asylum seekers. The actual number of international tourists coming to Ireland is still some way off full recovery.

Domestic tourism

Domestic travel is a vital component of Ireland's tourism industry. Demand from Irish residents underpins most tourism businesses across the country. Domestic demand accounts for more than half of receipts in many tourism and hospitality businesses, sustaining year round trading in accommodation, hospitality, activity and attraction businesses.

Irish residents took 13.3 million domestic trips in 2022, spending a total of €2.9 billion. Average trip length was 3.0 nights, a total of 34.2 million nights. Half of all domestic overnight trips (50%) were for holiday or leisure purposes, while over one third (34%) were visits to friends or relatives. In addition, an estimated 16.2 million day trips were taken in 2022, spending €856 million. Demand for domestic travel has made a rapid recovery, with the number of trips in 2022, exceeding pre-pandemic levels.

Demand appears to remains strong, despite the economic pressure on disposable incomes, with the latest data reporting a 15% increase in trips in Q1'2030 compared to the same period in 2019.

The outlook for domestic tourism is projected to be strong, based on the population growth, almost full employment, increasing leisure time and opportunities. The primary determinant of the rate of growth are expected to include the economy, increasing awareness of the leisure and event opportunities combined with aggressive marketing, innovative and attractive pricing propositions. A conservative projection would suggest average volume growth of close to 3% per annum over the period to 2030.

4. THE FUTURE: A New Way Forward

An enduring desire to travel driving global tourism growth

Long term forecast for international tourism is very positive, with demand predicted to grow, on average, at 5.8% per year over a ten year period, outpacing the growth in the overall economy. International visitor demand is expected to reach 2 billion by 2030, up from 1.4 billion in 2018, with further growth to 3 billion by 2050, according to the World Tourism Organisation (UNWTO). The fastest growth in demand is forecast to come from emerging and developing markets in Asia and South America, beyond the core traditional markets of the West. China is forecast to displace France as the world's top tourism destination by 2030, as well as becoming the largest source market for international travel.

The global tourism body – The World Travel & Tourism Council (WTTC) – is forecasting that the sector will grow its GDP contribution to $15.5TN by 2033, representing 11.6% of the global economy, employing around 12% of the world's workforce.

Global international tourism is well on its way to returning to pre-pandemic levels, with twice as many people travelling in Q1 23 than in the same period in 2022. Tourist receipts across Europe, having reached 87% of 2019 levels in 2022, are on course to top 2019 in current terms this year, according to estimates from the World Tourism Organisation (WTO). The recovery has been driven by strong intra-regional demand, and the reopening of intercontinental travel. Many countries are expected to recover to 2019 levels this year.

The post pandemic bounce driving travel demand continues despite the consumers facing higher costs of living, rising interest rates and an uncertain economic outlook. The pandemic has reinforced an enduring desire for travel, with some emerging trends indicating changes in people's travel motivations and behaviours.

Macro trends influencing travel demand around the world include population growth, an expanding middle class concentrated in urban areas, changing work and leisure patterns. Furthermore, the consumer is increasingly empowered by the expansion of online access to worldwide travel options.

Two recent studies on pan-European tourism, from the EU's Joint Research Centre and the European Travel Commission (ETC), suggest that tourists are starting to seek out destinations with milder climates, in response to extreme temperatures and wildfires. Such consumer behaviour may benefit the more temperate climates of Northern Europe, including Ireland.

The Consumer of the Future

A number of discernible trends in travel provide an insight into the consumer of the future. These trends identified from global research include:

- Wellness tourism, eco-tourism and remote working are enabling people to travel with purpose and stay longer;

- Consumers are increasingly using new technologies to benefit from easier and more convenient stress free travel experiences, including late bookings;

- Personalised travel experiences are increasingly been sought after;

- Demand for premium travel is on the rise as travellers are willing to pay more for better quality tourism experiences.

Ireland prime target segments are likely to want to explore the destination in a more immersive and experiential way, while being conscious of the economic, environmental and social impact of tourism. Customers of the future are likely to be more value conscious, with higher expectations of service providers.

Post pandemic trends shaping future demand

Macro-economic outlook

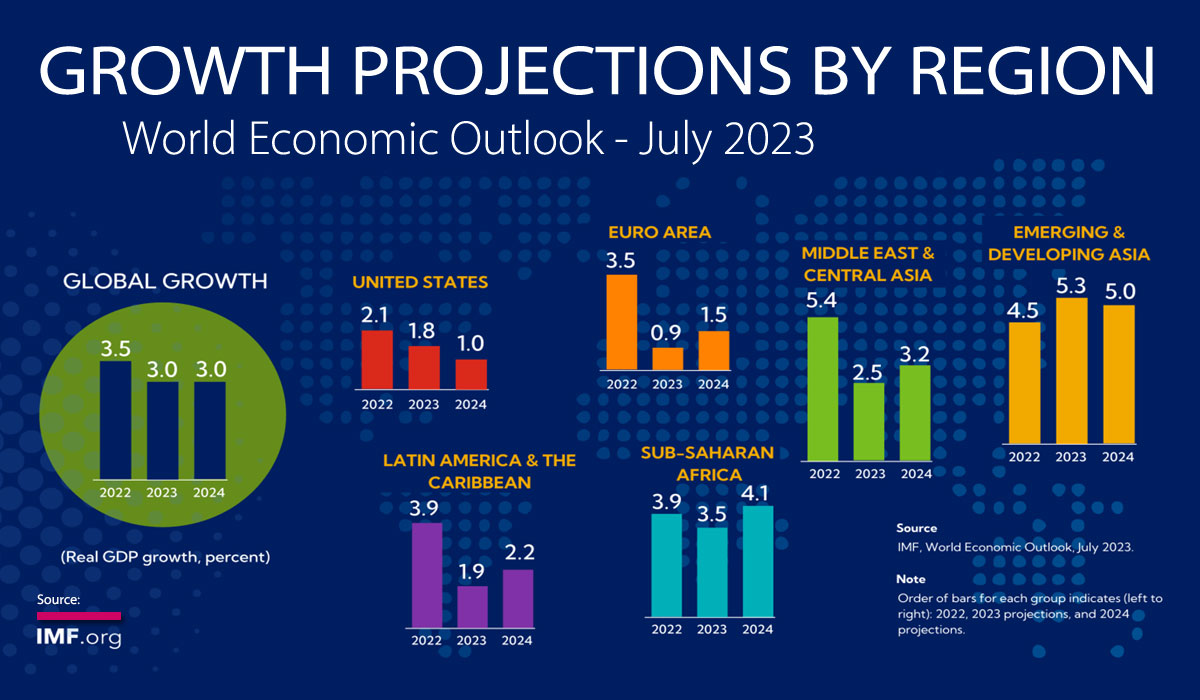

The global economy remains in a precarious state amid the protracted effects of the overlapping negative shocks of the pandemic, the Russian Federation's invasion of Ukraine, and the sharp tightening of monetary policy to contain high inflation. Most recently new of the economic clump in China, the world's second-largest economy, is further depressing the outlook for the global economy.

In July the International Monetary Fund has raised its 2023 global growth estimates slightly given resilient economic activity in the first quarter, but warned that persistent challenges were dampening the medium-term outlook. Despite inflation coming down the balance of risks facing the global economy remained tilted to the downside and with credit remaining tight. A five year outlook for real GDP growth at close to 3%, is a significant slowdown compared to pre-Covid years.

Sustainability to define winners and losers in tourism

The pandemic and global warming are reshaping consumer values with an increasing focus on ensuring the sustainability of the planet. Sustainability is the starting point, not just reducing the carbon footprint and energy consumption but also improving societal and environmental conditions while delivering economic benefits. The demand for sustainability encompasses a range of factors including protection of the environment, a reduction of transport's carbon footprint, materials used in construction, the way the food is sourced, processed and served, employment conditions, and benefits to the local community.

Sustainability is forecast to be a big segmentation factor for winners and losers in tourism. Experts confirm that those destinations and businesses which focus on innovation and sustainability will be most likely to the more successful in the future. Recent research by Accor, one of the biggest hospitality businesses in the world and Europe's largest hotel operator, found that 65% of travellers would respond positively if presented with more sustainable travel choices. A sustainable approach to future tourism will be key in driving economic benefits for Ireland.

A new national tourism policy is due from the Irish Government by year-end and will have sustainability at its core – the industry will need to deliver on its sustainability responsibilities.

Tech-enabled travel empowering the consumer

The pandemic has accelerated the adoption of new customer-facing technology by, probably, a decade in the course of a couple of years. Digitisation and the emergence of new technologies are fast changing the industry as we know it. Connectivity will continue to grow between suppliers, distributors and customers together with seamless connectivity between online and offline channels.

Customers are becoming more empowered though greater choice and control in the process of planning, booking and experiencing travel. Customisation of the travel experience is evolving as the tech giants continue to design products for frictionless access to personalised options.

Further developments, and lowering of cost, in augmented and virtual reality technology will provide new ways of previewing experiences and opportunities as well as delivering more immersive experiences across the tourism journey.

DiscovAR Dublin

DiscovAR Dublin is an exciting innovative application in the use of AR technology in tourism. The result of a partnership between Dublin City Council and Google, enables App users to open a 3D map of the city on their device and explore it, by blending data from Google Maps with 3D technologies. The visitor by interacting with video and audio elements can experience selected attractions and locations in the city. It is reported to make the capital 'first city in the world' to use AR technology for tourism.

Technology increasingly offers an opportunity for businesses to improve efficiency and productivity while improving the quality of the customer's experience.

Tourism in context of Ireland's Sustainable Development Goals (SDGs)

Ireland has adopted a whole-of-Government approach to the SDGs, adopted its first SDG National Implementation Plan in March 2018, including an ambitious 2030 Vision for Ireland, to fully achieve those goals and to support their implementation around the world. While governments hold primary responsibility for achieving the SDGs, partnership responsibility also rests with businesses and communities.

In addition to a significant alignment between the tourism industry's vision for 2030 and the strategic goals as set out in the National Planning Framework, tourism can directly contribute to 6 of the 17 goals of the UN Sustainable Development Goals. Namely, climate action, regional development, sustainable cities and communities, economic growth, reduced inequalities and innovation.

5. THE ROAD AHEAD: Opportunities & Challenges

As part of ITIC's consultation for this strategy numerous meetings were held with tourism leaders and stakeholders. This included a workshop in June 2023 with ITIC members who outlined their views for the medium to long term vision for Irish tourism. Such consultations helped develop this strategy with ITIC members highlighting the need for a greater focus on value in line with sustainability goals, the need for a shift in market as new opportunities open up, and the need to explore attracting major international events to our shores and lengthening the tourism season. Many of the recommendations within the report are on the basis of meetings and input from ITIC members and other travel, tourism and hospitality businesses. Throughout the last 4 months as deliberations and discussions took place with tourism professionals a number of opportunities and challenges were identified.

The prospects for growth in tourism remain strong, based on demographics and macroeconomic projections together with the post-pandemic evidence of the desire to travel. Airlines, transport and hotel operators across the globe continue to invest in future growth.

1. A confident forward facing industry

Despite the devastating impacts of the pandemic, and the current pressing economic challenges, Ireland's tourism businesses are confident of a full recovery and sustainable future growth. An industry pulse of ITIC members over recent months, in surveys and workshops, confirm an industry with confidence that the current challenges can be overcome with appropriate policy supports to enable Ireland to capture an increased share of an expanding market for tourism. This confidence is evident from the level of interest, and recent, investments in the sector by indigenous and external enterprises.

2. The Ireland tourism experience

The fundamentals of the appeals and experiences of Ireland's tourism are well aligned with the increasing focus on unique immersive experiences, natural attractions and the outdoor activity environment, cultural and heritage attractions, combined with a welcoming personal interface with local residents.

Professionalism within the sector has increased significantly in recent years, with many businesses at the cutting edge of delivering a quality service across all functions of the travel and hospitality experience.

Ireland's reputation is well established with research showing a high level of interest and intent to visit, including a healthy level of repeat visitors. The success, and creativity, of destination marketing cross social and traditional media channels has received international recognition and continues to extend the reach into new potential demand segments. The major demand trends point to an increased demand for the potential of Ireland's tourism experience in the international and domestic marketplace.

3. International connectivity

Airline and ferry connectivity has been a critical driver of Ireland's tourism growth over many years. Ireland benefits from a highly competitive network of access routes by airlines and ferry operators, including successful Ireland-based carriers. Up to 90% of visitors arrive by air, and a thriving airline industry is critical to Ireland's continued success.

Aer Lingus and Ryanair rapidly reinstated service post COVID – in summer 2023 Aer Lingus are operating an expanded transatlantic network, while Ryanair capacity is up 22% on short haul routes, compared to pre-pandemic levels. In addition, capacity offered by other airlines is almost back to 2019 levels. Ferry capacity is up on pre-pandemic levels, with a significant expansion of travel options and capacity on routes to/from mainland Europe post Brexit. Airline and ferry companies, air and sea port operators continue to invest heavily in fleets and infrastructure to deliver sustained growth in Ireland's connectivity.

4. Market development opportunities

Ireland's tourism is still facing headwinds in its post-Covid recovery, with rebuilding expected to continue through 2025. Industry reports indicate that tourists from the United States – Ireland's highest spending leisure visitors – lead the way, as demand for travel to Europe has bounced back strongly. Airlines are already announcing increased capacity for 2024 to Europe including Ireland.

Historically Ireland has drawn its visitors from four main source market groups – Britain, mainland Europe, North America, and Australia/New Zealand. Over time the balance of demand has shifted as a result of lessening of dependence on VFR visitors and increasing share of holiday visitors, with mainland Europe and North America the source of increasing numbers of tourists. In economic terms growth in tourism receipts, regional distribution of visitors, and demand spread widely across business sector, Ireland has become more dependent on the US market. Recent growth rates from the closer-in markets – Britain and mainland Europe – have been more modest, despite Ireland attracting a relatively low share of outbound tourism, and has been more in line with demand patterns of maturing markets. The composition of demand of inbound tourism to Ireland over the past decade shows only modest diversification of source markets when compared with competitor destinations across Europe, including Britain. The latter appear to have been more successful in attracting high spending inter-continental tourists from Asia, the Middle East and Latin America. Increasing numbers of leisure travellers to Europe from emerging travel markets would point to an opportunity for Ireland.

With an increasing focus on sustainable growth the time is opportune to reassess how best to successfully optimise tourism growth opportunities across source market and segments, based on robust market research and investment. Within established short haul markets targeting of shoulder and off-season demand would significantly contribute to sustainability and improve the utilisation rate and profitability of businesses.

Despite the positive opportunity outlook realisation of the potential is not without its challenges.

1. Ensuring a competitive tourist offering – delivering good value

Ireland a high cost economy

The cost of doing business is higher than in many of its European neighbours. For example, Ireland's minimum wage is more than 70% above the EU average, while electricity (+14%) and cost of credit (+50%) have historically been well above the European norm. Tourism is a labour, energy and capital intensive industry – these high cost inputs feed directly into higher prices for the visitor. In addition, the prices visitors pay reflects the cost of living within the country. Ireland was the most expensive European country to live in, at 46% above the EU average, with only Switzerland, Iceland and Norway having a higher cost of living in 2022.

Inflation hit tourist prices

Typically almost 80% of the expenditure by tourists in Ireland is on accommodation, food and drink, and internal transport. Pre-pandemic, Ireland was ranked in the top 5 most expensive destinations in Europe for the main items consumed by visitors. Recent research has shown, that while the cost of getting to Ireland is highly competitive due to very attractive airfares on offer, visitors encounter markedly higher costs in Ireland compared to many other competitor destinations.

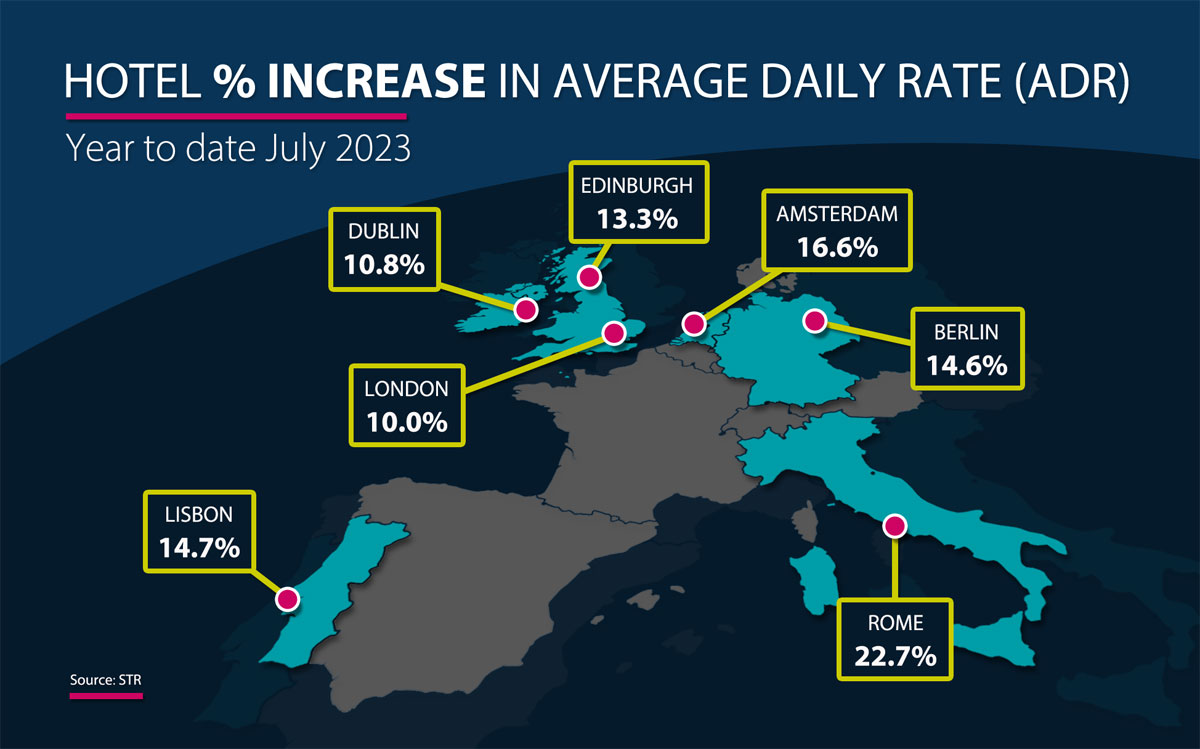

Prices in hotels and restaurants have been rising above the rate of overall inflation in Ireland. In 2022 hotel and restaurant prices in Ireland were found to be 26% above the average across the Eurozone; alcoholic beverages and tobacco prices almost double; and transport services at 26% more expensive. Compared to the UK, Ireland's main competitor in most source markets, prices of holiday components of accommodation, food and drink in Ireland were at between 23% and 30% higher. Latest data from the CSO shows that the annual rate of inflation for accommodation services, predominantly hotels, while slowing was at 6.2% to July 2023. Over the past year admission prices to cultural venues increased by 7.3%, while public transport costs decreased.

While there are identifiable underlying costs and supply factors to explain the high rate of increase in prices in the accommodation sector, the concern is that the rate of price rise in Ireland has been higher than in many competitor European destinations. Price inflation in the restaurant sector is broadly in line with experience across the EU.

Latest data from Smith Travel Research (STR), a global hospitality analytics practice, shows that the rate of increase in hotel rates in Ireland has moderated over the past year.

VAT on hospitality services

The increase in VAT from the temporary 9% rate to 13.5% from September 2023, will undercut Ireland's competitiveness. The increase will see VAT on accommodation rise to the third highest Europe, and restaurant food and alcohol ranked amongst the highest rates, compounding Ireland's high rate of exercise duty on alcohol. The VAT increase will further add to Ireland's loss of competitiveness at a time when inflation in key visitor components could continue to outstrip rising prices in competitor destinations.

Insurance costs

Despite recent reforms in the insurance sector, annual premiums for liability coverage continue to rise. Increasing premium costs, and a lack of competition in the market, has forced the closure of several tourism related businesses and events over recent years.

Competitiveness / Value imperative

High inflation, in an already high cost economy, coupled with supply side issues runs the risk of threatening the competitiveness of the Ireland tourism offering. The current competitive dynamic presents a set of new challenges for businesses in the sector. While price is not the sole defining factor of Ireland's competitiveness, value for money is undoubtedly a major determinant of competitiveness. As a tourist destination Ireland has positioned itself as a value experience rather than an inexpensive destination. Close to 60 % of pre-pandemic holiday visitors consistently rated their experience as 'good or very good' value for money. With the steep price rises Ireland's competitiveness is at serious risk of losing its value for money positioning in the international marketplace.

2. Loss of tourist accommodation stock

The provision of accommodation for refugees, including people fleeing the conflict in Ukraine and those seeking International Protection, is a moral imperative as Ireland plays its part in the ongoing humanitarian crisis. However, hotel and other tourist accommodation accommodations was not designed for long term housing needs and is far ideal for those seeking refuge. Furthermore, Ireland is an outlier in its dependence on tourist accommodation to provide shelter for refugees and asylum seekers.

At least 20% of tourist accommodation is currently withdrawn from the market and contracted for accommodating refugees. The contraction in the availability of tourist accommodation is most evident in a number of popular west coast popular tourist areas, including Donegal, Mayo, Clare and Kerry. The impact on the tourism economy is higher priced accommodation as demand exceeds supply; a loss of jobs; a decline in visitor footfall in traditional tourism areas, and a threat to the viability of downstream businesses catering to visitors. The extent of frustration of demand, or reputational damage, is as yet unknown.

Legislation to address the housing shortfall has also impacted the supply of tourist accommodation. Providers of short-term holiday lets, in addition to the requirement to obtain planning permission, the proposed Short-Term Tourist Letting Bill, awaiting approval from Brussels, will require such properties to register with Failte Ireland. The short term rental market advertised on line has been estimated at up to 27,000 premises, of which 20,000 are full properties, providing up to 130,000 beds, according to an estimate from Failte Ireland. The impact of the legislation could see a withdrawal of as many as 12,000 premises out of the short term rental market, potentially reducing Ireland's visitor capacity by at least 50,000 bed spaces.

Longer term the impact of a continued reliance on tourist accommodation to meet the State's need to house refugees, and the legislative requirements on holiday rental properties, is likely to result in an exit of some tourist accommodation providers from the market. The current situation weakens Ireland's tourism ecosystem – a complex, highly interdependent and diverse key sector of the economy – and threatens a full recovery and capacity for future tourism growth.

To meet future projected demand new investment in tourist accommodation will be required. A recent ITIC study commissioned with economist Jim Power reported at least 11,500 hotel bedrooms will be required by 2032 to meet projected demand and compensate for hotel attrition rates.

3. A staffing crunch

As the Irish economy is close to full employment, the supply of labour is limited. This has further exacerbated the recruitment situation in hospitality and tourism sector. Staffing shortages has led to a reduction in capacity and opening hours and, in extreme instances, business closures.

Post pandemic tourism and hospitality businesses across the developed world are experiencing difficulty in retaining and attracting staff. Recent data from Eurostat shows that construction trades, transport drivers, and cooks are the top shortages across Europe.

Seasonally adjusted employment in tourism industries is reported at 215,700 in June 2023, with recovery lagging behind other sectors of the economy.

In Ireland a tight labour market, with the lowest unemployment rate in over two decades – 4.1% in July 2023 – sees the sector struggling to attract and retain staff. Tourism businesses compete in a highly competitive marketplace for labour. Despite Ireland having one of the youngest, and fastest growing, populations in the EU, economic growth will continue, in part, to rely on attracting labour from outside the country to fuel economic growth. From a customer perspective the result has been a reduction in choice and/or the quality of the experience. This coupled with higher prices runs the risk of more serious longer term reputational damage and a limitation on growth.

Tourism and hospitality is a labour intensive business, with the quality of personal service a key value. With effective full employment levels, the tourism and hospitality industry is facing an existential challenge, with an urgent need to address recruitment and skills development. Increased investment by businesses will be required to attract, train and providing more attractive career opportunities in a well paid environment. Sustained growth in tourism earnings will depend on the capacity to meet visitors' expectations of a top class guest experience.

4. The Sustainability Challenge

The worsening effects of climate change have made decarbonisation a top priority for many industries. The World Travel & Tourism Council estimates that global travel and tourism accounts for between 8 and 11 percent of the world's emissions. If nothing is done, the sector's carbon emissions will only rise as it grows.

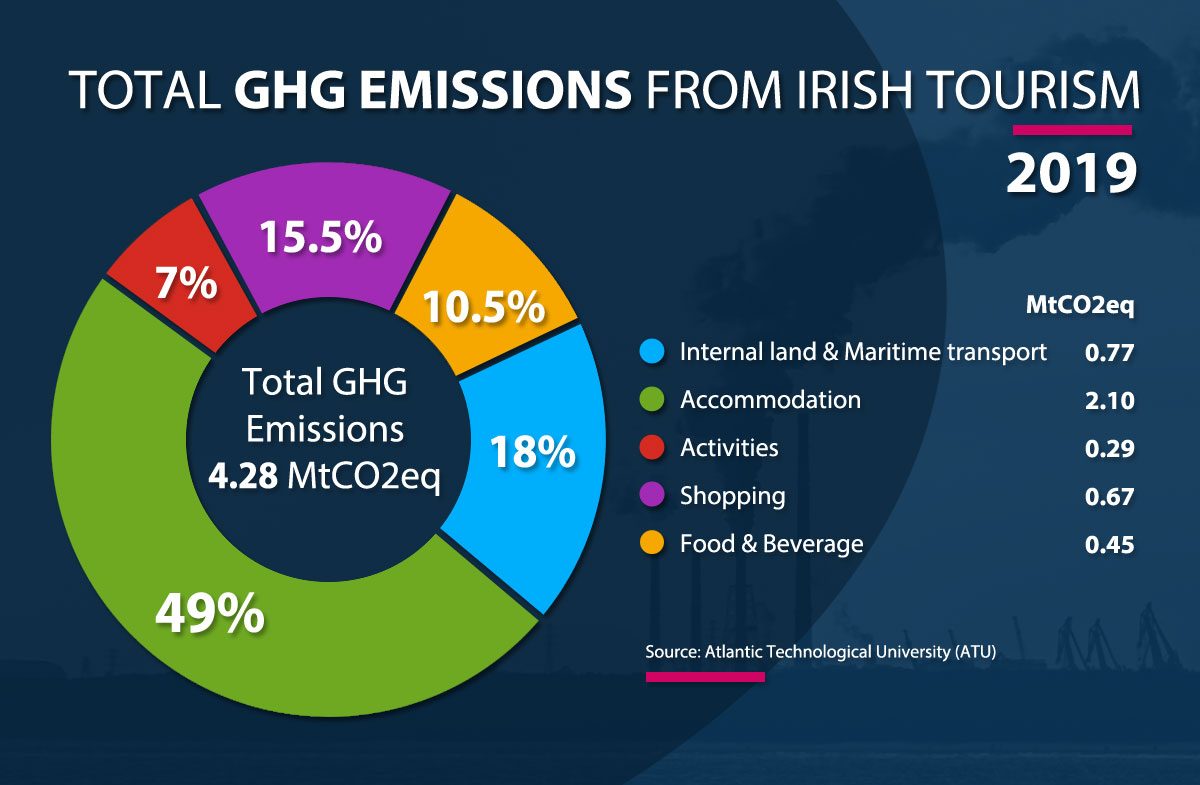

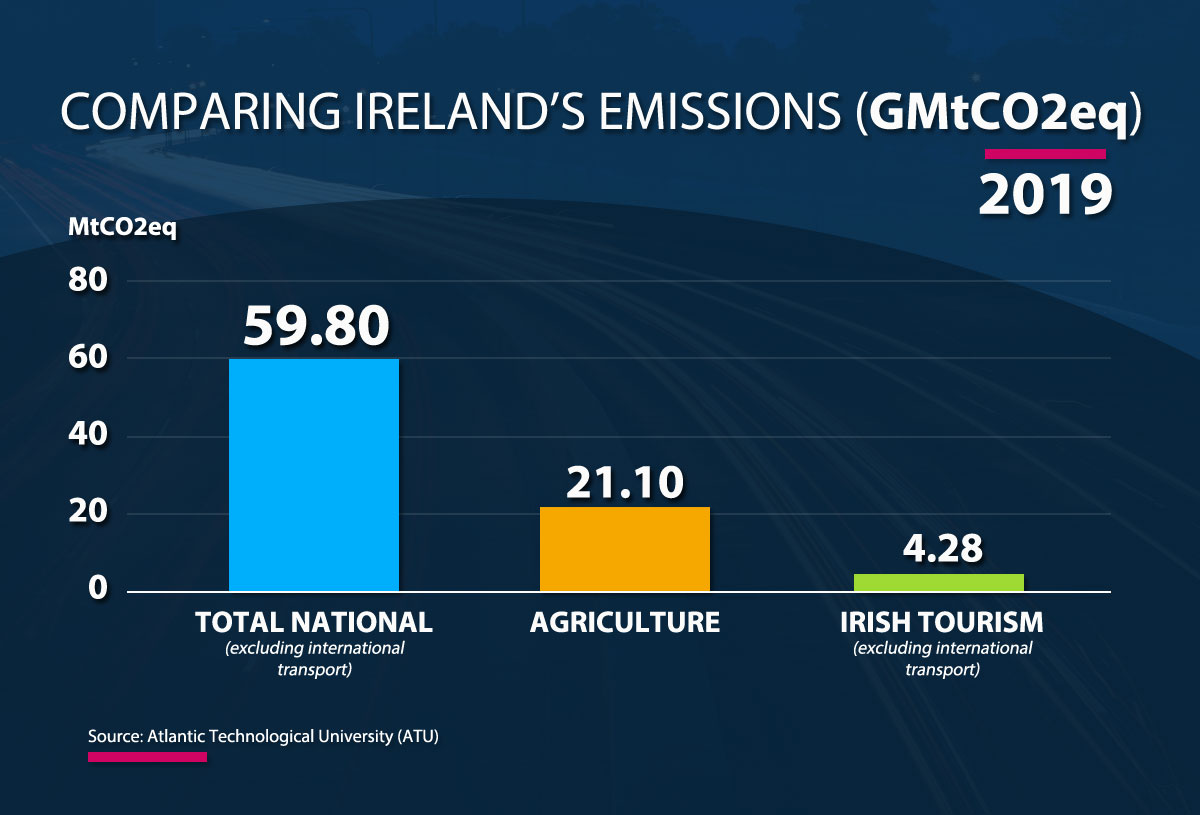

Ireland's tourism industry is estimated to be responsible for over 4 MtCO2eq (million tonnes of carbon dioxide equivalent) excluding international transport, or over 11 MtCO2eq when international transport is included, based on 2019 data, excluding emissions from outbound tourists and cruise ship passengers. Overseas visitors are responsible for 87% of emissions. [Atlantic Technological University (ATU)]

5. New Border entry procedures

Entering Europe and the UK will soon change for many travelling on a non-EU passport two new border control schemes come into operation.

European Travel Information and Authorization System (ETIAS): Travelers from outside the EU, who do not require a visa, will soon be required to apply for advance authorisation to enter member states. Implementation is awaiting the initiation of the EU's biometric Entry/Exit System (EES) based on new IT infrastructure at border entry points across the EU – a system which Ireland is not participating. Entry for travellers from third countries currently governed by visa entry will remain in place – with separate application required for entry to Schengen area (30 countries), the UK, and Ireland.

UK's new Electronic Travel Authorisation (ETA) will be required from 2024 for all international visitors. While Ireland and UK residents enjoy a restriction free Common Travel Area (CTA), the new requirement could discourage dual UK & Ireland visits from non-residents, and limit all island itineraries.

State Policy and support architecture

Exploiting the opportunities and minimising the challenges as articulated above are dependent on pro-tourism policies and supportive state architecture. In that context the horizontal cross-cutting nature of the sector represents a challenge as to the optimum placing of political and administrative responsibility for tourism within national government structures. While transport, heritage, culture, the natural environment, and sports each have a contributory role in the visitor experience, a review of international best practice shows that in more than half of OECD member states responsibility for tourism now resides within an economic ministry.

"While frequently destination marketing and promotion is identified as the key role of government but on closer examination it is apparent as a country's tourism industry matures that more successful destinations focus primarily on enterprise policy and strategies." (OECD: SME and Entrepreneurship Policy in Ireland, 2019)

The scale of the opportunity for Irish tourism warrants the integration of tourism in a national enterprise policy and strategies in pursuit of shared economic goals. Tourism has the potential to deliver a greater contribution to economic growth, particularly in respect of spatial distribution, regional economic, social and environmental development. A medium to longer term policy framework would improve the prospects for investment in the sector. Furthermore the tourism sector requires a new set of metrics to meet data gaps and measurement challenges to improve the monitoring of performance with a focus on measuring the economic contribution, including the further development of national and regional Tourism Satellite Account (TSA), together with real time performance indicators.New mobile technology based data tools, such as remote sensors and big data management systems, are revolutionising visitor tracking. Ireland has yet to exploit the opportunities presented by data sources, including mobile telecommunications and payment systems, to monitor visitor flows and behavioural patterns.

6. THE SUSTAINABILITY IMPERATIVE

"Tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities"

In 2015 the UN developed a set of 17 Sustainable Development Goals in order to frame the UN member states' agendas and policies up to 2030. Following this in 2018 the Irish Government set out how Ireland intends to implement the 17 Sustainable Development Goals (SDG) through development of actions and targets around each goal. It is incumbent upon all Government Agencies and Departments to ensure these actions and targets are adhered to and that each sector contributes to Ireland's realisation of these goals. Specifically there are four Sustainable Development Goals (8, 12, 14 & 17) that have targets relating to tourism. The most relevant SDG is Goal 12 namely "Develop and implement tools to monitor sustainable development impacts for sustainable tourism that creates jobs and promotes local culture and products."

ITIC and Irish tourism businesses have taken a leadership position on sustainability for some time and a seminal report by ITIC was published 18 months ago calling for clear metrics to be put in place so that industry would know against what to measure its performance in this critical space.

Opportunities & Challenges

There are both opportunities and challenges within Irish tourism's journey to a more sustainable future.

Becoming sustainable is simply a "must do". Implementing transformational change will be good for the planet and, if done correctly, also good for businesses' bottom line as well as supporting the communities within which tourism is embedded. In an Irish tourism context successful implementation of sustainable tourism practices should deliver metrics that will help to establish a better understanding of carbon and financial costs and help mitigate against both. It has long been recognised that collaborative agendas are necessary to ensure that tourism can be a force for sustainable development and Government, the tourism agencies and the tourism industry must commit to working together to ensure that the sustainable tourism agenda is a central part of the thinking for practitioners, policy makers and visitors.

It has been shown that building a sustainable business promotes longevity and more interaction with key stakeholders. Prior to the pandemic there had been a growing realisation among individual tourism operators that sustainable practices were not necessarily a cost. Changing consumer preferences has led to many enterprises taking steps to make their offering more sustainable and generating more business as a result. It is clear that industry needs to continue moving in a sustainable direction – both because of the benefits to the environment and communities, but also to individual businesses. Over time, sustainability must become the norm rather than the best practice exception.

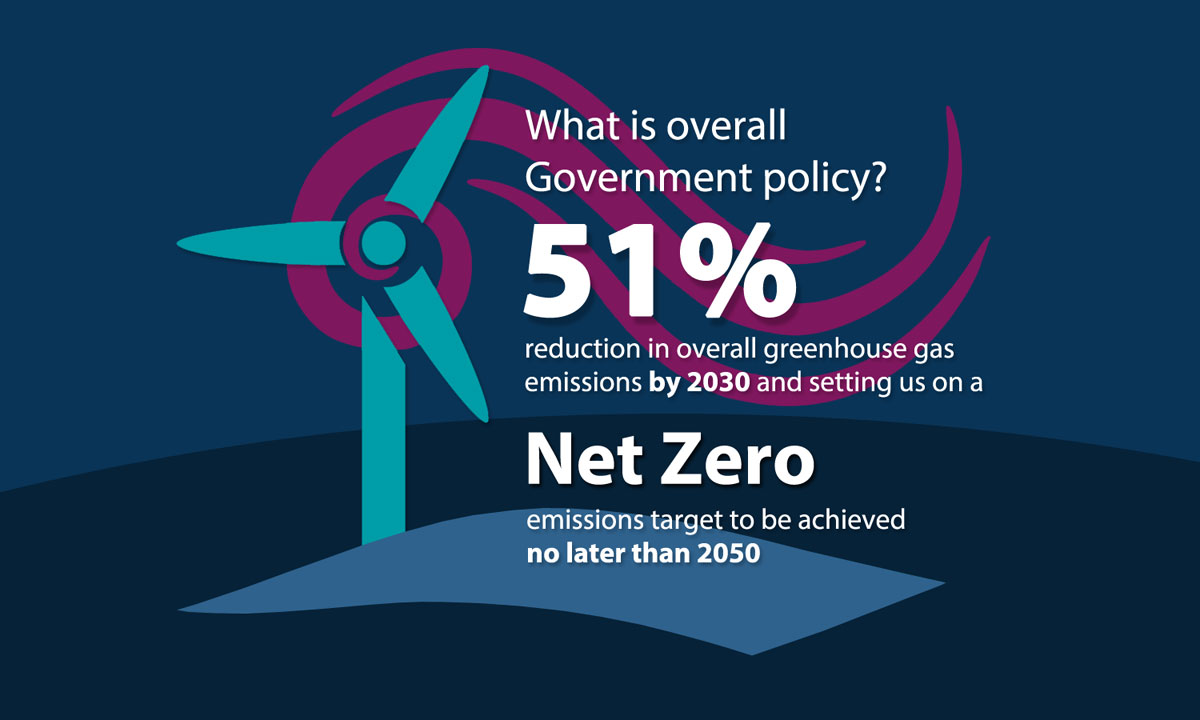

As tourism aims to recover lost ground from the pandemic and grow into a €15 billion industry as articulated in this strategy, Ireland's climate action commitments must always be central. Ireland's tourism industry will play its full part and has made great strides in the right direction already. Irish tourism will be leaders and not laggards in helping the country reduce its green house gas (GHG) emissions by 51% by 2030 and being carbon neutral by 2050.

The Just Transition Funding of €68 million received from the EU and earmarked for tourism capital investment in the Midlands is a very exciting development for Irish tourism. To be spent by 2026 the money is expected to kick-start the tourism economy in the region and develop a key economic engine to replace the phasing out of peat production.

Growing evidence shows that sustainable companies, or those with good Environmental Social Governance (ESG) and certification, deliver better financial performance, and investors now value them more highly.

The worsening effects of climate change have made decarbonisation a top priority for many industries. The World Travel & Tourism Council estimates that global travel and tourism accounts for between 8 and 11 percent of the world's emissions. If nothing is done, the sector's carbon emissions will only rise as it grows.

Ireland's tourism industry is estimated to be responsible for over 4 MtCO2eq (million tonnes of carbon dioxide equivalent) excluding international transport, or over 11 MtCO2eq when international transport is included, based on 2019 data, excluding emissions from outbound tourists and cruise ship passengers. Overseas visitors are responsible for 87% of emissions. [Atlantic Technological University (ATU)]

Shaping a sustainable future for tourism

Key policy issues which need to be addressed to take account of changing consumer values and deliver a sustainable future for the sector have been identified by the OECD. These include:

- a paradigm shift in perceptions and metrics of tourism success – across all levels of government and stakeholders, with a greater focus on environmental and socio-cultural pillars of sustainability in addition to economic benefits;

- integrated policy approach with industry and communities – to grow tourism within the wider context of national regional and local development strategies;

- mainstreaming sustainable policies and practices – a transition to a green, low-emission and climate resilient tourism economy;

- more sustainable tourism business models – business have a key role to play in adopting eco-responsible practices and advancing technologies across the transport and tourism sector to better deliver a positive impact on sustainability;

- better measurement for better management – improved, robust, timely and disaggregated system of tourism statistical metrics.

The drive to more sustainable tourism

Aviation: The European aviation industry was the first in the world to commit to the realisation of a net-zero goal for all departing flights by 2050. The use of Sustainable Aviation Fuels (SAF) will play a decisive lead role in the decarbonisation, together with aircraft technological advancement and air traffic management. Irish airlines are making significant capital investment in more energy efficient aircraft while committing to use of Sustainable Aviation Fuel (SAF).

Europe's aviation leaders recently called on member states to confirm the ReFuel EU Aviation Regulation and enable Europe to become a leader in SAF production worldwide. There is significant opportunity in tying the production of SAF with the increased use of hydrogen to reduce the use of biofuels for SAF. The decarbonisation of aviation requires industry and government to work together in establishing production facilities to ensure reliable supply together with ensuring the price differential versus traditional aviation Jet Fuel is significantly reduced.

Ferry and Cruise: Switching to 'net' zero carbon fuels is the long-term solution to shipping's decarbonisation. This transition is being driven forward by the economic performance of zero-emission vessels, environmental considerations, and the development and implementation of international regulations and policies. Operators in the sector are investing in ships fuelled by LNG (liquefied natural gas) – a fuel which emits virtually no sulphur dioxide, nitrogen dioxide or particulate emissions, as well as reducing carbon dioxide output by 25%.

Key focuses around sustainability onboard ships include investment in exhaust gas cleaning systems that minimise sulphur emissions, use of innovative, non-toxic, anti-fouling hull paints to reduce resistance, and the potential use of bio-fuels which can be up to 86% less carbon intensive than fossil fuels.

An interesting approach to promoting responsible consumption is Irish Ferries' selection of crew uniforms, which now contain 95 percent recycled polyester recovered from plastic bottles. In 2022, the parent company purchased close to 1,000 garments, equating to 42,000 plastic bottles being recycled and prevented from reaching the oceans or landfill sites.

Road & rail: Ground transportation plays an important role in Ireland's tourism, with a significant large proportion of visitors enjoying a touring holiday. Ambitious plans for upgrading and use of alternative fuels on public transport networks are unlikely to be realised within the current decade, including key tourism related infrastructure projects to provide seamless public transport to/from airports. However, some projects including ongoing investment in the new bus and rail fleets will see greater reliance electric power for urban bus fleets and commuter rail.

Inbound Tour Operators Sector: A recent study has found that group tours attract visitors with a lower on island carbon footprint relative to an average visitors. The study estimates that a typical package holiday visitor, handled by inbound tour operators, has an on-island carbon footprint is 0.132TCO2 eq., 54% lower compared to the average on-island tourist carbon footprint of 0.287 TCO2 eq. (ATU – Atlantic Technology University Study). Their extended stay likely includes visits to more locations around the island which, in return, support local and marginal communities. And short distances between attractions in Ireland – as opposed to most larger countries – allow more destinations to be visited per km spent on transport.

Visitor attractions are working closely with suppliers to mitigate the carbon footprint of visitors, and will be engaging with the ZEVI (zero emissions vehicle infrastructure) roll-out, as well as committing to reducing energy, water usage, and waste through participating in international benchmarking.

The Cruise Hire Sector, after extensive research this year, will see the fleet powered by sustainable Hydrotreated Vegetable Oil (HVO), which will reduce carbon emissions by up to 90%.

The industry has the potential to develop more sustainable tourism experiences delivering more value-added visitors, while contributing to the country's overall sustainability objectives. However, to realise a more sustainable tourism industry, in which Ireland becomes a recognised leader, some key strategic initiatives will be required across the tourism industry. These include a portfolio of accreditation schemes for each business sector across the supply chain; targets and annual measurable goals for reduction in carbon emissions, waste, greater community engagement, and positive environmental impacts. A comprehensive Government led support framework will be required, including education, mentoring, certification, and funding to accelerate the transition.

CASE STUDIES

7. AMBITIOUS GROWTH TRAJECTORY

A new way forward

The urgent need to lay the foundations of a transformation of tourism's offering to a model of sustainability will not only allow Ireland to maintain its market positioning but will facilitate its competitiveness and secure the future for businesses and employees in the sector. In addition a prosperous tourism sector will facilitate regional development and the preservation of natural and cultural values. More importantly, tourism can contribute directly to six specific goals of the UN Sustainable Development Goals (SDGs).

The major highlights are expected from 2025 onwards, provided the sustainable growth is supported by government policies to facilitate a transformative shift in strategies on the part of the industry and state agencies to deliver renewed growth in tourism receipts.

Value is expected to increase at a sharper rate than volume with the domestic market +3% and overseas +4 to 6%. Value has the potential to increase +50% to €15 billion per annum by 2030 with volume growing at approximately +30%. The divergence of value and volume projected growth rates are due to varying source market and segment growth rates as well as rising prices. It is ITIC's view that the upper growth rate is possible if the actions within this report are implemented.

Demand from overseas is anticipated to recover at a higher annual growth rate over the period to 2026. Growth in demand over the period is projected to vary across the source markets, with growth at a slower than aggregate average from close in source markets, compared to an above average rate of growth from more valuable markets of North America and emerging long haul origin markets.

Note: In the absence of volume and value statistics on international tourism to Ireland since early 2020 and the introduction of a new methodological approach by the Central Statistics Office (CSO) the revised data release new data series is not directly comparable with data from pre-pandemic years. The dearth of current robust data on international tourism to Ireland present a particular challenge in presenting growth scenarios in absolute volume terms.

Explanatory Note

The projections for the short to medium term target include:

growth in holiday visitors, increasing this segment's share of total visitors;

better spread of demand over the year, with particular focus on growth in the shoulder season;

identification of value-added segments to boost revenue; and

growth in repeat holiday demand by delivering better value.

ITIC's estimate of 2023 tourism revenue is based on CSO Q2 data for overseas visitors and CSO Q1 data on domestic travel and includes an estimate of Irish carrier receipts.

The revenue projections are expressed in 2023 terms, and will be subject to inflationary impact on prices and currency exchange rates. The 2030 estimates are based on Compound Annual Growth rate of 4% to 6% (note CAGR higher for overseas visitors than domestic market).

Projections are subject to revision as data on 2023 tourist volume and value becomes available.

Demand variables which will influence outcome include source market mix; seasonality; purpose of visit; type of trip & length of stay and demand by type of accommodation.

Employment assumption include limited spare capacity; tight labour market & tech driving productivity improvement.

Accommodation supply difficult to project due to attrition rate of hotels contracted to Government for humanitarian reasons and impact of legislation on self catering supply.

Do nothing option

Based on international tourism forecasts and trend analysis supported by ITIC's membership business outlook, failure to adopt a new policy, and a fresh strategic approach, to the development of tourism would inevitably lead to:

- A loss of appeal and competitiveness of Ireland as a tourist destination;

- Investment failure – by public and private funding in innovation and expansion, including carriers;

- An over dependency on low growth traditional markets and segments, threatening the sustainability of enterprises;

- Failure to realise tourism's potential to foster regional economic development;

- Failure to achieve Ireland's sustainability goals.

8. ACTIONS

SUSTAINABILITY

1. ACTION

Irish tourism industry to partner with Government and Agencies to deliver sector climate action programme.

Lead Responsibility

Industry

Other Stakeholders

Government,

Fáilte Ireland

UN Sustainable Development Goals

2. ACTION

Develop a unified island of Ireland certification principle for tourism enterprises and incentivise businesses to join same.

Lead Responsibility

Fáilte Ireland,

Tourism Northern Ireland

Other Stakeholders

Industry,

ITIC,

Northern Ireland Tourism Alliance

UN Sustainable Development Goals

3. ACTION

A strategic partnership between Fáilte Ireland and the Sustainable Energy Authority of Ireland for benefit of industry to help it transition to carbon reduction.

Lead Responsibility

Fáilte Ireland

Other Stakeholders

SEAI,

Industry

UN Sustainable Development Goals

4. ACTION

Ireland to take a lead in Sustaianble Aviation Fuel, hydrogen and biofuels R&D and production, supported by financial incentives.

Lead Responsibility

Government

Other Stakeholders

IDA,

Airlines,

Airports

UN Sustainable Development Goals

5. ACTION

Expedite energy efficiency developments through planning process.

Lead Responsibility

Government

Other Stakeholders

Local Authorities

UN Sustainable Development Goals

6. ACTION

Ireland to sign up to Glasgow Declaration, a UNWTO declaration that aims to lead and align climate action across tourism stakeholders including Government, Agencies and Industry.

Lead Responsibility

Government

Other Stakeholders

Industry,

Fáilte Ireland

UN Sustainable Development Goals

7. ACTION

To assist businesses transition to carbon-neutrality, and support circular tourism economy, explore development of off-setting project within Ireland including biodiversity, reforestation, sequestration.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

Industry

UN Sustainable Development Goals

8. ACTION

Expedite electrification of road transportation with roll out of fast charging infrastructure nationwide. The Zero Emissions Vehicles Ireland (ZEVI) should be fast-tracked with partnership with hotels and attractions.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

CRCI,

IHF,

AVEA,

IAAT

UN Sustainable Development Goals

COMPETITIVENESS

9. ACTION

Tourism businesses to deliver high satisfaction and value for money rating from visitors.

Lead Responsibility

Industry

Other Stakeholders

Fáilte Ireland,

Industry

UN Sustainable Development Goals

10. ACTION

Tourism competitiveness be monitored and addressed, paying particular attention to labour, insurance and regulatory costs, in line with recommendations of the National Competitiveness Council.

Lead Responsibility

Fáilte Ireland

Other Stakeholders

ITIC

UN Sustainable Development Goals

11. ACTION

The 9% VAT rate should be restored to ensure Irish tourism's competitiveness compared to its European peers.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

ITIC

UN Sustainable Development Goals

12. ACTION

Prime domestic marketing to increase value of staycations year round.

Lead Responsibility

Fáilte Ireland

Other Stakeholders

Industry

UN Sustainable Development Goals

13. ACTION

Strategic review of overseas source markets to deliver a balanced portfolio of revenue potential and value-added segmentation.

Lead Responsibility

Tourism Ireland

Other Stakeholders

ITIC,

Fáilte Ireland,

Carriers

UN Sustainable Development Goals

14. ACTION

Refresh and renew Tourism Brand Ireland and review efficacy of regional brands.

Lead Responsibility

Tourism Ireland,

Fáilte Ireland

Other Stakeholders

ITIC

UN Sustainable Development Goals

15. ACTION

Review consumer segmentation to finite budgets are targeted efficiently in overseas markets.

Lead Responsibility

Tourism Ireland

Other Stakeholders

ITIC,

Fáilte Ireland

UN Sustainable Development Goals

16. ACTION

In the light of changing border entry protocols across Europe and the UK, a review of Ireland's entry and visa requirements is opportune, including the merits or disadvantages of joining Schengen, to ensure that Ireland is not competitively disadvantaged.

Lead Responsibility

Department of Justice

Other Stakeholders

ITIC,

Fáilte Ireland,

Tourism Ireland,

Carriers

UN Sustainable Development Goals

17. ACTION

Re-establish the Taste the Island initiative and deliver a new Food Tourism Strategy for Ireland.

Lead Responsibility

Fáilte Ireland

Other Stakeholders

Tourism Northern Ireland,

RAI,

IHF,

ITIC

UN Sustainable Development Goals

18. ACTION

Grow Ireland's digital leadership in tourism marketing and e-commerce capability.

Lead Responsibility

Industry

Other Stakeholders

Fáilte Ireland,

Tourism Ireland

UN Sustainable Development Goals

CONNECTIVITY

19. ACTION

Support Dublin Airport in delivering high quality international connectivity in the national interest, through growth in passenger and aircraft movements and delivery of air transport related infrastructure to improve safety, efficiency, customer services and access.

Lead Responsibility

Local Authority

Other Stakeholders

DAA,

Airlines,

ITIC

UN Sustainable Development Goals

20. ACTION

A new Regional Airport Programme 2025-2030 required, aligned to EU State Aid limits, to ensure the sustainability of airports providing connectivity to the Regions.

Lead Responsibility

Government

Other Stakeholders

Airports

UN Sustainable Development Goals

21. ACTION

Prioritisation of tourism enabling infrastructure – airport development; Metro link to Dublin Airport; national broadband roll-out; improved motorway access; and coach parking.

Lead Responsibility

Government

Other Stakeholders

Transport for Ireland,

Local Authorities

UN Sustainable Development Goals

SKILLS & CAREERS

22. ACTION

Surplus of €1.5 bn within National Training Fund to be made accessible to tourism and hospitality enterprises.

Lead Responsibility

Government

Other Stakeholders

Industry,

IHF,

Restaurants Association of Ireland

UN Sustainable Development Goals

23. ACTION

A new Hospitality Centre of Excellence, under the auspices of an existing third level institute, modelled on Switzerland's success in hospitality skills and lifelong learning.

Lead Responsibility

Government

Other Stakeholders

ITIC,

Fáilte Ireland

UN Sustainable Development Goals

24. ACTION

Inclusion of identified hospitality skills on Eligible Occupation list to meet sector's labour shortages.

Lead Responsibility

Government

Other Stakeholders

IHF,

RAI,

Vintners' Associations

UN Sustainable Development Goals

25. ACTION

Explore Continuous Professional Development opportunities for professionals in the industry.

Lead Responsibility

ITIC

Other Stakeholders

Technical Universities of Ireland

UN Sustainable Development Goals

26. ACTION

Establishment of Tourism & Hospitality Careers Oversight Group funded through National Training Fund.

Lead Responsibility

Fáilte Ireland

Other Stakeholders

Industry,

IHF,

RAI,

AVEA,

IAAT

UN Sustainable Development Goals

SUPPLY CONSTRAINTS

27. ACTION

A comprehensive 2 year plan as to how Ukrainian refugees and international asylum seekers are to be housed and how over-reliance on tourism accommodation stock is to be reduced.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

Local Authorities,

ITIC,

Irish Hotels Federation

UN Sustainable Development Goals

28. ACTION

Financial incentives to attract investment in visitor accommodation in designated areas.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

ITIC,

IHF,

Local Authorities

UN Sustainable Development Goals

29. ACTION

Ensure short term tourist let legislation from EU is applied responsibly to protect self-catering tourism product in regional Ireland.

Lead Responsibility

Government

Other Stakeholders

Local Authorities,

ITIC,

Irish Self Catering Federation,

Air BnB,

Fáilte Ireland

UN Sustainable Development Goals

30. ACTION

Reduce bottleneck in car hire supply by introducing VAT equalisation measure.

Lead Responsibility

Government

Other Stakeholders

Car Rental Council of Ireland,

ITIC

UN Sustainable Development Goals

INVESTMENT

31. ACTION

Minimum €50m annual capital investment programmes in product innovation to complement private sector commitment including development of Midlands and North-East hero attractors.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

Local Authorities,

Industry

UN Sustainable Development Goals

32. ACTION

A blueprint for tourism product & experiences out to 2030 including a review of historic buildings in State ownership re potential tourism use and funding for same.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

Local Authorities,

OPW,

ITIC

UN Sustainable Development Goals

33. ACTION

Sustained minimum €200 million annual investment in Failte Ireland and Tourism Ireland to ensure industry supports and appropriate domestic and international marketing campaigns.

Lead Responsibility

Government

Other Stakeholders

Fáilte Ireland,

Tourism Ireland,

Industry

UN Sustainable Development Goals

34. ACTION

A strategic study to identify how new technology, artificial intelligence and robotics will impact the tourism sector, its industry and consumers.

Lead Responsibility

Fáilte Ireland

Other Stakeholders

ITIC

UN Sustainable Development Goals

35. ACTION

Complete Regional Events Centre and maximise business tourism value to country.

Lead Responsibility

Local Authority

Other Stakeholders

Private Sector,

Industry

UN Sustainable Development Goals

POLICY & SUPPORT FRAMEWORK

36. ACTION

Responsibility for tourism, as a key indigenous enterprise sector, be assigned to an economic Ministry, alongside other business sector.

Lead Responsibility

Government

Other Stakeholders

ITIC

UN Sustainable Development Goals

37. ACTION

In a changing economic and business environment, a review of tourism legislation is due as well as strengthening of the roles of State agencies therein.

Lead Responsibility

Government

Other Stakeholders

ITIC,

Fáilte Ireland,

Tourism Ireland

UN Sustainable Development Goals

38. ACTION

A review of the sources, methodologies, timeliness and robustness of Ireland's tourism data is opportune to ensure that it reflects current international best practice.

Lead Responsibility

Government

Other Stakeholders

CSO,

ITIC,

Fáilte Ireland,

Tourism Ireland

UN Sustainable Development Goals