IRISH TOURISM: RECOVERY & OUTLOOK

10 JANUARY 2023

INTRODUCTION

As we enter a new year it is difficult to gauge the mood of Irish tourism businesses – raise a glass to the fact that 2022 was far better than anticipated or nervously take a sip as to what 2023 holds in store?

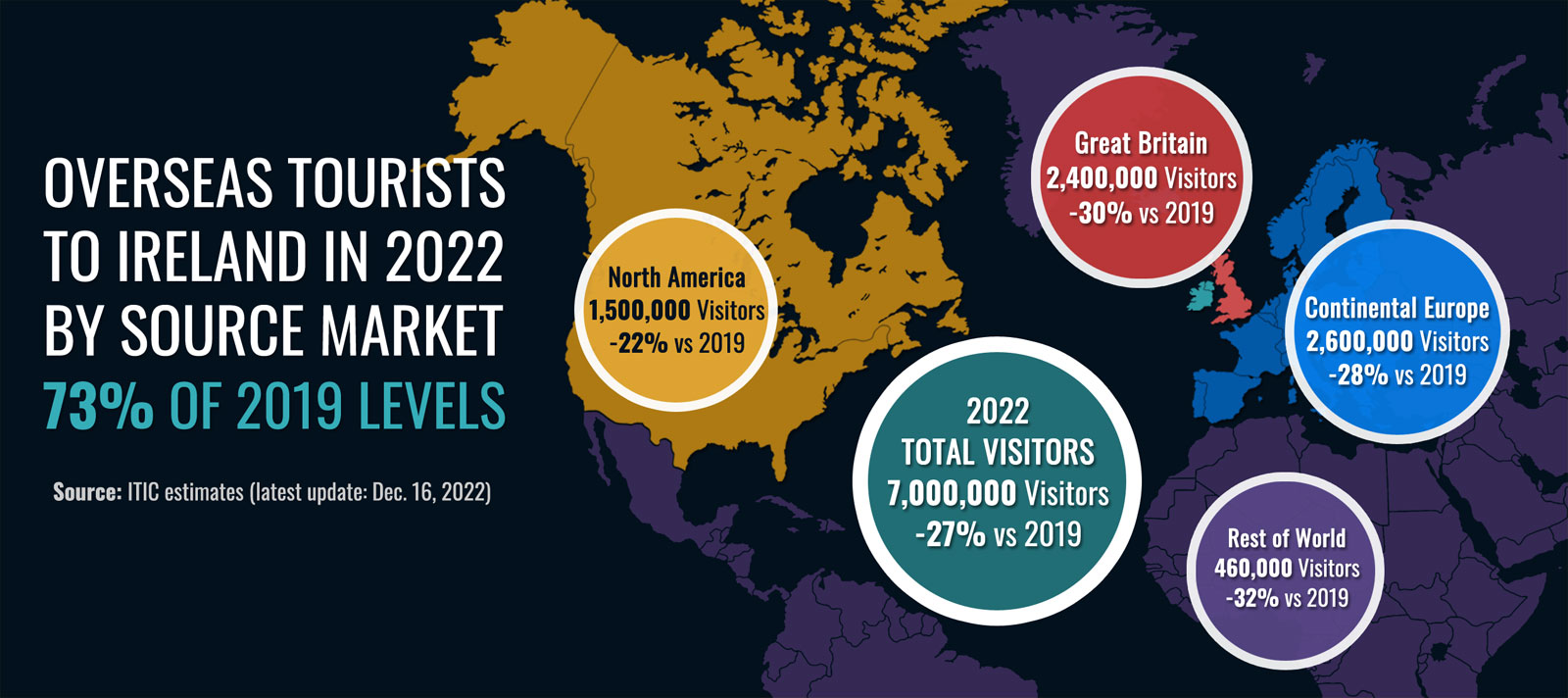

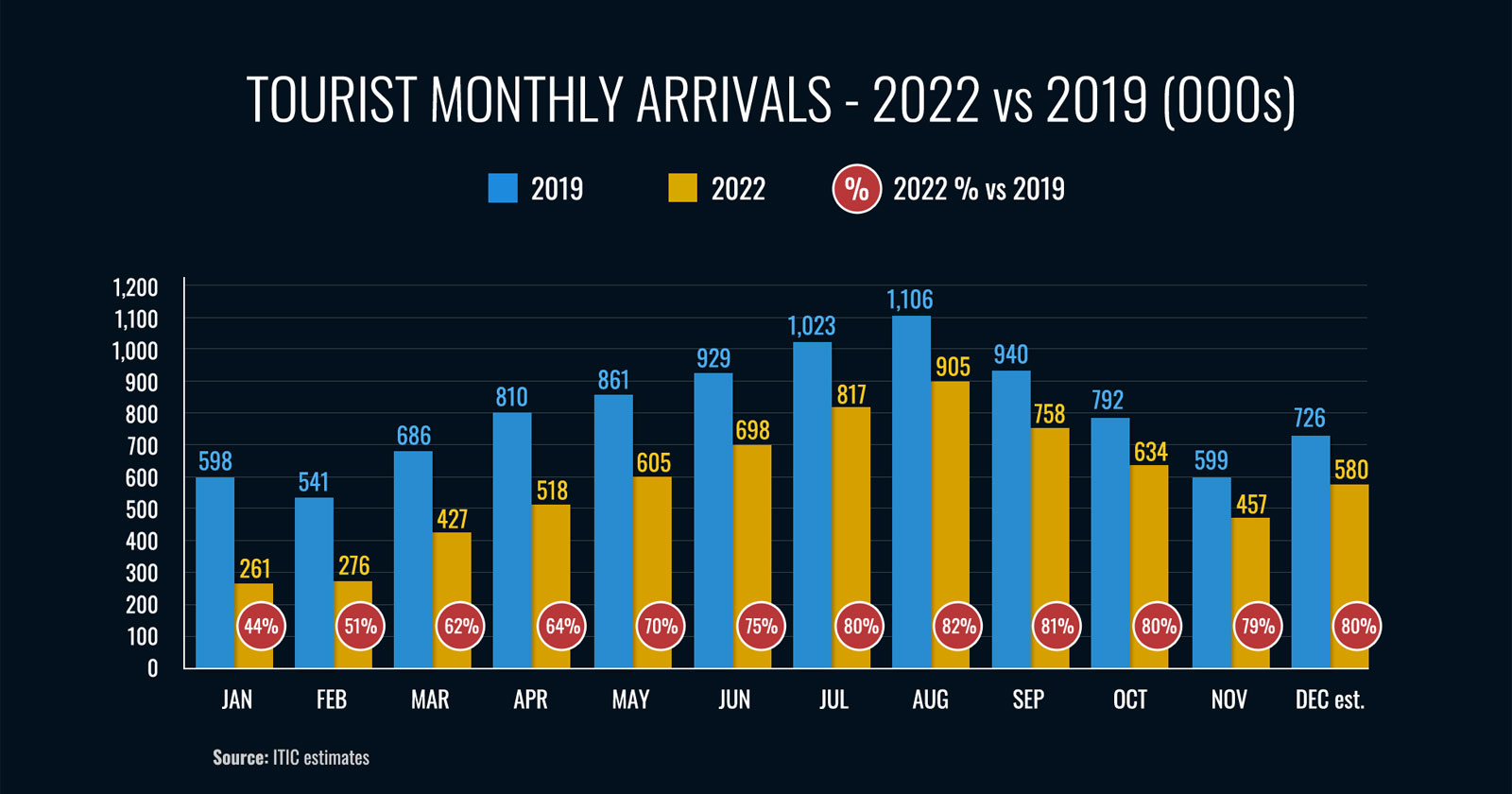

Certainly, compared is to this time last year – when Covid was rampant and the industry was shut – things are much more positive. Since travel restrictions were finally lifted back in Q1 2022 the speed and strength of the recovery in tourism numbers to Ireland has exceeded expectations and the surge in demand has surpassed most industry projections. The Irish Tourism Industry Confederation (ITIC) estimates that 7 million international tourists came to Ireland in 2022, a 73% recovery compared to the pre-pandemic peak of 2019. Not an inconsiderable feat considering there were no international holiday-makers in the intervening 2 years. Pent-up demand, deferred bookings and accumulated savings all boosted business as supply struggled to meet the surge in demand.

However hopes of difficulties being in the rear-view mirror have quickly evaporated with inflation and particularly energy prices soaring to unsustainable levels along with a much weaker global economy. This allied to a sharp reduction in tourism accommodation as a result of Government policy means that there is considerable unease about the outlook for 2023 with fears that continued recovery will be threatened. This bulletin by ITIC offers a deep dive into tourism's recovery last year and its outlook for the year ahead. It looks at the restoration of connectivity to Ireland and also outlines the hopes and expectations for key source markets. ITIC analysis suggest that full recovery is not expected until 2026 and in this context it is critical that pro-tourism policies from Government are pursued including the extension of the 9% VAT rate and the amelioration of supply bottlenecks.

2022 – A YEAR OF RAPID RECOVERY

International travel to & from Ireland reopened in 2022

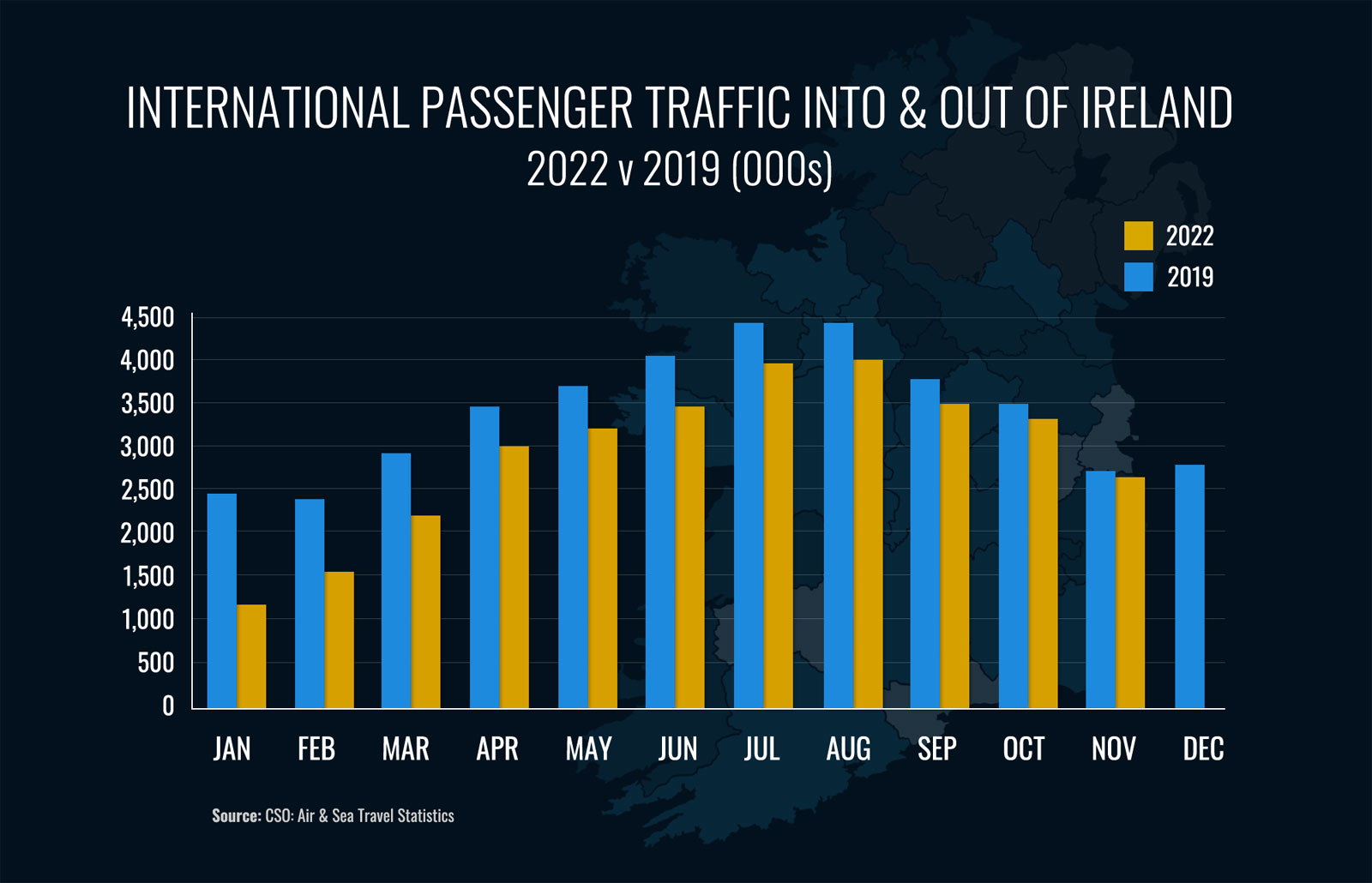

As the spread and risk of COVID infection receded and travel restrictions were lifted international traffic rebounded on the back of pent up demand, high levels of personal savings and a resilient airline industry. The result was a surge in travel which far surpassed projections in the speed of recovery and the depth of demand. As a result many airports across Europe, and other travel providers, were swamped by demand volumes.

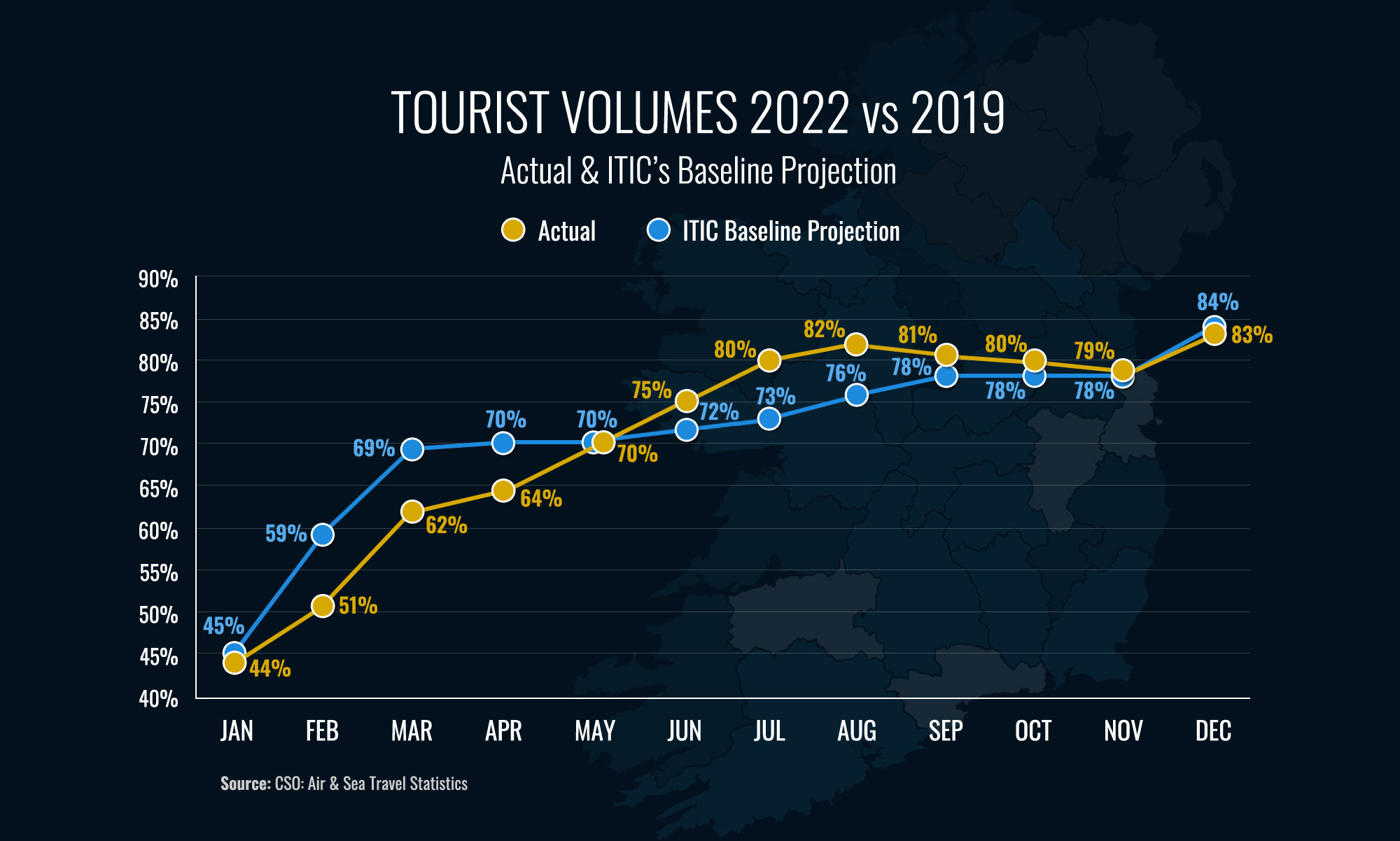

International travel to and from Ireland experienced a rapid recovery, led by outbound demand of Irish residents. Over the earlier months of the year the dominance of Irish originating demand was obvious as travel restrictions were relaxed. Total travel volumes in Q1 were just below two thirds of volumes over the same period in 2019, Q2 passenger traffic had recovered to 86% and continued to build strongly to reach 90% of 2019 levels in Q3. Inbound tourist arrivals lagged the speed and rate of recovery of Irish outbound travel.

Overseas tourists rebounded to 73% of 2019 levels

An estimated 7 million overseas tourists visited Ireland, compared to 9.7 million in 2019. This excludes day visitors and transfer traffic.

The speed and strength of the recovery in travel to Ireland, in common with most other destinations, far exceeded expectations. The surge in demand surpassed most industry projections, leading to some bottlenecks in international travel.

Note: ITIC estimates on tourist volumes are provided in the absence of official CSO survey sourced data on tourist volumes, value, and tourist profiles, including purpose of visit, length of stay, accommodation used, etc.

The early months of the year were subject to ongoing travel restrictions, with Ireland adopting a more conservative approach to the easing of restrictions. The pattern of recovery of tourist arrivals very much mirrored the lifting of testing requirements, with USA and Canada relaxing requirements in June providing a boost to transatlantic travel. A slow start to the year led to a progressive build up to a return of overseas visitors from Q2 leading to a particularly strong demand in the peak months of Q3, with the momentum extending into the later months. All indications point to a resilient holiday season demand in December.

Ireland's robust recovery owes much to Ryanair's aggressive expansion of service on short haul routes and Aer Lingus' restoration of transatlantic routes and capacity. As markets re-opened for travel carriers reported a narrowing of the booking window for travel, with an increase in short lead time for near future travel.

Demand patterns

Frustratingly the CSO has not reported on tourism data since before the pandemic. As a result the type of visitor, expenditure profile, and duration of stay are all lacking. Nonetheless ITIC research suggests that the composition of post-pandemic demand for travel to and from Ireland showed a number of noticeable shifts in the relative share by purpose of travel.

- VFR visits and homecomings were amongst the first to resume as international travel reopened. Over the first half of the year such visits accounted for a more significant share of arrivals, estimated to have been the dominant reason for travel in the early months of 2022 as travel restrictions were lifted.

- Holiday or leisure trips rebounded as the summer season approached releasing pent up demand, with high levels of demand for peak season travel. Demand from North America proved to be more buoyant than from other markets, driven by a high proportion of deferred bookings together with a sharp appreciation in the value of the US dollar. Recovery from mainland Europe and Britain was driven by main holidays. Travel from emerging markets in the AustralAsia-Pacific region, amongst the last markets to reopen for international travel, was largely dependent on the diaspora and repeat visitors. The atypical year for international travel is not surprising that main holidays accounted for a bigger share in this category with additional holidays slower to recover mirroring in part the resumption of events and activities in Ireland.

- Business travel recovery has lagged other segments. Corporate travel has been slower to resume with business trips from Britain, Ireland's top source market, reported to be slowest to recover post pandemic and post Brexit.

Restoration of connectivity- key driver of Ireland's recovery

Airline capacity operated to/from Ireland reached close to 90% of 2019 capacity over the summer season schedule, with the current winter schedule matching pre-pandemic levels on many routes.

Recovery was strongest in June across most markets, except North America which reached peak recovery in July and August. Overall recovery was most marked on mainland European routes reaching 95%, followed by transatlantic routes at 86% and routes to Britain at 85%. Reinstatement of routes and capacity on east bound long haul routes lagged to reach 80% of 2019 levels.

A marked characteristic of the restoration on European routes was a surge in capacity on offer to Mediterranean sun resort destinations to cater for outbound demand.

Ryanair, the market leader on short haul routes to/from Ireland, gained market share following a speedy restoration of capacity and aggressive marketing of low fares, especially to the outbound sun holiday market. Ryanair stimulation in selected markets saw airport traffic in Ireland coming close to full recovery (-5.9%) in October – amongst the top performing air markets in Europe. (check CSO air stats for Oct.)

Aer Lingus, the market leader on transatlantic routes, reinstated services and capacity as the market re-opened, catering to the surge in demand for travel to Europe from the USA.

Foreign network carriers serving Ireland restored service and capacity over the course of the year providing connectivity to all the major hub airports in Europe and the Middle East.

Ireland's return of airline capacity exceeded the overall recovery by European airlines which reached 82% of the pre-pandemic level in July.

Ireland is currently enjoying a bumper winter schedule with capacity on most routes back to or exceeding pre-pandemic levels. Ryanair is operating record schedules from Dublin, Cork, Shannon and Ireland West airports including a number of new routes. Aer Lingus is serving 12 gateways in USA & Canada on up to 150 departures each week, while maintaining its short haul route network. International airlines serving Ireland are operating a winter schedule close to pre-pandemic levels.

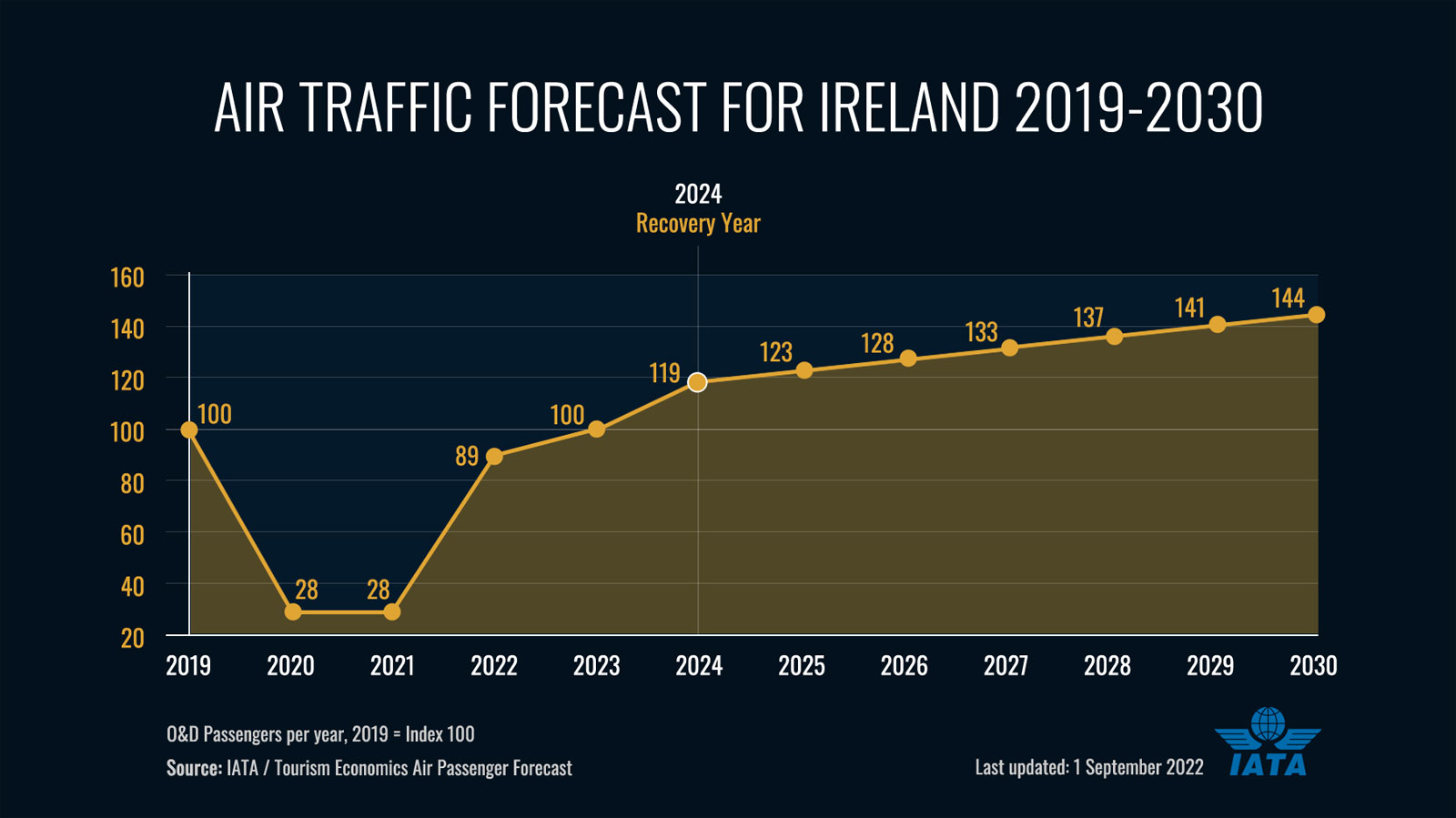

IATA, the representative organisation for global aviation, estimate that air traffic forecast for Ireland is set to match 2019 levels by 2024. Of course air traffic does not equate to inbound tourism volume and ITIC estimate that full tourism recovery for Ireland will lag this.

Recovery not without its challenges

In common with many other destinations Ireland experienced a number of challenges in 2022 due to the fast rebound of demand for international travel. These have included airport congestion, labour shortages across all service businesses, car hire supply, and rising prices.

In addition Ireland experienced a number of specific supply-side issues, most notably a reduction in available stock of visitor accommodation. A number of properties, mainly hotels, were contracted to cater for the influx of refugees from Ukraine and asylum seekers from other parts of the world.

Despite significant accommodation and staffing shortages, and inflationary pressures, initial findings suggest that Ireland retained its value proposition despite domestic media coverage of excessive pricing by a minority of providers. Demand for hotel stays grew over the year as travel recovered. Peak season demand saw average hotel occupancy rate top 80% in each month between June and September. The domestic market remained the primary source of demand for hotels in Ireland. Overseas guests accounted for just under 30% of all stays between January and September 2022.

2022 an atypical year

Despite robust recovery, 2022 has been far from a typical tourism year. The extraordinary rebound of post pandemic demand does not necessarily point to a progressive trajectory of recovery into 2023, especially in light of the rising costs of energy and food and an economic slowdown, if not recession, across Ireland's key tourism source markets.

2023 – A CHALLENGING YEAR AHEAD

Situation Analysis – An Overview

EXTERNAL CONTEXT

IRELAND CONTEXT

Geopolitical context

The Russian invasion of Ukraine on 24 February 2022 has resulted in immense societal and economic turbulence, geopolitical tensions and the largest displacement of Europeans since World War II.

The war has also imperilled global economic recovery from the impact of the pandemic. It has triggered the biggest energy price shock since the 1970s, threatening food supplies and other supply chains, resulting in inflation reaching a 20 year high.

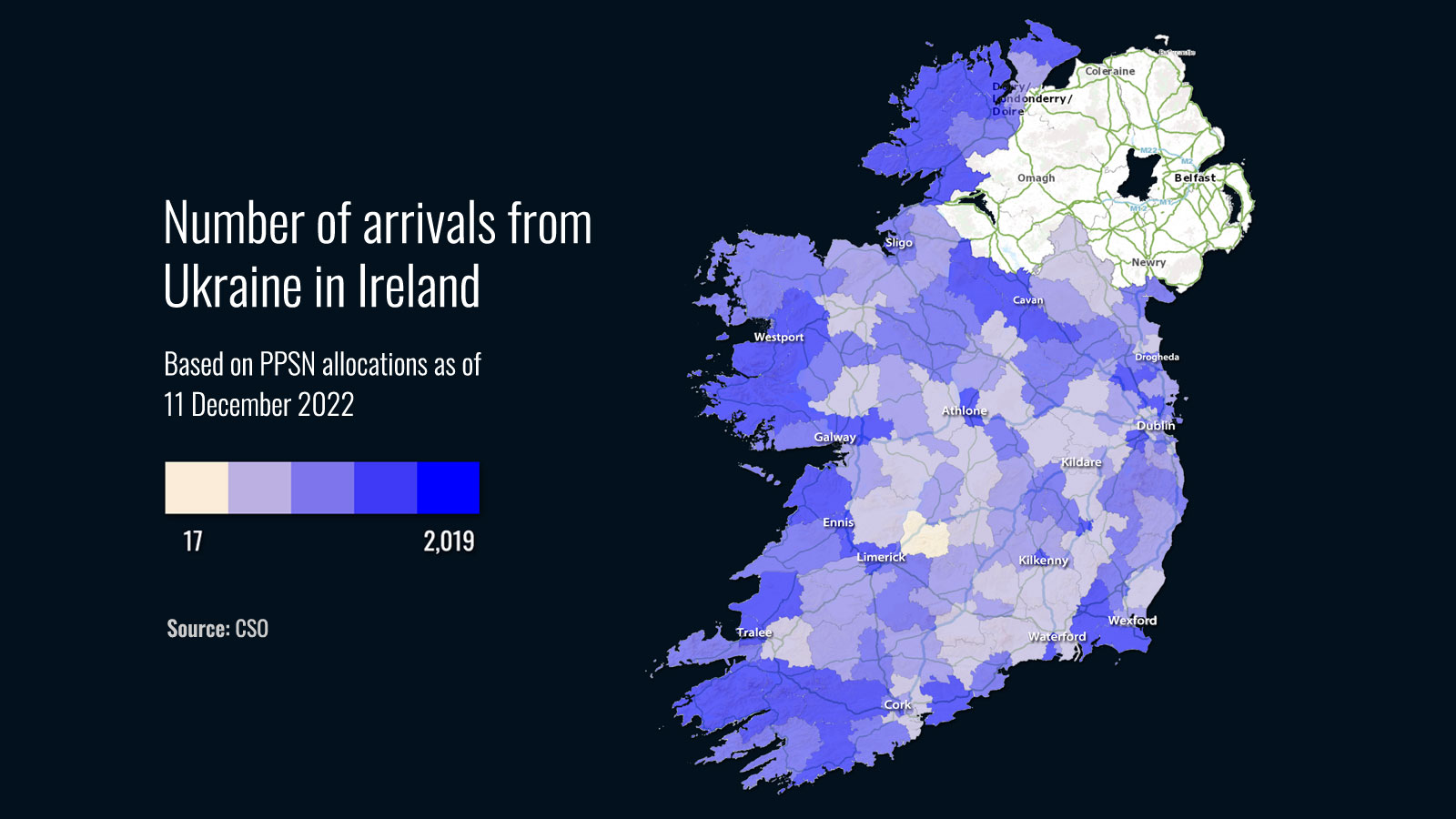

Latest estimates put the number of Ukrainians fleeing the war at over 5 million across Europe, not counting over 2 million entering Russia. As at December 11th, Ireland has welcomed 67,448 Ukrainians, with arrivals averaging just over 1,000 per week over recent months. Ireland, under the European Union's Temporary Protection Directive, has accommodated more people per capita than other European states excluding Germany and countries bordering Ukraine.

The World Health Organisation estimate that between 2 and 3 million could be displaced in the coming months as Russia attempts to 'weaponise winter' by targeting attacks on energy and water infrastructure in populated urban areas.

Prospects of a diplomatic solution to the conflict in the immediate future currently appear remote. The outlook, from most analysts, is for a protracted conflict in 2023.

Macro-economic context

Outlook for the global economy

The global economy is facing mounting challenges amidst the largest energy market shock since the 1970s and the cost-of-living crisis for many households from rising inflation pressures. However, the global economy is expected to avoid a recession next year but is facing a sharp slowdown.

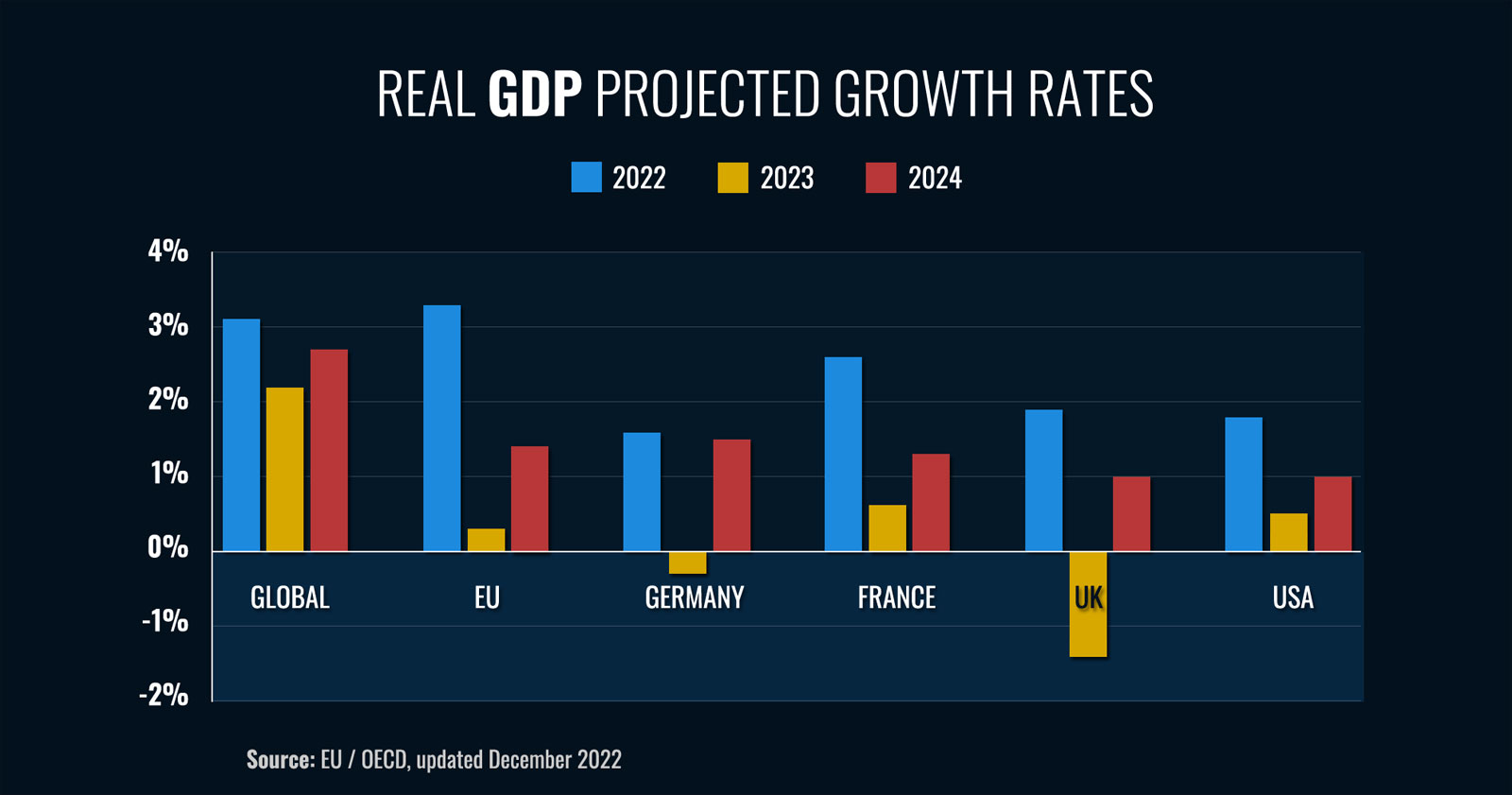

2023 is likely to see weaker growth, a lowering of the rate of inflation and the end of rate hikes, with the U.S. narrowly missing a recession, Europe and the UK contracting and Asia offering green shoots for growth. World economic growth is set to slow from 3.1% in 2022 to 2.2% in 2023 before accelerating to 2.7% in 2024. The global slowdown was hitting economies unevenly, with Europe bearing the brunt as Russia's war in Ukraine drives an energy price spike and hits business activity.

Inflation has soared to levels not seen for many decades, despite Central Banks raising interest rates to curb inflation. As prices and interest rates surge, real term earnings or wages are failing to keep pace in many counties resulting in deep cuts in consumer purchasing power. The good news is the rise in inflation has somewhat abated in the closing months of 2022.

The interplay of inflation and central-bank intervention will ultimately shape the story of economic growth for 2023. The last 12 months have seen the fastest increase in the US Federal funds rate since 1981, and the fastest increase in European Central Bank (ECB) rates since the establishment of the Eurozone. The key to recovery in consumer consumption is containment of inflation with recent indications that Central Banks intervention in raising interest rates may be slowing inflation.

The "world is facing substantial headwinds and substantial risks over the horizon" and "countries also need to take bold steps to address some of the longer-term challenges to lay the foundation for a stronger and more resilient economy."

Secretary General, Mathias Cormann, the Organisation for Economic Cooperation and Development (OECD)

November 22, 2022

With excessive post-COVID consumer demand and the battle against inflation continuing to weigh on growth in 2023, global GDP growth will top out at just 2.2%, narrowly defying recession, but lower than the estimated 3% growth expected for 2022.

Inflation Forecasts

Inflation, economic contraction, higher interest rates and higher energy prices are expected to see consumers curtailing their discretionary spending, including travel. The early part of 2023 is expected to be softer than the demand trend experienced in the latter half of 2022. The extent of the slowdown may well be determined by the impact of energy costs and the severity of the winter months. The summer months could shape up well as research suggests that consumers are firmly committed to resuming travel and may prioritise discretionary spending on holidays.

Euro Zone – A challenging year ahead

Real GDP growth is forecast to grow by just 0.3% in 2023 on the back of the ongoing energy crisis and tightening monetary policy. GDP growth in 2024 is forecast to resume with a consensus estimate of 1.4%.

Of the three biggest EU economies, Germany is forecast to return the third worst-performance within the G20 countries (-0.3%), while Italy (0.2%) and France (0.6%) are likely to post modest growth, according to the OECD.

Inflation: Headline inflation dropped for the second consecutive month to 9.2% year-on-year in December to 9.2%, down from 10.1% in November and the October peak at 10.6%. Energy continued to represent the biggest driver, but down from 34.9% in November to 25.7% in December, as natural gas price continues to decline from its peak in August, according to the latest figures.

Interest rates: the European Central Bank, driven by inflation concerns, interest rates four times in 2022 to its current 2% level. The bank is expected to continue to raise rates, possibly to 3% by mid-year "Interest rates will still have to rise significantly at a steady pace" to ensure that they can return inflation to the 2% target in a "timely" manner, according to an ECB statement.

Unemployment: at a record 6.6% low, jobs filled and hours worked are ahead of pre-pandemic levels on the back of increased labour market participation. While there may be some weakening of employment across the euro zone, any increase in unemployment is expected to be marginal.

The euro: A combination of weak economic growth, the war in Ukraine and the tardy response of the European Bank in raising interest rates saw the euro devalue in the latter half of 2022. The decline in value was most marked against the US dollar, with the currency finishing up the year down 6%, having earlier been traded at close to parity. The euro gained marginally in value against sterling over the year.

Energy prices remains among the significant downside risks to economic recovery – the dominant component of inflation for businesses and consumers. The outlook could become more challenging in the latter part of winter into spring in the face of possible gas shortages and higher prices.

The short term outlook is likely to see high inflation and low consumer sentiment impacting private consumption. Inflation is expected to stay high due to the pass-through of energy and producer prices to consumers, the depreciation of the euro and rising wage pressures, but gradually moderate over the next two years.

Looking specifically at Germany, Europe's largest economy, the country has a high dependency on Russian energy. Latest data showed inflation dropping from 10% in November to 8.6% in December. The economy recorded a 0.4% growth in Q3'22, slightly more than expected, leading some economists to predict the recession will not be as bad as initially feared. However, Germany's dependence on exports, continued energy price volatility, and reduction in incomes and saving dampening private consumption, remain persistent risks to economic recovery. While the labour market remains robust amid intensifying shortages, annual negotiated pay rose only by 2.9% in the second quarter of 2022, resulting in a real wage decrease of 4.4%.

High inflation in Germany is reducing real incomes and savings, dampening private consumption. Latest data shows consumer confidence inching up after a long period of decline although still a long way off historical levels.

USA – Avoiding recession, a soft landing?

Americans expect worsening economy in 2023, as one third say inflation is causing them major strain, according to a recent WSJ poll. A 'soft landing' is a plausible outcome where job openings are falling while unemployment remains low, although the risk of a recession remains.

Inflation: The latest consumer price index (CPI) showed prices rising annually by 7.1% in November, a continuation of a gradual decline from a 40 year high of 9.1% in June. Forecasts suggest that inflation could fall to just 2.4% by the end of 2023.

Interest rates: The Federal Reserve continued its battle against inflation by raising its benchmark interest rate by a half percentage point to a targetted range between 4.25% and 4.5% in mid-December to a 15 year high. The combination of slowing growth and cooling inflation is likely to prompt the Fed to curb its rate hiking, possibly reaching a peak of 4.5% to 4.75% in early 2023 and held throughout the year before a steady decline in 2024.

Employment: Jobs growth has been steady in 2022 adding 4.5 million jobs, although with some shifts within sectors most sensitive to borrowing costs. Wages are 5.1% higher than a year ago, a bigger increase than expected, according to the latest data for November from the US Department of Labour. Despite the labour market cooling in December, as hirings slowed, unemployment rate has ticked down to 3.5%, back to the pre-pandemic level. However, the Fed project that unemployment could rise d in 2024 and 2025 as economic growth falters or nudges into recession.

US Dollar: The currency gained 8% on a basket of currencies over the year, the best appreciation of the dollar in seven years. The dollar hovered around parity against the euro for several weeks in November, before finishing the year at $1.068 against the euro.

The UK – on the brink of recession

The UK is grappling with twin threats of rampant inflation and weaker to negative economic growth, and is forecast to be the second weakest performer of the world's big economies in 2023. The UK's poor performance is the result of a combination of a 41-year-high hike in the cost of living, rising interest rates, post- pandemic and Brexit impacts, government action to bring down borrowing and debt, and the market turbulence of the September budget.

GDP: The economy is forecast to shrink in 2023 – a contraction in GDP in the last quarter 2022 would put the economy officially in recession after a 0.2% contraction in the third quarter. December saw a fifth consecutive month of contraction in UK factory output to a 31 month low, according to the S&P's latest manufacturing purchasing managers index. The latest trend data points to a mild rather than sever recession with GDP contracting over four quarters ending in ending in the middle of 2023. Forecasters differ on the depth and length and depth of the recession with the UK's Office for Budget Responsibility predicting a 1.4% decline in 2023. The economy is expected to return to 1% growth in 2024.

Inflation: The consumer price index rose by 10.7% in the 12 months to November 2022, down from 11.1% in October. Rising prices in the hospitality sector offset reduction in transport costs. The annual growth of UK food prices was 13.3% in December, the highest reading on record, according to new figures from the British Retail Consortium. The annual rate of inflation (CPI) is expected to fall rapidly by mid-2023, with the Bank of England forecasting a rate at around 5% by end 2023, falling to 1.4% in 2024.

Interest rates: Higher mortgage costs and credit card interest rates are a particular pressure facing millions of households, reflected in a dampening of retail sales. The Bank of England may raise interest rates to 4% in February, the 10 successive increase since December 20212.

Employment: The unemployment rate increased marginally to 3.7% in the three months to October, as vacancies fell on an annual basis not seen since early 2021. The CBI forecast unemployment to reach 5% by year end 2023. While pay rose by a stronger than expected 6.1% over the same period, according to the ONS, wages continue to lag inflation. The UK is currently experiencing widespread industrial unrest with strikes across many sectors, including health and transport.

£ Sterling: The currency declined in value over the course of 2022, down 5% against the euro. As political certainty is one of the key drivers for the performance of a currency, the expectation is that the pound will at least stabilise is not appreciate in value. Morgan Stanley, breaking ranks with many other economists, expect Sterling to strengthen in 2023.

Asia: An Optimistic Outlook

Asia's outlook for the year ahead is relatively upbeat, with three of the world's largest economies – China, Japan and India – driving a return to modest growth. China, following the repeal of its Covid-zero policies and full reopening of its economy, is forecast to grow by 5% in 2023, a significant improvement on the current forecast of 3.2% in 2022, although still well below annual growth over the past decade.

China is one of the few major economies expected to see growth pick up next year after a wave of COVID lockdowns. Growth is forecast to rise from 3.3% this year to 4.6% in 2023 and 4.1% in 2024.

Data sources: include OECD; EU Commission / Eurostat / ECB; US Fed Reserve; Bank of England; ONS (UK); McKinsey; Morgan Stanley; Reuters; Financial Times.

Consumer sentiment benchmarks

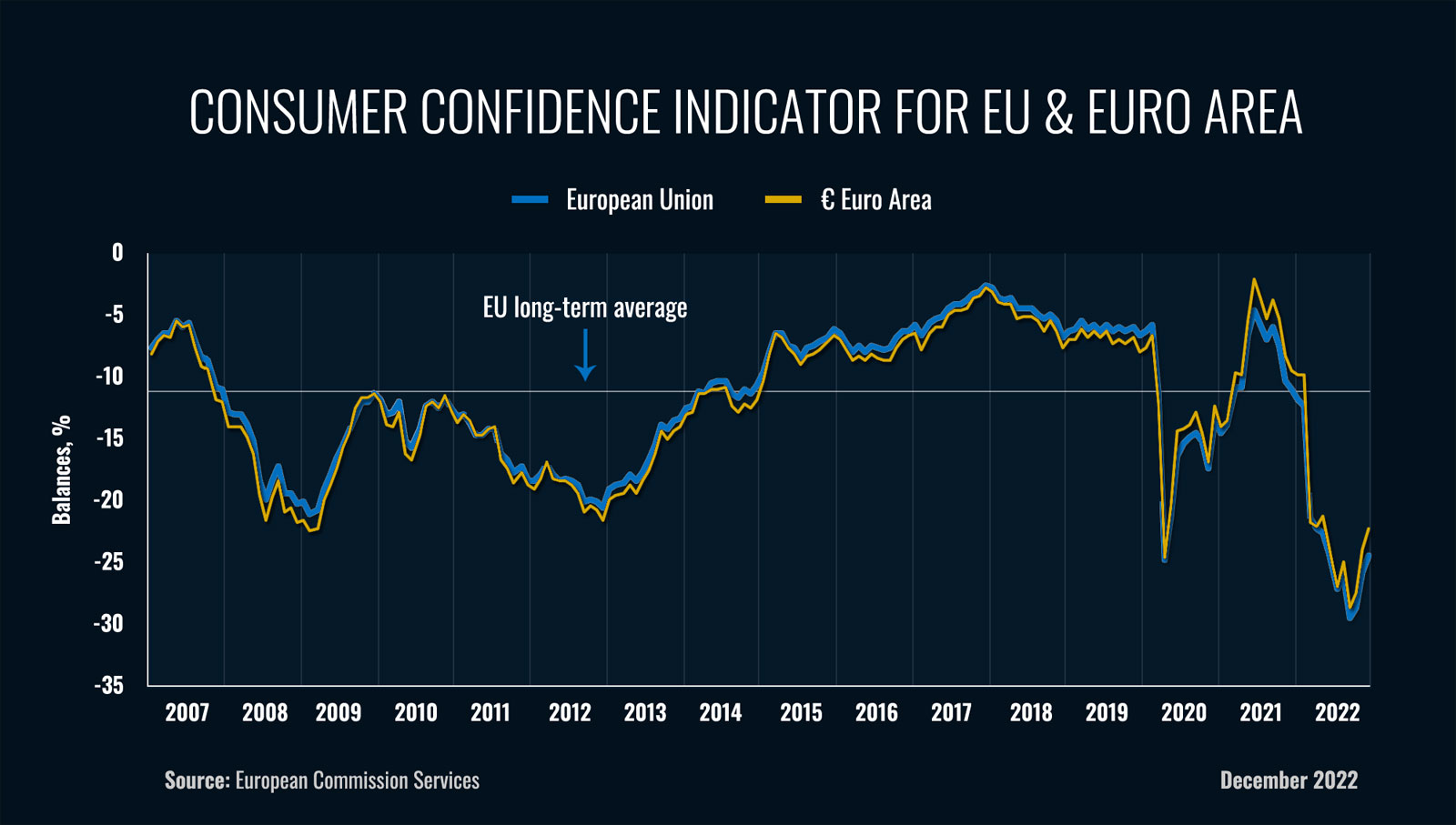

European Consumers' confidence remains well below its long-term average

Consumer sentiment indictor rose marginally in December compared to November, according to the European Commission. However, the index is still in serious negative territory after a free fall of more than a year, and only marginally above the trough reached at the onset of the COVID-19 pandemic.

As European consumers contend with double digit inflation and soaring costs of living – monthly retail sales have slowed more than at any other time during the pandemic, with sales significantly down in Germany and France.

In terms of the U.S., consumer confidence has improved on the back of an expectation of a fall in inflation. While overall consumer spending is expected to decline in 2023, as excess savings are tapped out and debt rises, consumers are still expected to have enough pent up demand and resources to keep spending at a reasonable level on travel.

Meanwhile, UK consumer confidence still remains at a record low. Despite this British holidaymakers are reported to continue to prioritise travel abroad, recent polling from Skyscanner revealed.

2023 – CONNECTIVITY RESTORED

Expanded airline and ferry services

As currently planned the summer schedule (April – October) will provide close to 2019 capacity with several new routes. Many of the additions to the schedule are aimed primarily on serving the surge in the Ireland outbound demand for popular sun and city break holidays, however there are several new services and additional capacity on routes of particular potential for inbound tourism. The schedule is subject to change as all services may not necessarily operate as airlines evaluate market conditions and finalise schedules.

Airport Coordination Limited (ACL), which coordinates take-off and landing slots at Dublin Airport, shows potential seat capacity on offer could reach just over 30m in summer 2023, up 17% on summer 2022. Ryanair and Aer Lingus – the top two carriers at the airport – are each planning on double digit capacity increases.

Connectivity provided by all major European, North American and Middle Eastern network carriers has been reinstated and continue to expand service to Dublin, Cork and Shannon.

Short haul connectivity

Ryanair, the market leader on short haul routes, will operate record summer schedules to/from Irish airports. The airline continues to expand the number of routes served and capacity, with record seats on offer in 2023. The expansion is perhaps most evident on record operations planned for Cork, Shannon and Knock airports next summer, including many new and expanded service to sun holiday resorts. New cross-channel routes include Newcastle and Liverpool to Shannon, and from Newquay to Dublin.

Aer Lingus continues its expansion on transatlantic services, with Aer Lingus Regional services, operated by Emerald Airlines, continuing to expand on cross-channel routes. UK-Ireland services include Heathrow-Cork increased frequency plus new Aer Lingus Regional new routes from Aberdeen and Southampton to Dublin.

All major European network carriers maintain or expend their services to/from Ireland

New and additions of particular potential for inbound tourism include:

- Tel Aviv – Dublin: EL AL Israel Airlines to launch service from March 26, 2023, (3 flights per week).

- Bergen – Dublin: Widerøe Airlines with twice weekly service from 27 April 2023.

Transatlantic

Aer Lingus: up to 129 departures per week on a total of 15 transatlantic routes from Ireland, rebuilding connectivity and driving its commitment to connecting Europe to North America via its Hub in Dublin Airport.

United, American, Delta, Air Canada and Air Transat plan to operate up to 115 departures per week on 12 routes with some adjustments to 2022 schedules.

New for Summer 2023

- Cleveland, Ohio – Dublin, Aer Lingus' new service from 19 May 2023 (4 departures per week).

- Hartford, Connecticut – Dublin, Aer Lingus daily service reinstated from 26 March 2023.

- Chicago-Shannon, United Airlines new daily nonstop seasonal service from 26th May 2023.

- Minneapolis St Paul – Dublin: ACL report notes that Delta Air Lines has indicated it could operate a service on the route inaugurated by Aer Lingus in 2019, but dropped in 2020 due to COVID-19.

- Calgary-Dublin: Westjet is increasing frequency while discontinuing its service from Toronto and Halifax.

Middle-East

- Emirates restored double daily service.

- Qatar Airways frequency 11 to 12 per week.

Ferry services

Increase in tourist capacity on direct European services for Summer 2023 include:

- Stena Line adding a second ferry between Rosslare and Cherbourg.

- Brittany Ferries upgrading its service between Rosslare and Bilbao.

CHALLENGES AND RISKS FACING IRISH TOURISM IN 2023

Maintaining Ireland's competitiveness

Competitiveness, currently a fast changing dynamic, presents a new set of challenges for Irish tourism businesses. While price is not the sole defining factor of Ireland's competitiveness, value for money undoubtedly is a major determinant of competitiveness.

Any increase in price at a rate higher than in competitor destinations would damage Ireland's competitiveness and its reputation as a 'good value for money' destination – each of which would have lasting consequences beyond 2023. The experience of Ireland's tourism price inflation outpacing that of competitor destinations during the Noughties, prior to global financial crash in 2008, resulted in a loss of market share over the course of the economic downturn and a prolonged seven to eight year recovery of international tourist volumes and values to the country.

2023 will see a slowing economy, if not recession, across Ireland's source markets, while rising prices are being exacerbated by uncertainty surrounding supply side inputs and supply. Tourism businesses are facing a number of challenges in maintaining competitiveness in a market which will undoubtedly be more price and value conscious. Past experience has amply demonstrated that some market segments of tourists to Ireland are have been especially critical of perceived poor value for money, when compared to their place of origin and experiences in other destinations. British visitors, a high volume year round market for Ireland historically have been the most critical of price and value for money, followed by selected segments of visitors from mainland Europe.

Businesses facing a cost 'cliff edge'

As businesses struggle with rising costs of inputs, uncertainty surrounds two critically important supports for the sector – the 9% VAT rate for hospitality and the Temporary Business Support Scheme (TBSS) which are due to end on February 28. Each of these have a critical bearing on pricing for the coming season and withdrawal would severely damage Ireland's competitiveness in the international marketplace. A recent report by economist Jim Power on the economic rationale for extending the 9% VAT rate suggests that the scheduled increase would cost 24,000 jobs and add 4.1% to inflation on accommodation and food services.

No easing of staffing pressures on tourism & hospitality businesses

Already many hospitality and tourism businesses have struggled to hire the people they need and to fill longer term skills gaps. European research points to workers quitting their jobs in high numbers even as the economic picture darkens – exacerbating a high job vacancy rate and skills gap.

Failte Ireland surveys report that up to four out of five businesses have experienced difficulty in filling positions, with specific skills shortages identified. Staffing levels have yet to recover to pre-pandemic levels. Industry estimates suggest that close to 3,500 Ukrainians have found employment in the accommodation and hospitality sector.

The labour market in Ireland is expected to remain tight with the unemployment rate below 4.5%. The job market remains buoyant across almost all sectors, despite some lay-offs and a slowing of hiring in some sectors. 90% of employers are planning to hire staff in 2023 the highest level in 6 years, according to a recent survey from Hays Ireland. The survey reports that 79% of employers are expecting to increase pay in 2023, with the average wage increase anticipated to be in the region of 5%, a figure which will be exceeded in some sectors. In addition, the ongoing housing crisis is impacting employers' ability to recruit staff in many locations.

Businesses in addition to facing an energy crisis and rising input costs and interest rates are gearing up for wage inflation, and new employment legislation, which will put pressure on prices and erode company earnings.

The risks to tourism persist, and may be further exacerbated, in 2023, including:

- A loss of competitiveness resulting in loss of market share and prolonging recovery;

- Staffing shortages forcing businesses to curtail trading; and

- Slippage in the quality of the tourist experience.

Reduced tourist accommodation supply

It is expected that Ireland's stock of visitor accommodation in 2023 will be sharply less than in 2019. The reduction in capacity arises from the Government's reliance on tourist accommodation to house those seeking refuge together with new legislation impacting short term rentals.

Ireland's reliance on tourist accommodations as humanitarian shelter

At present almost one quarter (23.5%) of the country's tourist accommodation stock, including 17% of hotel bed capacity, is under contract to the Government to meet humanitarian needs. This represents a total of 42,000 beds in registered tourist accommodation premises, including almost 26,000 in hotels, are effectively withdrawn from the market.

% of tourist accommodation, registered with Failte Ireland, currently contracted by the Government:

Source: DCEDIY – November 2022 data

The geographic distribution of Ukrainian guests mirrors the supply of tourist accommodation with a heavy concentration along the western seaboard, where up to one third of tourist accommodation in popular locations is currently withdrawn from the market.

Official data shows the distribution of Ukrainian refugees across the country by Local Elector Area (LEA). This shows that Ennistimon, encompassing Lahinch, Co. Clare, has the highest rate of Ukrainians per 100 of the population at 9.51%. In terms of volume, Killarney is catering currently to the largest number of refugees in any one location, outside of Dublin's North Inner City.

The crunch point will occur in March/April when operators will determine the future of much of this capacity currently withdrawn from the tourism market. At time of writing it is difficult to foresee an adequate supply of alternative accommodations coming on stream to meet the State's need to provide shelter for those fleeing conflict. While hotels, guesthouses and B&Bs can play a part in providing humanitarian relief, almost exclusive reliance on the sector is not sustainable nor is the accommodation suitable for long term housing needs.

If the level of tourism accommodation stock is unavailable next year, industry estimates it could cost the broader tourism economy up to €1 billion in lost earnings.

New legislative regime for short term holiday rentals

New Government legislation to address the housing shortfall requires all short-term and holiday lets, of up to 21 nights, to register with Fáilte Ireland. The short term rental market advertised on line has been estimated at up to 27,000 premises, of which 20,000 are full properties, providing up to 130,000 beds, according to Fáilte Ireland.

From April 2023 all online platforms, including Airbnb, Booking.com, HomeAway, TripAdvisor and others, can only advertise properties with a valid Fáilte Ireland registration number. The legislation proposes fines of up to €5,000 for failure to comply by letting websites and/or landlords in cases brought before the District Court.

The impact of the legislation, when implemented, will lead to a significant reduction in short-term let tourist bed spaces. A six-month grace period is expected to be provided for properties which need to comply with change of use planning requirements to operate in the short term rental market.

Risks arising from a significant reduction in tourist accommodation, include:

- Reduction of Ireland ability to cater for tourist demand, especially in the peak season, thereby limiting trade. The impact is most likely to impact demand from the domestic, British and mainland European markets, limiting the supply of mid-range accommodation.

- Scarcity of supply leading to inevitable price increases above inflation in locations, and at times of, high demand;

- Significant downstream loss of trade for the service sector – restaurants, pubs, shops, transport, tours, etc. – in locations where tourist accommodation is withdrawn from the market; Downstream businesses such as shops, attractions, pubs, restaurants and cultural experiences will be hit particularly hard. Fáilte Ireland data clearly shows that for every €1 a tourist spends on accommodation, €2.50 is spent on ancillary tourism services.

- Loss of employment traditionally associated with tourism.

Consumers face higher travel costs in 2023 and beyond

Airline and ferry fares have increased over the past 12 months as a result of higher cost for conventional fossil-based fuel, with jet fuel increased by nearly 150% in the last year. Despite a fall in fuel prices in recent months, the outlook for 2023 suggests that travel fare increases may continue to outpace inflation in many markets, as carriers cope with higher non-fuel input costs, including labour and airport charges.

Beyond 2023

Airline passengers face higher ticket prices as the industry moves towards its target of reducing emission to net zero by 2050. Ryanair's group chief executive, is on record as saying that air fares will rise by as much as 30% in the medium term, as climate action measures will add to the cost of travel. Most recently, the European Commission, as part of its climate package, has recommended that the decades-long tax exemption on aviation and maritime fuels be ended. Already several member states reliant on tourism, particularly those dependent on aviation due to geography, are seeking some flexibility arguing that a levy on transport fuel would not be effective in achieving the aim of encouraging use of alternative means of transport and would cause disproportionate economic damage to a number of destinations.

ITIC – MARKET OPPORTUNITIES & SCENARIO PROJECTIONS

The current market environment for international travel

MARKET PROSPECTS

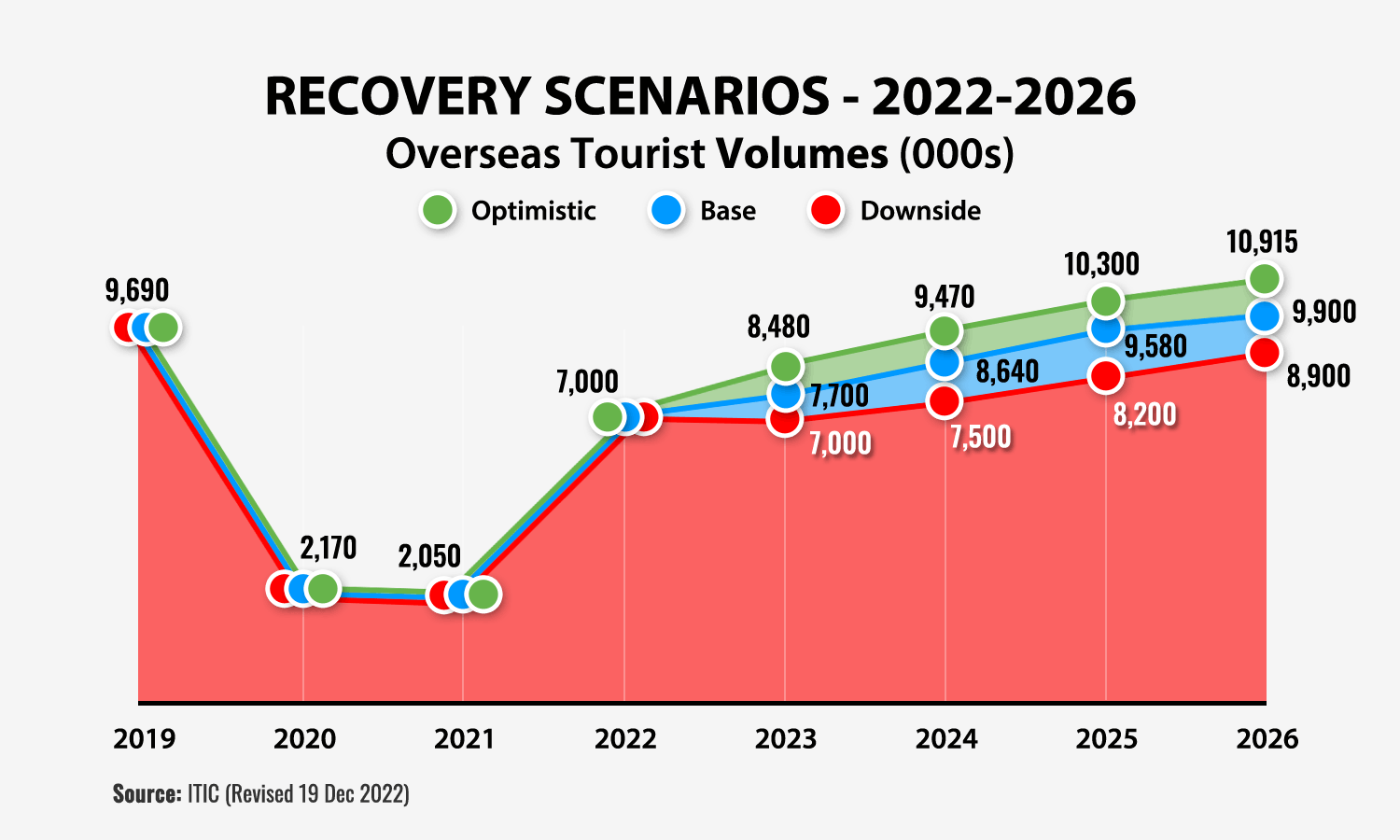

Revised recovery scenarios

In the context of changed economic conditions and short term outlook for markets, the recovery path for Irish tourism to pre-pandemic tourist volumes, is expect to be delayed in 2023, despite a better than predicted out come in 2022. It should be kept in mind that Q1 in 2022 was very slow due to the unwinding of Covid restrictions whereas 2023 will hopefully have no trading speed bumps during the calendar year.

The model, based on revision of recovery path, suggests:

- Base line scenario: approx. 10% tourist volume growth in 2023, with a loss of momentum of the recovery rate experienced in the latter part of 2022 going into 2023. Recovery momentum is expected to resume in the latter half of 2023.

Full recovery is now pushed back to 2025/26 - Upside scenario: based on an economic soft landing could be expected to deliver up to 20% year on year volume increase on 2022. The upside performance is based on a significant increase in North American and tourists from selected European markets in 2023.

Full recovery: 2024/25 - Downside scenario: projects only a marginal change in annual volume in 2023, based on negative impact on leisure visits from short haul markets, at least in the first half of 2023. Full recovery further delayed to 2027/28.