Behind the Data: A dive into annual Irish tourism statistics

19 FEBRUARY 2025

CONTEXT

Last week the CSO published inbound tourism statistics for 2024. This is the first time, due to methodological changes, that there is a direct annual comparison with the previous year.

The Irish Tourism Industry Confederation (ITIC) have studied the data and this bulletin outlines some of the key findings and interpretations. Although revenue (+11%) and volume of international visitors (+5%) are up compared to 2023, the key metric of the number of nights those visitors stayed in the country is down (-4%).

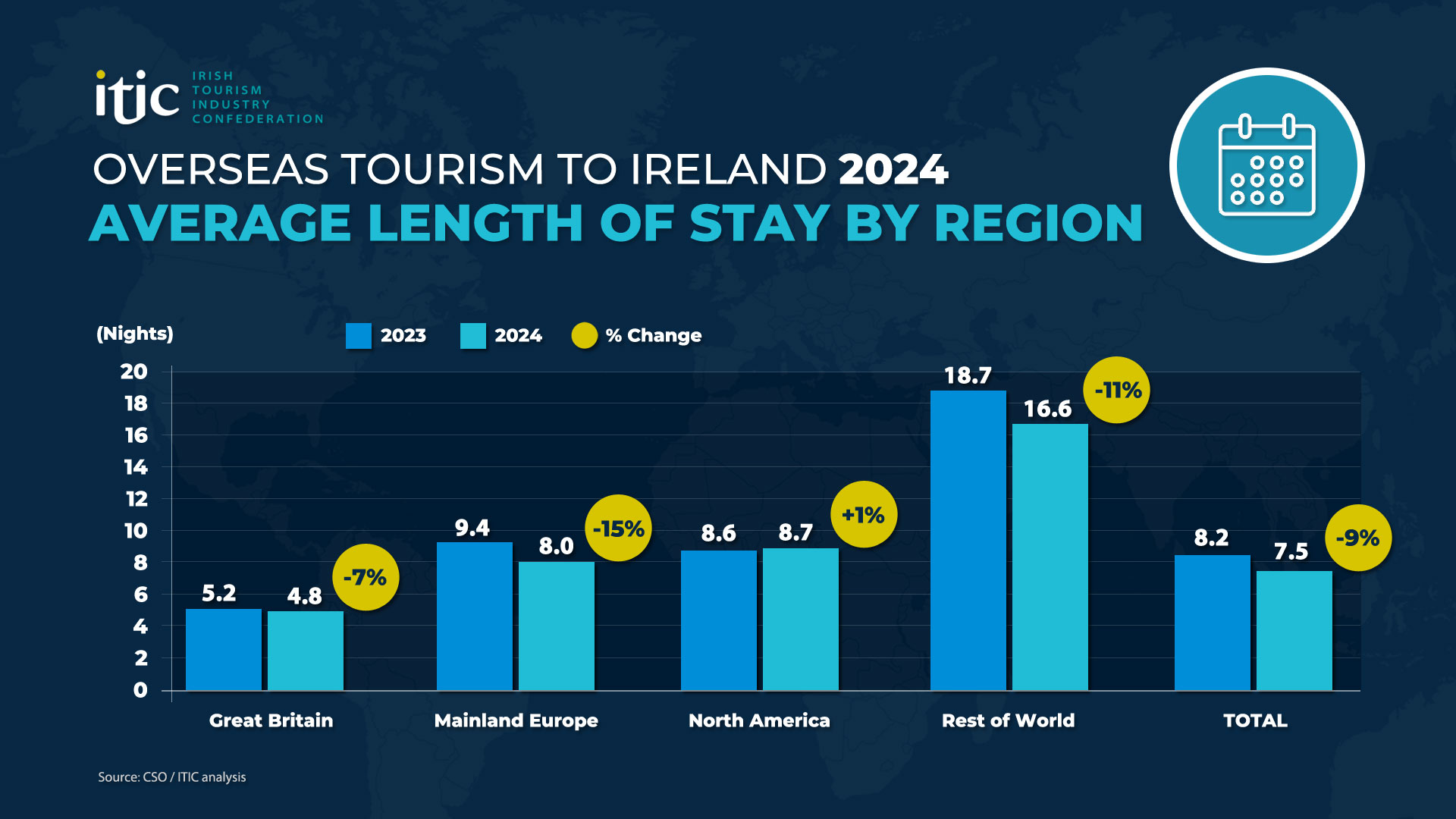

The annual statistics throw up lots of interesting information. Although there are many positive indicators, there are some causes of concern below the headline figures; the average length of stay of European visitors fell by 15%, business tourism had a relatively soft year with the number of nights spent in the country down 18%, while visitor numbers from Australia and New Zealand fell by 5%.

The CSO data does not reflect business sentiment and ITIC research amongst members, along with Fáilte Ireland's industry barometer, show that cost of business pressures continue to squeeze profit margins for tourism and hospitality enterprises. ITIC remains hopeful of continued revenue growth for the year ahead although this is predicated on pro-tourism and pro-enterprise policies from Government.

DATA ANALYSIS

North America growing in importance

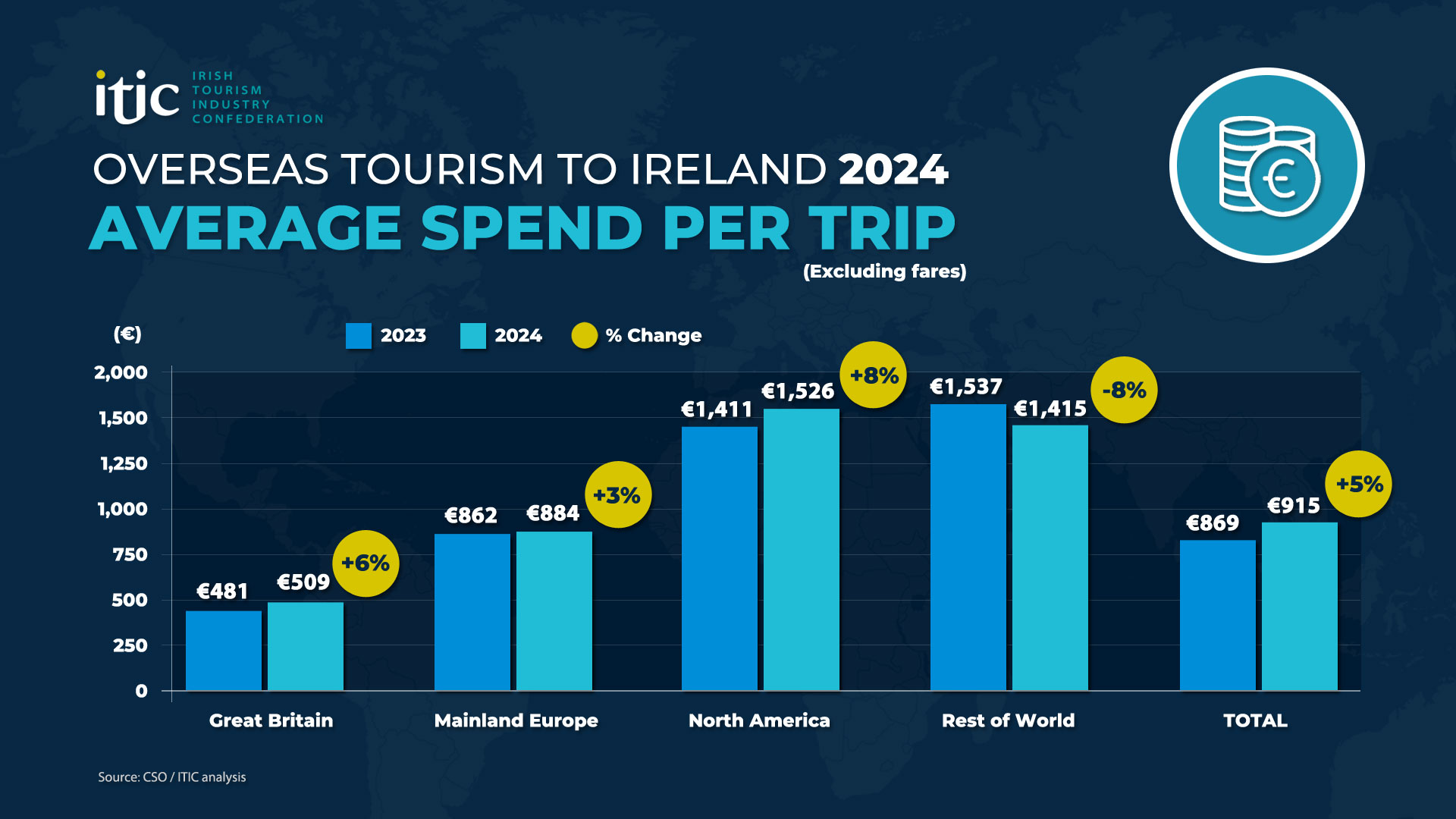

The Irish inbound tourism economy is now worth €6.03 billion (excluding fares) which is an increase of 11% on the 2023 performance.

North America has become increasingly important and now accounts for 36% of overall spend. As welcome as this is it does mean a risk of over-concentration in one key source market.

With ever improving transatlantic air access and major events such as the College Football game and NFL fixture, US business is expected to remain strong in 2025. Saying that from a risk diversification perspective, Irish tourism would be well served by a more balanced portfolio of source markets in the coming years.

US and Canadian visitors spent on average €1,526 per person while in Ireland in 2024, three times what the average British visitor spent (€509) and nearly double what the average European tourist spent (€884). 1.24 million US visitors (+9%) and 198,100 Canadian visitors (+24%) enjoyed the Irish tourism product last year.

European softness

The performance from Mainland Europe proved mixed in 2024 compared to 2023. Visitor numbers from the key markets of France and Germany were up 2% and 4% respectively with overall European spend up 8%.

However, there was a marked reduction in the number of nights spent in Ireland by Europeans (-11%) with the average length of stay falling from 9.4 nights to 8 nights (-15%). Europeans are traditionally more price conscious and may have been deterred by the lack of 3 star accommodation particularly on the West coast due to hotels contracting with Government for humanitarian reasons. Nonetheless, European visitors did spend €2.08 billion in Ireland last year and Europe is a vital source market for Irish tourism with strong air and sea access and a common currency.

ITIC welcomes the strategic review of European markets being undertaken by Tourism Ireland and industry will support all efforts to maximise the potential business on offer.

Great Britain; our nearest neighbour

Great Britain remains the largest source market by volume for Irish tourism although a significant proportion of these visitors fall into the 'visiting friends and relatives' category rather than 'holidaymaker'. Overall there was 3% increase in visitors from England, Scotland and Wales and spend was up 9%.

British visitors on average spend €509 while in Ireland compared to €884 by Europeans, €1,415 by those from the Rest of the World or €1,526 by North Americans.

With the British economy expected to face a turbulent year Irish tourism will have to fight hard for business in 2025.

Purpose of Visit analysis

The CSO data also includes a purpose of visit survey of visitors. Those that came to Ireland last year for holiday purposes was up 11% and with holiday bed nights up 8%.

The VFR market saw a decline in trips, bednights and average stay while business trips (those here for meetings, incentives, conferences and events) were up 8% although the number of nights they did business in the country was down 11% and their average stay falling from 6.3 nights in 2023 to 5.2 nights (-18%) in 2024.

A new Business Events strategy was launched last year, a collaboration between Fáilte Ireland, Tourism Ireland, the Department of Tourism and industry stakeholders, and it is hoped that this sees growth in this important segment in the coming years.

The bed nights conundrum

Overall visitors to Ireland in 2024 stayed 4% less nights in the country than in 2023.

All segments, with the exception of holidaymakers, saw a decline in bed nights. This is a key metric for Irish tourism – the aim of the current national tourism policy is to extend the average length of stay of visitors although this has fallen by 9% last year.

This requires further analysis. Is it to do with a lack of accommodation at peak times? Is it a global phenomenon? Is it driven by the sharp fall in European bed nights? Industry leaders and tourism agencies will be keen to get answers to these questions.

Less bed nights means less meals eaten, less attractions visited, less hotels stayed in, less cultural experiences enjoyed – it has a knock on effect throughout the Irish tourism economy.

Where did visitors rest their heads?

The accommodation type used by international visitors shows some interesting trends. Hotels saw strong growth in volume (+10%) and bednights (+8%) while Guesthouse/B&Bs saw double digit growth.

Growth was more modest in the self-catering/rental properties although nearly 4 million bednights were spent in this sector showing that Government must tread carefully with proposed short-term tourism letting legislation.

CONCLUDING NOTE

ITIC has warmly welcomed the tourism priorities within the Programme for Government.

The hospitality VAT rate is set to be reduced, employer PRSI reform is scheduled, and there is a commitment to lift the Dublin Airport passenger cap as well as supporting regional airports.

It is vital that these measures – and others – are implemented. Tourism and hospitality is the country's largest indigenous industry and biggest regional employer and cannot be taken for granted. The data emerging from 2024 paints a broadly positive picture for Irish tourism but there are some mixed indicators. There is a significant prize to be grasped for the country – in terms of regional balance, employment, business profitability and exchequer returns – if Irish tourism can grow sustainably in the years ahead.