INTRODUCTION

Ireland, an island nation with an open economy off the mainland of Europe, is critically dependent on air service connectivity. It acts as an essential facilitator of trade, investment and especially tourism, the country's largest indigenous industry, accounting for 13% of all Irish employment and the biggest regional employer.

In fact Ireland's tourism and aviation sectors are intrinsically linked and mutually inter-dependent. Tourism relies on aviation to bring in visitors and airlines rely on tourism to fill seats.

75% of the Irish tourism economy is made up of international visitation and 90% of all international tourists arrive into the country by air. The numbers are stark and in this context the Irish state should be doing all within its power to support the aviation sector and make sure it is allowed grow in a responsible manner. Regrettably the current passenger cap at Dublin Airport limits further growth and, along with the State's failure to maximise support for Cork and Shannon airports, this means that the welfare of 40,000 tourism and hospitality businesses in the country is immediately jeopardised.

This bulletin from the Irish Tourism Industry Confederation (ITIC) on the importance of aviation to Irish tourism argues that air connectivity is crucial to the Irish economy, opportunities are there to be grasped, but challenges must be overcome with sensible and prudent pro-tourism and pro-enterprise policies.

The bulletin concludes with 6 key recommendations that ITIC urges the Government to adopt without delay namely; Lifting of the passenger cap at Dublin Airport; Maximising the underutilised capacity at Cork and Shannon airports; Incentivising the use and development of Sustainable Aviation Fuel; Assist and enable the decarbonisation of Irish airports; Align Ireland with other island nations in the EU in relation to aviation needs; Support moves to consolidate air traffic control across the EU.

All of society and the economy has an obligation to helping Ireland achieve its Climate Action Plan and targets by 2030 and 2050. The global aviation sector is committed to net zero by 2050 but it must be enabled to do so. The State's Climate Action Plan includes references to aviation but acknowledges that flights by their nature are interjurisdictional and will therefore be largely determined by EU regulations. Thankfully though Irish carriers are leading from the front in terms of sustainability; Aer Lingus has committed to operating 10% of its flights using SAF by 2030, well ahead of the EU mandate, while Ryanair operates the youngest and most efficient fleet of aircraft and has also contracted significant SAF supply.

Irish tourism is well placed on the ground to be leaders in sustainability – carbon calculators have been rolled out, an all-island accreditation scheme is to be launched, and the industry is making bold and radical moves to decarbonise. The carbon impact of how international tourists get here is also being addressed but a realistic debate must be had and the dependence of an island economy on aviation must always be kept in mind by policy makers.

Elaina Fitzgerald Kane

ITIC Chair

Eoghan O'Mara Walsh

ITIC CEO

AVIATION NATION

AIR SERVICES – A driver of Ireland's tourism growth

90% of tourists arrive by air

Ireland, an open economy off the mainland of Europe, is critically dependent on air service connectivity, as an essential facilitator of tourism, trade, and investment.

Ireland's tourism and aviation sectors are intrinsically linked and mutually inter-dependent. Tourism relies on aviation to bring in visitors and airlines rely on tourism to fill seats. Nine out of every ten tourists arrive by air. The post pandemic rebound in tourism has been driven by the reinstatement, and further expansion, of air services.

Tourism has benefited from two major international airlines based in Ireland – Aer Lingus and Ryanair – which have been a driving force in expanding the country's tourism source market footprint across Europe and North America.

Air transport liberalisation transformed Ireland's tourism economy

Tourism to Ireland has been radically reshaped by airline deregulation over several decades, resulting in significant expansion of air services and greater competition. The real cost of airline travel has fallen by 60% over the period making it more accessible to more people. Aircraft have become 70% more energy efficient, with a 75% reduction in aircraft noise. Ireland played a leading role in advocating the liberalisation of European aviation, under the direction of the EU Competition Commissioner, Peter Sutherland

The transition from a highly regulated system of bi-lateral agreements between countries to a pan EU member states deregulation package, was phased in from 1986. Final agreement on the creation of a Common Aviation Area in 1992 was a major achievement in promoting competition, abolishing protection of national carriers, and the development of air transport, within an open market and encouraging new entrants.

Ireland was a major beneficiary of the opening up of competition for intra-European services, including the entry of new carriers, most notably Ryanair. Irish tourism benefitted from a first mover competitive advantage with the launch of Ryanair, a pioneer low cost in Europe. Ryanair carried 183.7 million passengers in its financial year ending March 31, 2024 – more than any other airline in Europe.

More recently the Open Skies Agreement between the EU and the United States, which became effective on March 30, 2008, allowed for full open competition on transatlantic air services. The impact on Ireland's transatlantic connectivity has been transformative – allowing US carriers to come on the route, while giving Aer Lingus open access to gateways in the USA. Similar EU open skies agreements have created a legal framework for all bi-lateral relationships with third countries around the world in the field of air transport. The measure has opened connectivity between Ireland and markets in Canada, the Middle East and China.

Demonstrable correlation between connectivity & tourism growth

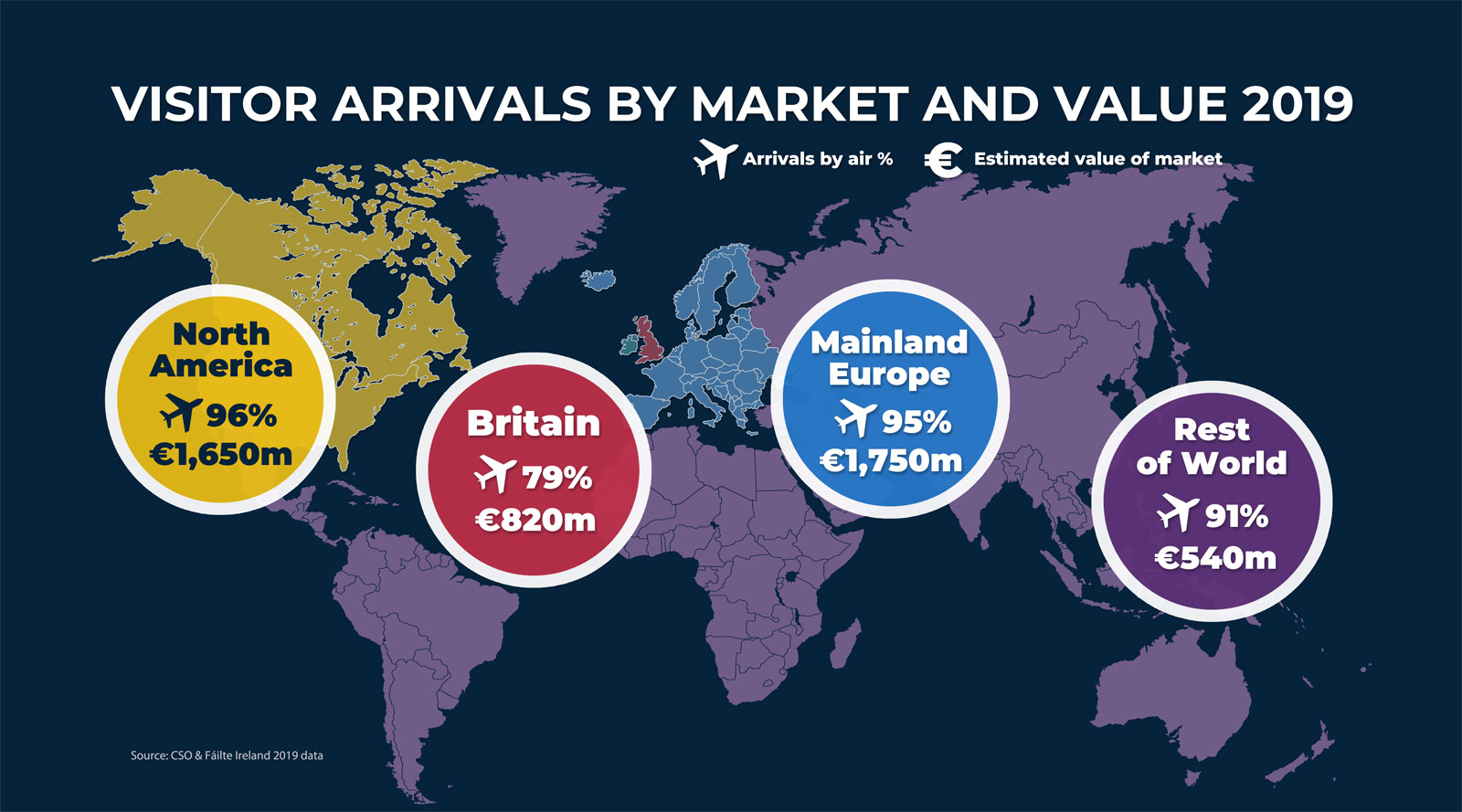

Ireland's island geography makes air service connectivity an essential enabler of inbound tourism. Visitor arrivals by air have been increasing in absolute volume and in relative importance on selected routes. Most recent annual data from the CSO for Irish tourism was pre-pandemic and shows the dominance of air connectivity.

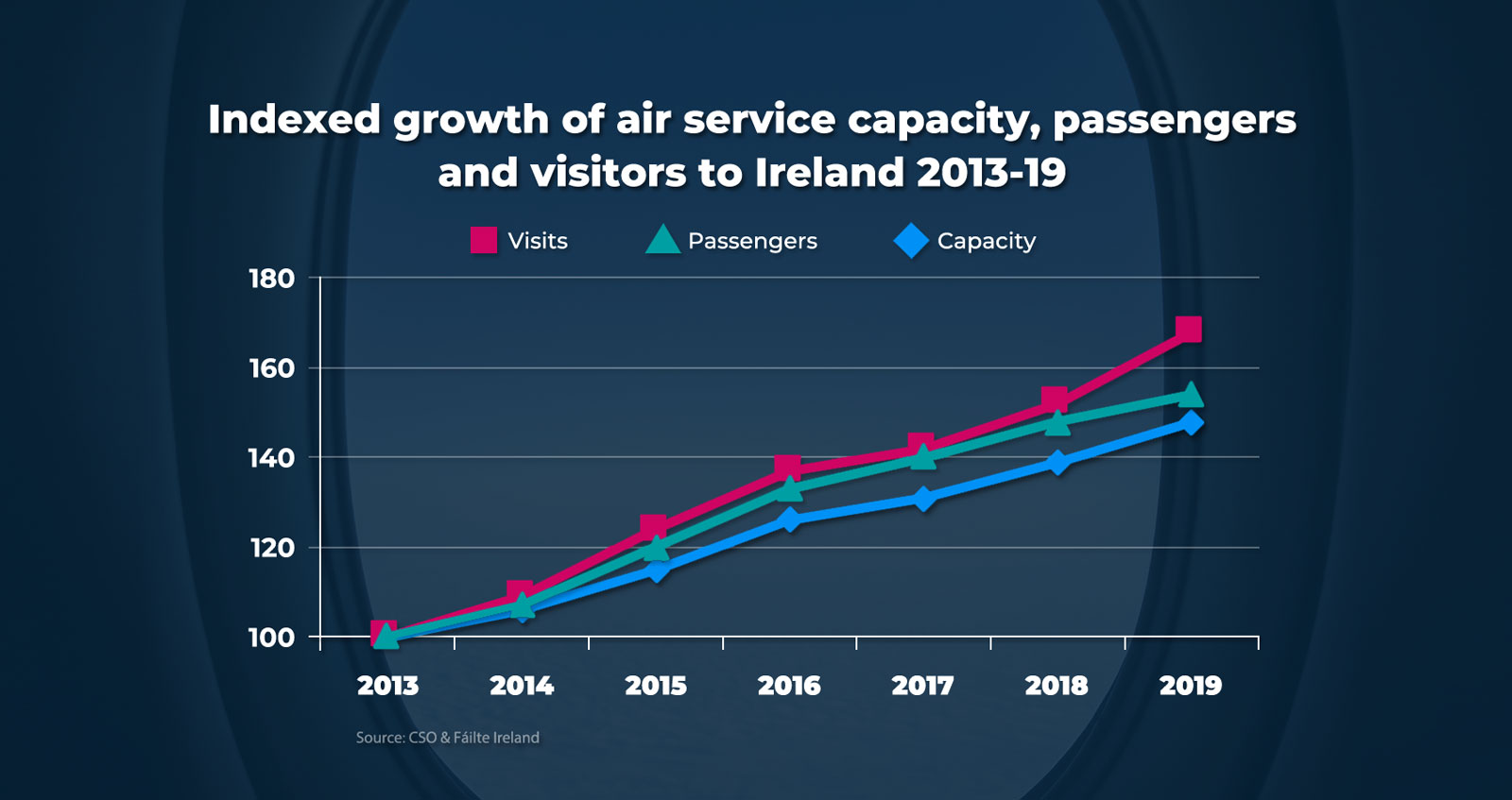

Over the immediate pre-pandemic period a strong correlation between expansion of air services and growth in visitor arrivals is evident. Over the period 2013 to 2019 aggregate capacity on scheduled air services increased by 48%, with total air passenger traffic growing by 54%, while international visitors to Ireland showed a 68% increase. Demand from inbound visitors outpaced outbound demand from Irish residents on many new and expanded airline routes at Dublin Airport over the period.

The most demonstrable impact of increased air lift on tourist arrivals in the immediate pre-pandemic years has been the expansion of direct air service to Ireland from the USA, Canada, and Germany, while the launch of services via the Middle East has driven demand from new emerging markets beyond Europe and North America.

CONNECTIVITY

The island of Ireland currently enjoys a network of air service connectivity with direct links to over 40 countries, on almost 300 city pair routes served by over 30 airlines.

Ireland's airport network comprises six airports providing international scheduled passenger services. Nine airports provide on the island of Ireland. Dublin, Cork and Shannon airports are in state ownership, with regional airports at Knock, Kerry, and Donegal in receipt of state support.

Ireland ranked 6th best in total connectivity recovery in June 2023 compared to June 2019, with Dublin Airport one of only a handful of airports that exceeded pre-pandemic hub connectivity in 2023.

Dublin Airport's effective route development strategy has seen the airport improve its direct connectivity ranking from 20th in 2019 to 14th in 2022 and 2023 in the league of European airports. The vast majority of growth has come from expansion of existing routes.

Dublin Airport is now the 5th largest transatlantic hub airport in Europe.

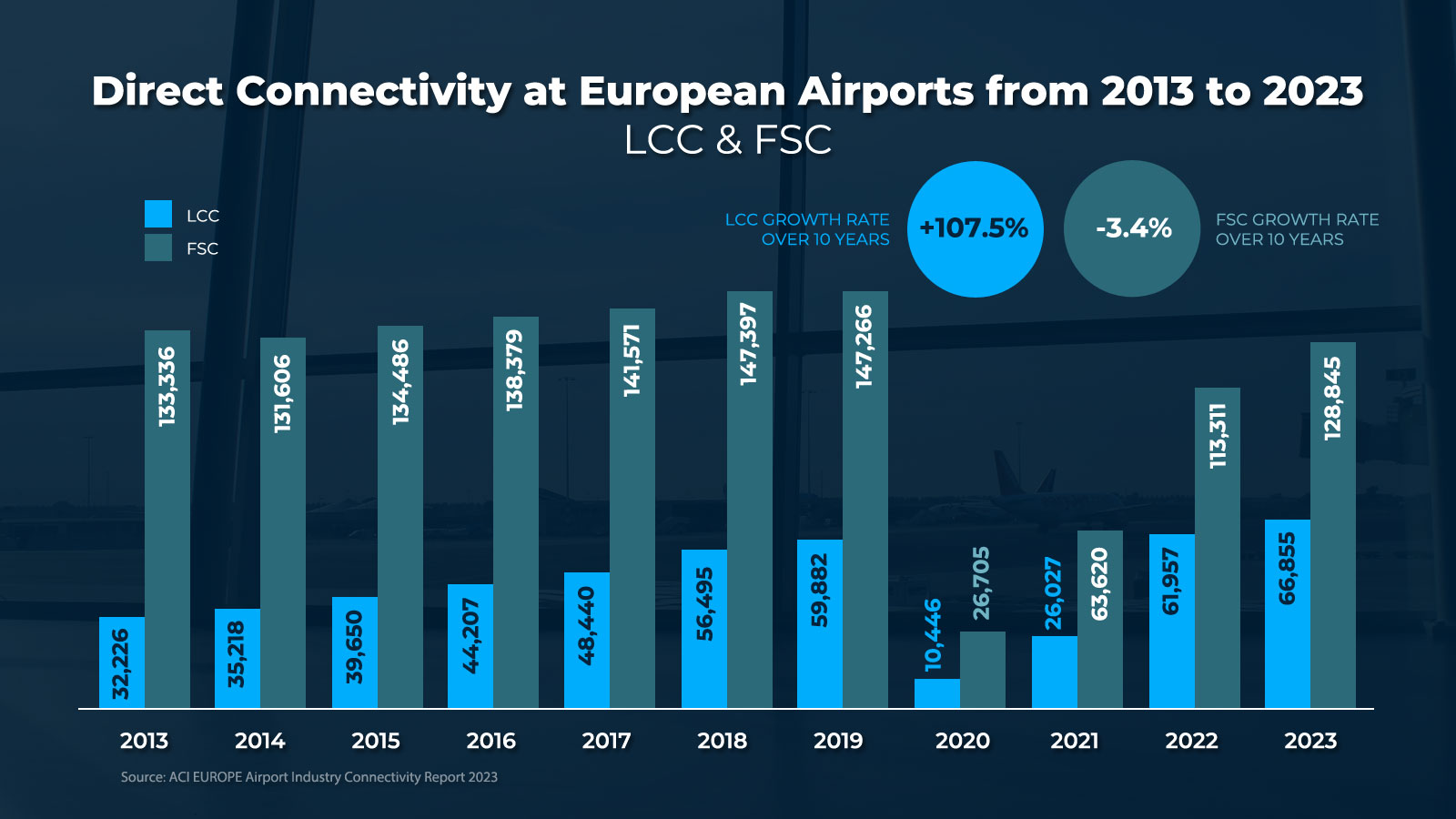

Over the past 10 years, Ireland's direct connectivity gains in short haul markets have been almost exclusively attributable to low cost carriers (LCCs), notably Ryanair. This reflects the pattern across Europe where LCCs now provide 46% of direct connectivity at European airports, up from 38% in 2019. Ireland's direct and indirect global connectivity is well served by the major network carriers and global alliance member airlines. Ireland's long haul connectivity has been expanded on the North Atlantic, with new gateways and alliances led by Aer Lingus while the entry of three Middle Eastern carriers, and the more recent arrival of an airline from China, has significantly broadened Ireland's global reach, including indirect connectivity, serving tourism, trade and FDI.

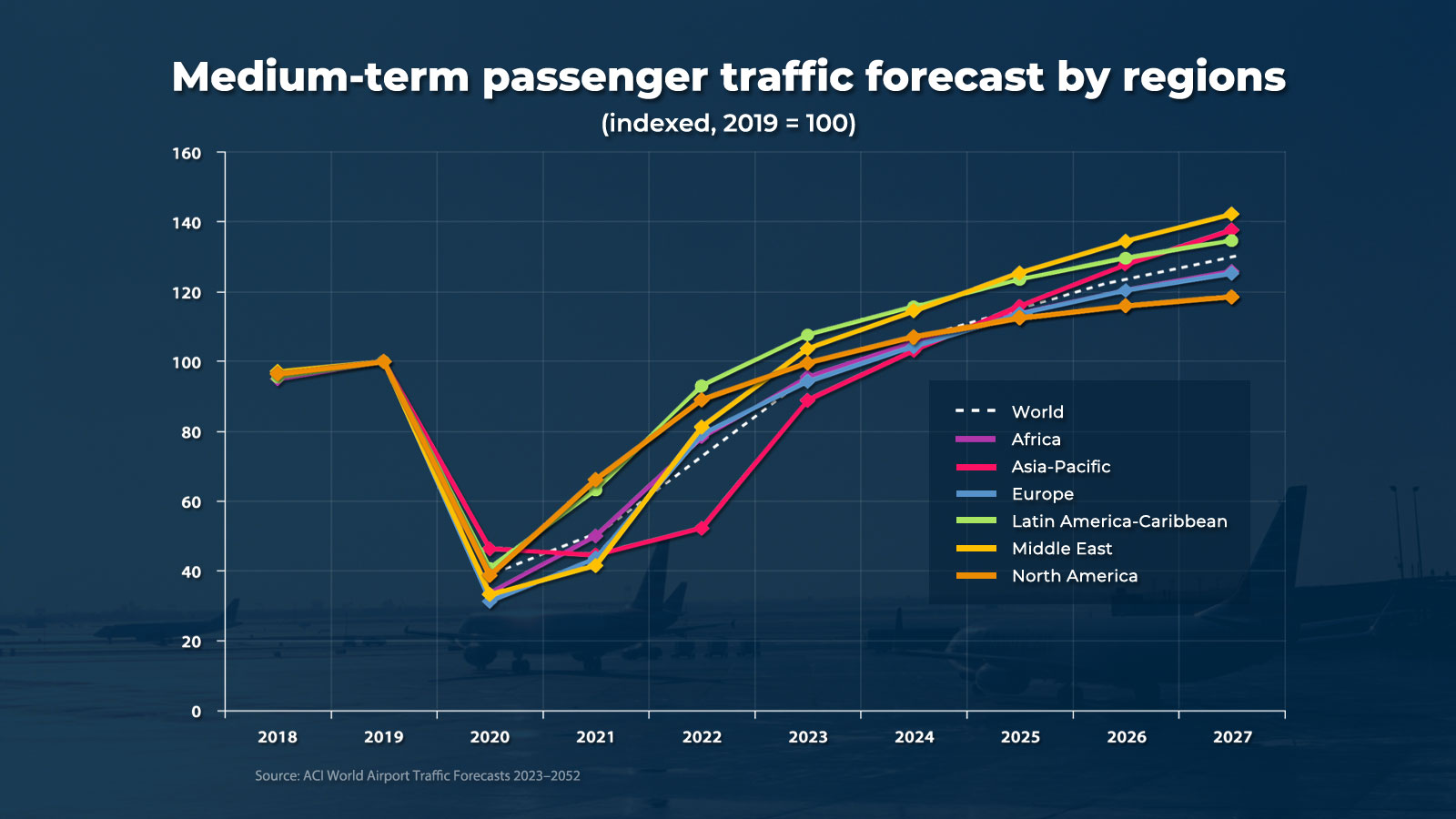

International travel rebounds from COVID

The resilience of travel demand as the world emerged from COVID proved to be stronger than many had predicted. By 2023 most countries in Europe reached between 90% and 120% of the passenger numbers seen in 2019. European airport network report a 95% recovery to pre-pandemic levels in 2023. However, less than half of European airports (44%) have fully recovered passenger volumes to 2019 levels, suggesting a marked shift in passenger demand patterns, according to ACI Europe.

The growth in passenger numbers outpaced available seat capacity in many instances, implying improved load factors and arguably stronger financial performance.

Western Europe, which accounts for most of the traffic in the larger region, saw resilient growth despite economic uncertainties and connectivity to the important Asia Pacific market still being impacted by the war in Ukraine. Popular tourist destinations, such as Spain, Italy, Portugal and Greece, saw strong growth in international passenger traffic in spite of such headwinds.

Over the past two years low cost carriers (LCCs), with Ryanair leading the way with speedy reinstatement and aggressive expansion of services, have garnered a larger share of the short haul travel market.

Dublin Airport, Ireland's premier gateway, has recovered pre-pandemic direct connectivity. This reflects the distinctive pattern of the traffic recovery coming out of the pandemic, largely driven by Leisure and VFR demand, boosted by low cost carrier expansion and very much focused on the intra-European market, with legacy carriers driving recovery and growth on the transatlantic market. Shannon Airport, Cork, Knock and Kerry airports have also seen a prebound in passenger traffic and have recovered to pre-pandemic levels.

LCCs have been growing direct connectivity at regional airports in Ireland, as is the case in across Europe.

Ireland: 39 million passenger air market in 2023

A record 39.2m passengers passed through Irish airports in 2023. Passenger throughput was 20% up on 2022, an additional 6.7m people, on a 16% increase in the number of flights. Compared to pre-pandemic passenger volumes in 2019, last year saw an increase of 3% (1.1m more passengers). Dublin was the key gateway handling 85% of total passenger traffic.

Almost 274,000 flights were handled by Ireland's five main airports in 2023, with Dublin handling 84% of all flights (229,756), Cork accounted for 7% of all flights (19,777), while Shannon handled 5% (14,998).

London-Heathrow, London-Gatwick, and Amsterdam-Schiphol were the most popular routes for passengers travelling through Dublin airport in 2023. The top route for Cork and Shannon airports was London-Heathrow, for Knock airport it was London-Stansted. Despite it being in the three most popular routes from Dublin Airport, Shannon Airport remains unconnected to Amsterdam-Schiphol.

Passenger traffic on most main country pairs showed recovery over pre-pandemic levels, with routes between Ireland and Spain carrying 18% more passengers, with double digit increases on services to/from Italy and France. Passenger volumes on services between Ireland and Germany were down 20%, with demand on routes between Ireland and Britain was down 5% on 2019. Passenger volumes on transatlantic routes were marginally down (-2%), while services to/from the Middle East and Asia carried 8% more passengers in 2023 compared to 2019.

Available survey data would indicate that demand from Irish residents for outbound travel recovered, and expanded, faster than inbound tourist demand in each of the past two years. With an increase in the tourism VAT rate and Government's reliance on hotels and guesthouses for humanitarian reasons there are cost pressures and capacity blockages impacting on inbound tourism numbers.

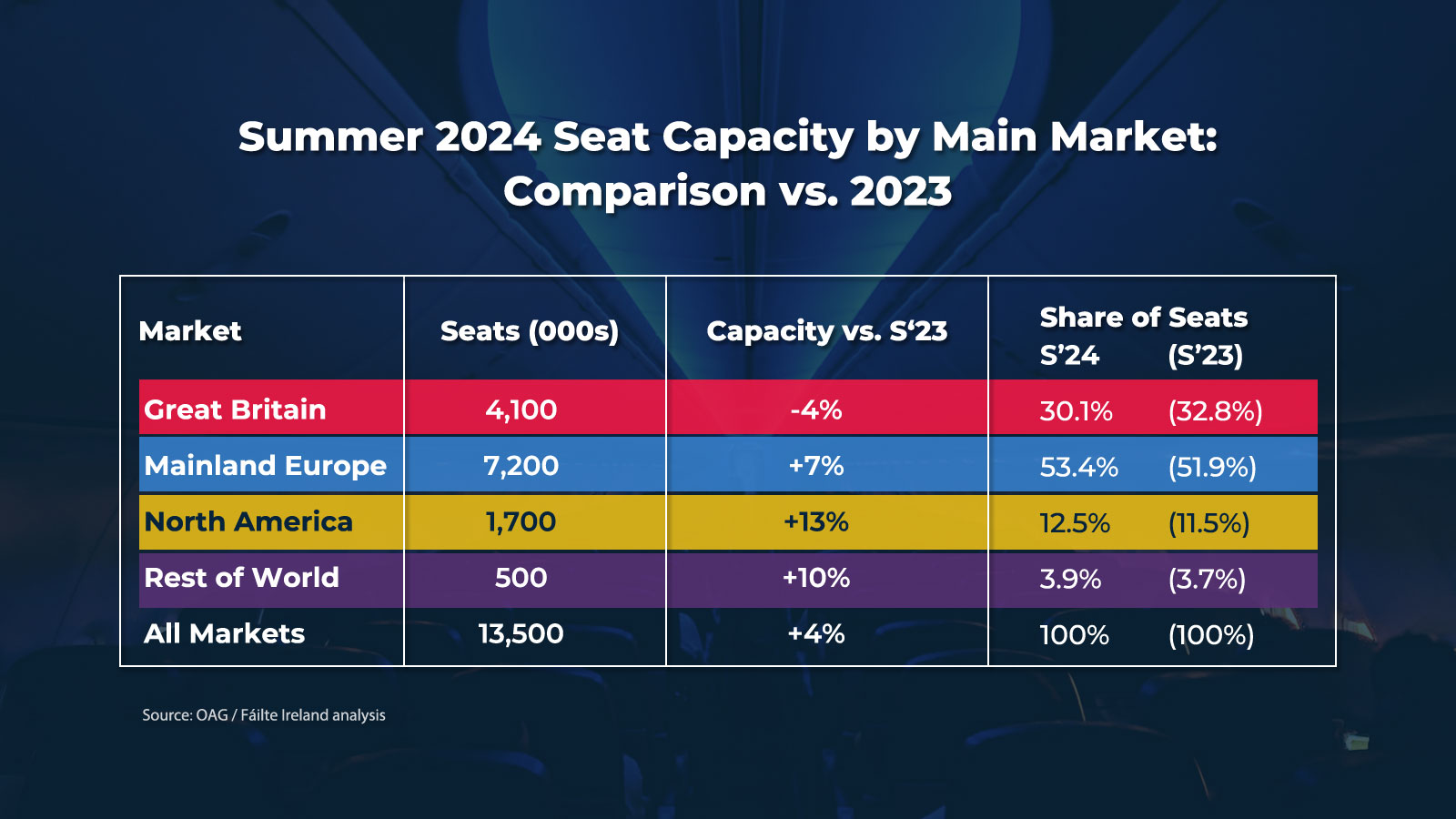

Scheduled Airline Schedules to/from Ireland: Summer 2024

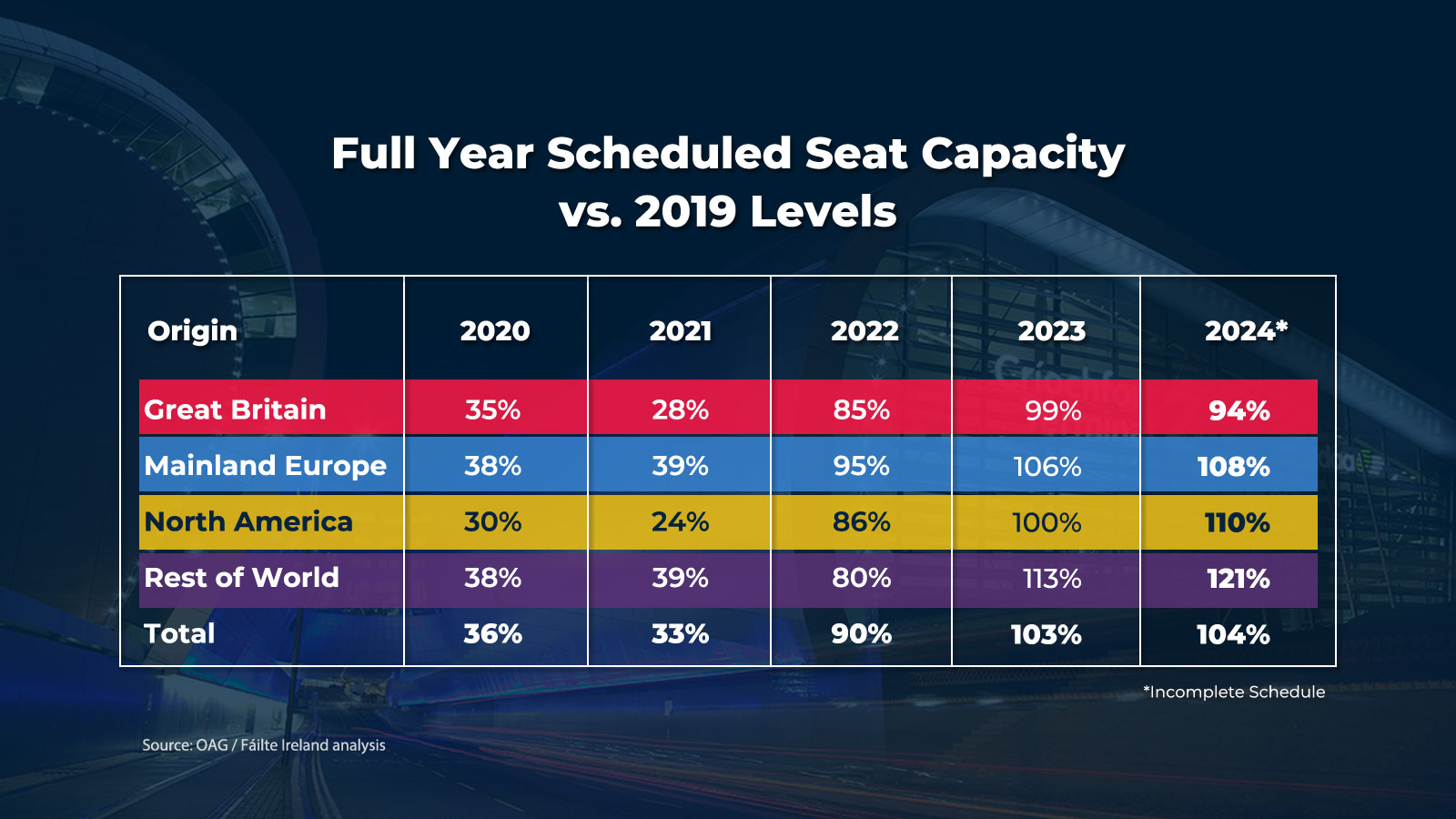

Air access over the summer season (March 31 to October 26) is scheduled to be 4% above summer 2023, with 13.5m seats on offer in each direction on 280 routes connecting Ireland to international destinations. This is the second consecutive summer with a capacity above pre-pandemic levels. This follows on from a 10% year on year capacity increase over the winter schedule (end October '23 to end March'24).

82% of the capacity on offer caters to both inbound and outbound demand, with the balance (18%), categorised as 'sun/pilgrim' routes, catering to outbound Irish demand. Overall capacity on the latter routes has increased by 10% since last summer, compared to a 3% increase on all other routes. The growth in capacity on offer in airports outside of Dublin in 2024 is largely driven by services targeting the outbound market to 'sun and pilgrim' destinations across Europe – double digit increases at Cork, Knock and Kerry, to a 29% growth at Shannon airport. Capacity at regional airports potentially catering to inbound tourists is down at Knock (-16%), Kerry (-4%), with Dublin Airport the only gateway offering more seats on routes with significant potential for inbound tourists.

Current best estimates suggest that the aggregate air service capacity for calendar year will be 4% ahead of 2019 levels, subject to final confirmation of airlines' winter schedules.

Competitiveness of Irish carriers

Airfares to Ireland are highly competitive, with the majority of tourists rating the cost of getting here as representing good value for money. The cost of travel to Dublin for a city break in 2024 was found to be the least expensive within its competitor set of destinations from most source markets, based on research undertaken by Failte Ireland. Ryanair is the price leader from short haul markets.

Transatlantic airfares to Ireland are highly attractive and competitively priced from key US gateways, compared to other popular European destinations. Aer Lingus, the price leader in a highly competitive market, offers the most keenly priced fares to Ireland and, in many instances, transfer travel to other European points.

OPPORTUNITIES

Positive outlook for continued growth in in international tourism

International tourist arrivals worldwide are on course to exceed pre-pandemic numbers by the end of 2024, with close to an estimated 1.5 billion international arrivals, according to the latest UNWTO outlook.

Demand for international tourism market is projected to continue to grow in the coming years.Total export revenues from tourism are estimated to reach US$1.7 trillion in 2024. Latest outlook suggest that over the next five years international tourist receipts will grow at an annual average rate of 3.5%.

The expectation is that the rate of growth in demand for international travel will outpace the rate of global economic growth. However, demand growth will be shaped by a complex interaction of factors, including the ongoing geopolitical tensions, weak economic growth and escalating sustainability challenges. Demand for international leisure and VFR travel will be a significant driver of the increase in demand for air travel. Global trends borne out by research show that consumers will continue to prioritise leisure travel, valuing experiences, time spent with family and friends, and wellness moments.

VISION 2030: An Irish Tourism Strategy for Growth

By 2030 the industry can be worth €15 billion to the national economy, employing up to 350,000 people across the country, and delivering €3.5 billion tax receipts to the exchequer each year. A pathway to achieve this goal has been set out in a strategy by the Irish Tourism Industry Confederation (ITIC) in September 2023, following extensive consultation across the business community.

The industry is confident about the future, as witnessed by the scale on ongoing capital investment commitments by the private sector. This is despite current cost and staffing pressures and significant supply bottlenecks facing businesses. Tourism also can positively contribute to meeting Ireland's commitments on climate change and delivering on the UN Sustainable Development Goals.

A thriving and highly competitive airline industry is critical to tourism's future growth.

Airline passengers to double over next 20 years

Global passenger traffic is set to double over the next 20 years to 20 billion passengers per annum, by which time China will have replaced the US as the world's biggest aviation market.

Global passenger traffic in 2024 is forecast to grow by 12% to reach 9.7 billion passengers or 106% of the 2019 level. The rate of increase is expected to gradually decelerate in succeeding years.

Short to medium term projections suggest that passenger traffic worldwide is predicted to grow at CAGR of 4.3%, with a steep recovery gradient observed in the first 3 years (9.1% CAGR for 2023 to 2026), then converging to the pre-COVID-19 growth rate (3.6% CAGR for 2023 to 2042). Markets in regions of the world beyond North America and Europe are expected to show the fastest growth rates over the next five years.

Macroeconomic factors, such as global inflation, global GDP growth rates, downturns in business confidence levels, and geopolitical conflicts, pose significant risks and uncertainties in future projections.

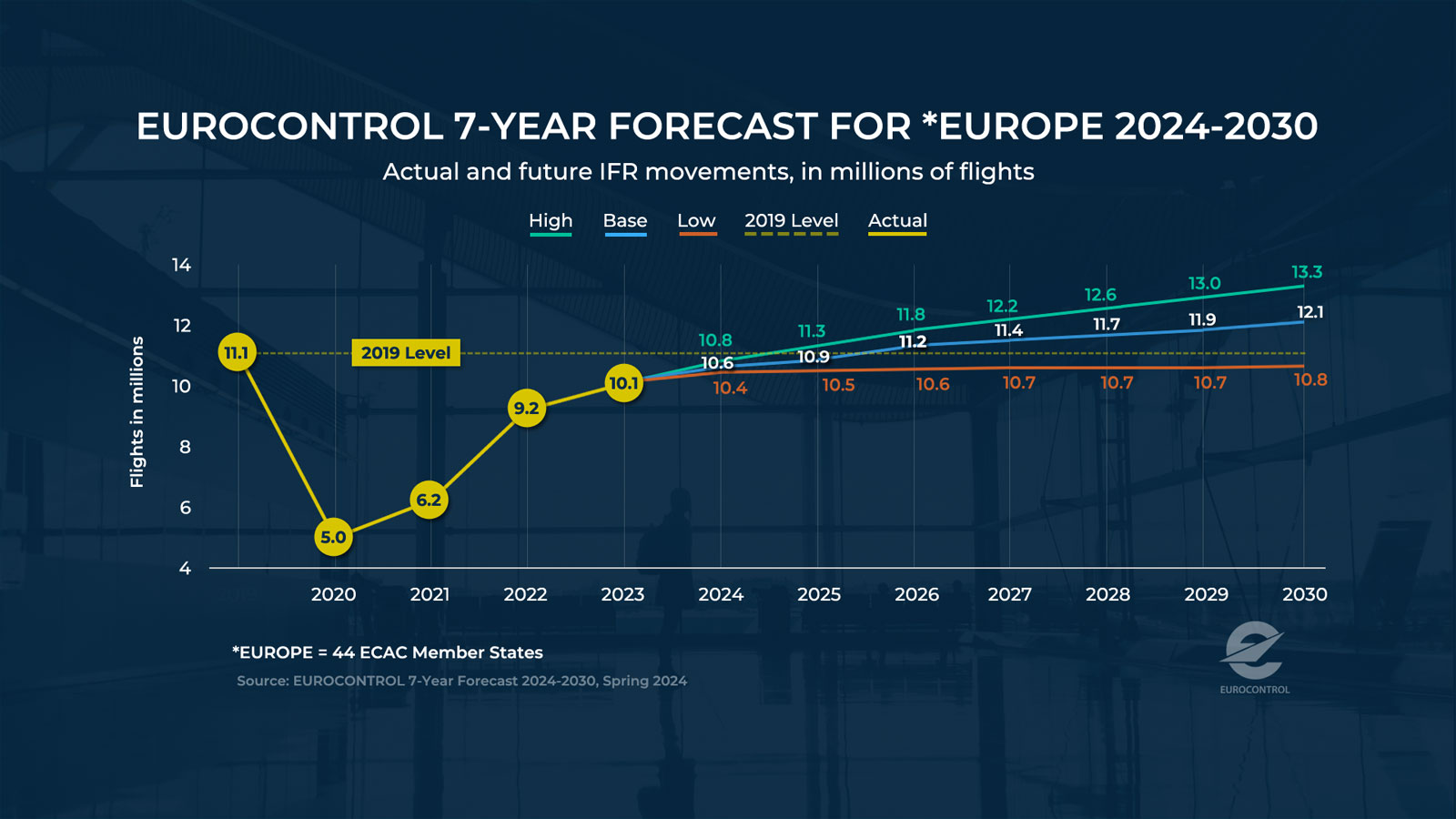

Growth forecast for Europe & Ireland

The number of flights across Europe's airspace in 2030 will be at between 109% and 120% of 2019 levels, based on EUROCONTROL's latest forecast. The base case forecast would see the number of flights grow by an annual average of +2.5% (CAGR) between 2024 and 2030, with a high growth scenario of +4.0% CARG. The specific forecast for Ireland's terminal flight servicing in Ireland is set at +3.3% base case (+ 1.4% CAGR) over the period.

Ireland's National Aviation Policy

The aviation sector plays a pivotal role in Ireland's economic and social prosperity, contributing over €10 billion annually to GDP and connecting the island of Ireland to the rest of the world. Aviation is clearly a critical enabler of the country's tourism sector. Ireland's tourism export industry is a source of close to €2bn to Irish carriers annually.

Ireland's first National Aviation Policy (2015) specifically identifies the role of air services for the tourism industry and commits to "creating conditions to encourage the development of new routes and services, particularly to new and emerging markets; ensuring a high level of competition among airlines; and to optimising the operation of the Irish airport network to ensure maximum connectivity to the rest of the world."

Ireland's aviation policy is centred on three main aims, enhancing enhance Ireland's connectivity, fostering the growth of aviation enterprise in Ireland, and maximising the contribution of the aviation sector to Ireland's economic growth and the needs of business, tourism and consumers. An important commitment for tourism is the creation of conditions to encourage the development of new routes and services, particularly to new and emerging markets.

The national aviation policy also recognises the important role regional airports play in their areas and in regional development. These airports continue to be important because of a level of international connectivity that they bring to a region for tourism and businesses.

The Government's policy commitment to boosting air services has been demonstrated by a range of measures in recent years, including the significant supports provided during the pandemic. The package of financial supports to the sector during the COVID pandemic was critical to the survival of the sector and provided the foundation for a speedy reinstatement of services.

Passenger traffic across the regional airports last year was up 9% when compared with 2019 passenger levels, with passenger traffic in Q1'24 16% higher with compared with the same period in 2023. However there is still plenty of both underutilised capacity and unrealised demand, particularly at Cork and Shannon airports and this must be maximised. The Irish Government could be significantly more generous with state aid for capital expenditure at these 2 key state airports whilst staying within EU state-aid rules. This would allow Cork and Shannon to incentivise airlines and spread economic benefit to the West coast supporting regional balance. Current data shows that 38%(3.2 million) inbound visitors flying into Dublin Airport are travelling to the west coast of Ireland.

The limit on passenger thresholds at regional airports should be raised to support vital infrastructure that brings connectivity and tourists into regional Ireland. Support is vital for Shannon and Cork airports to ensure the long term viability of regional airports.

CHALLENGES

The aviation industry has always been challenged by new, and occasionally, disruptive forces. Geopolitical events, pandemics and environmental events have each impacted capacity and demand around the world. In many cases such "shock events" result in new challenges as changed supply and demand patterns emerge. Post COVID the global airline industry, and Ireland's connectivity, face a number of significant challenges.

The immediate challenge facing Ireland's connectivity and tourism growth is the 'Dublin Airport Passenger Cap' restriction, maximising regional airport connectivity, while the overarching challenge is sustainability of the travel and tourism industry, amongst other supply and demand issues.

Airport Infrastructure – Dublin Airport 'Passenger Cap'

Passenger traffic growth at Dublin Airport is in jeopardy due to a 2007 planning approval condition which set a limit of 32 million passengers per year on the airport, now commonly referred to as the 'passenger cap'. While the scope of the passenger cap is unclear, the ongoing uncertainty surrounding the capacity limitation imposed by historic planning condition has serious implication for Ireland's connectivity and puts in jeopardy the expansion plans by airlines based at and serving Dublin Airport. At risk is investment in new, more sustainable and more fuel-efficient aircraft to enable that growth and contribute to sustainability objectives.

The restriction when imposed was due mainly to concerns on the adequacy of the ground transport infrastructure capacity serving the airport at that time. Since then, improvements to the M50 motorway, increased use of the Port Tunnel and the addition of a range of new public transport options have facilitated passenger throughput, even on the busiest summer days when upwards of 120,000 passengers pass through the airport. The rationale for the cap is no longer valid.

According to industry regulator the Irish Aviation Authority (IAA), "demand for slots for summer 2024 has increased relative to demand in summer 2023″. DAA, which operates the airport, estimated that "real demand" was running at between 34 million and 35 million passengers.

The Irish Aviation Authority (IAA), the industry regulator, most recently has set a limit of 14.4 million airline seats for the coming winter season (from October 27th next to March 29th, 2025), to ensure the planners' cap is not breached. Major airlines, including Ryanair and Aer Lingus, look set to challenge the decision to limit the number of passengers passing through the airport next winter, questioning the legality of the IAA's role to regulate on the basis of applying a local authority's planning condition.

Planning uncertainty is undoubtedly constraining growth, now only in the short term but will stymie expansion in the medium to longer term as airlines expand and launch new services at other European airports. In the meantime all efforts should be made made to maximise underutilized capacity at Ireland's regional airports.

All airlines maintain that the cap will drive up air fares as it limits the number of flights at the airport, and threatens jobs growth. A recent report by Jim Power Economics starkly illustrates the impact on a small open island economy with a strong dependence on tourism and Foreign Direct Investment, of a failure to quickly resolve the planning issues at Dublin Airport. The measurable impacts suggest that for every 1 million passengers annually denied use of Dublin Airport, €1.4 billion would be lost to the economy in direct, indirect and induced expenditure, €322.1 million would be lost to the Revenue in tax revenues foregone, and 37,000 direct, indirect and induced jobs would be lost. Furthermore "InterVistas' analysis from last year indicates that maintaining the current 32 million cap would lead to Ireland forgoing an additional 17,800 jobs and €1.5 billion in GVA by 2030. By 2055, the number of jobs lost to Ireland would be 53,300 while €4.4 billion would be lost in GVA. This would have huge implications for Ireland's tourism sector and business community, with trade and visitor numbers being constrained."

Plan to increase Dublin Airport's capacity to 40m passengers

The DAA lodged a major infrastructure application with Fingal County Council in December 2023. The €1.5 billion plan includes the building of 11 distinct infrastructure projects to bring Dublin Airport's annual capacity to 40 million passengers. This major project proposal may take years to be processed through the existing planning system during which time the cap will remain in place, resulting in billions of euro in damage to the Irish economy along with serious loss of employment.

The DAA has expressed confidence that it is possible to grow Dublin Airport and Ireland's connectivity while delivering on its target for net zero carbon emissions by 2050. The DAA also acknowledged that the planning application will take a number of years. It is imperative that the spare capacity at regional airports such as Shannon and Cork be utilised for enabling growth in the short to medium term.

The operator of Ireland's main aviation hub has asked for wider planning exemptions for airport infrastructure and new rights to bypass local authority planners for developments with no aircraft noise implications. This would allow the DAA to make direct planning applications to An Bord Pleanála, or its successor An Coimisiún Pleanála, as well as seeking a fast-track appeal mechanism. As the Government is in the process of an overhaul of the planning process legislation, providing an exemption in primary legislations for key national strategic airport infrastructure, would facilitate the airport operator to carry out operational modifications. It would allow the operator to make changes in relation to the provision of airport services and facilities, without the need for a formal planning application. A similar regime operates in other jurisdictions, including the United Kingdom, in respect of key strategic infrastructure. This would replace the current system which has been characterised as inflexible, unduly complex and "involves undesirable delays and risks" in a submission by the airport operator to the Department of Housing.

Negative impact on tourism

The tourism industry projection of growth in receipts from a current level of €10 billion to a level of €15 billion by 2030, is at serious risk if the passenger cap is not removed. A recent economic report estimates that the current planning uncertainties could result in the loss of up to €15 billion in tourism revenue, the opportunity for 65,000 new tourism jobs missed and €3.6 billion in increased tax revenues sacrificed. Currently the passenger cap at Dublin puts at risks charter and ad-hoc flights thereby seriously limiting Ireland's opportunities to host once-off high profile events, at an estimated loss of €500 million per annum. The consequence of keeping the cap in place will cause both significant economic and reputational damage.

Ireland's future tourism strategy is critically dependent on international air access, lifting the passenger cap at Dublin Airport will require a more urgent intervention to provide a resolution. In the interim, every effort should be made to ensure that passenger traffic is secured for Ireland Inc by maximising access to Ireland's regional airports where there is considerable spare capacity and unrealised demand.

Addressing aviation's environment impacts

Sustainability, the balance between the benefits and costs to society, is the main challenge facing air transport, but also the biggest opportunity. Air transport currently delivers, in terms of jobs and economic development, an estimated 2% to 3% of global GDP, whereas the costs to society include about 2% of human-induced greenhouse gas emissions (about 1bn tonnes compared to 50b tonnes), as well as noise and other impacts on the environment. The challenge is to maintain the sector's positive economic and social contribution while reducing or eliminating the CO2 emissions and other impacts. Reducing emissions from aviation is one of the most serious challenges of addressing the climate emergency.

The European aviation industry was the first in the world to commit to the realisation of a net-zero goal for all departing flights by 2050. The use of Sustainable Aviation Fuels (SAF) will play a decisive lead role in the decarbonisation, together with aircraft technological advancement and air traffic management. Irish airlines are making significant capital investment in more energy efficient aircraft while committing to use of Sustainable Aviation Fuel (SAF).

A recent report from IATA 'Aviation Net-Zero CO2 Transition Pathways Comparative Review', comparing 14 leading net zero CO2 transition roadmaps for aviation, found a broad consensus on the transition measures to net zero by 2050. While all the mitigation levers are based on current and evolving decarbonisation technologies and solutions, the greatest reduction of CO2 emissions will be delivered by the use of Sustainable Aviation Fuel (SAF). The report confirms SAF forms as an essential component achieving net zero CO2 emissions by 2050. The policy implication is clear – strong support for the production and use of SAF is essential for achieving the target.

European targets for SAF

The EU has introduced legislation, under RefuelEU, that mandates minimum levels for the supply and use of SAF: from 2% of total aviation fuel in 2025 rising to 70% by 2050, with sub-targets for sustainable aviation fuel from renewal resources (eSAF) of 1.2% in 2030 and 35% by 2050.

Europe's aviation leaders recently called on member states to confirm the ReFuel EU Aviation Regulation and enable Europe to become a leader in SAF production worldwide. The decarbonisation of aviation requires industry and government to work together in establishing production facilities to ensure reliable supply together with ensuring the price differential versus traditional aviation Jet Fuel is significantly reduced.

SAF opportunities for Ireland

With a long and innovative history and an established reputation in the global aviation industry, Ireland has an opportunity to lead the way in the rollout of SAF in the EU and beyond. Ireland is well placed to become an important European player in SAF from renewable sources (eSAF), given its abundance of offshore wind resources of over 50GW of fixed offshore wind potential. A Government SAF Taskforce, of industry stakeholders established in December 2023, is charged with developing a national SAF policy roadmap. This is intended to help inform policy development and identify the actions necessary to ensure that Ireland can meet its regulatory obligations to decarbonise aviation and consider the broader opportunities for SAF in Ireland. The output will help inform policy development and identify the actions necessary to ensure that Ireland can meet its regulatory obligations to decarbonise aviation and consider and broader opportunities for the use and production of SAF in Ireland. The output of this work will play a critical role in driving sustainability not just in aviation but also for the tourism sector.

Given the importance of SAF in supporting decarbonisation of aviation, the tourism sector will stand to be a direct beneficiary. Therefore, Ireland has to focus on domestic production of SAF in both development and implementation of national policies and also through its advocacy at European level.

In particular, Ireland is well placed to become a regionally important player in eSAF, given its abundance of offshore wind resources (over 50GW of fixed offshore wind potential)

The SAF taskforce set up by Minister Chambers is tasked with supporting development of this roadmap.

The Taskforce terms of reference note the importance of developing a national SAF policy roadmap now to support the deployment of SAF. The SAF Taskforce established in December 2023 brings together stakeholders with responsibility for and interest in policy development and implementation in relation to SAF.

Supply Chain Constraints

New aircraft orders at a record high

As global travel returns to normal, and with worldwide airline seat capacity reaching 99% of pre-pandemic level in 2023, airlines and leasing companies have embarked on an unprecedented aircraft ordering spree. The boom in demand is driven by customers who had deferred fleet plans in 2020 through 2022, together with a move towards the latest fuel efficient aircraft.

Unfortunately aircraft production struggles to keep pace with demand, with the record global order book resulting in a significant increase in backlog. Even before the pandemic Original Equipment Manufacturers (OEMs) struggled to keep pace, COVID-19 pandemic saw shortages emerge in everything from raw materials to microprocessors.

While the demand is certainly there, in terms of both airline traffic and aircraft orders, the challenge is to eradicate supple chain issues. For at least the next two years, the aviation market will be supply-constrained, rather than demand driven.

New aircraft deliveries exacerbated by difficulties at Boeing

As the airline industry is dominated by a duopoly of two manufacturers – Boeing and Airbus – disruptions in either of these companies have massive effects on the wider industry.

Boeing was hit by a series of quality and safety issues related to production of its 737 Max and 737-9 aircraft groundings. The US Federal Aviation Authority (FAA) currently prohibits Boeing from increasing 737 MAX production until quality issues are addressed. Boeing is now reporting a 36% decline in quarterly aircraft deliveries, while its backlog has grown to $529 billion, including over 5,600 commercial aircraft.

Although Airbus is benefiting from Boeing's crisis, delivering twice as many commercial aircraft in March 2024, the global airline industry is impacted by a growing scarcity of the most modern fuel efficient aircraft.

Closer to home, Ryanair expects Boeing to deliver 40 new aircraft by mid-July, out of 57 planes that were due by the end of April. The delay in deliveries has forced the airline to adjust it planed peak summer schedule across its network.

Shortage of skilled personnel

Expansion of airline travel is contingent on an adequate supply of qualified personnel, including engineers, technicians, flight and ground crews, in a tight labour market environment. The sector experienced a loss of personnel who left the industry during the COVID shutdown, together with a slowdown in training due to the pandemic. Despite the climate change challenges facing the sector – it is facing a big transformation, it provides an exciting career path to young, educated professionals. Matching the growth in demand for air travel will require an expanding labour force.

Air Navigation

The EU Single European Sky initiative seeking to reform European air traffic management, aiming to enhance safety, efficiency and lower the environmental footprint of flights, has yet to be realised. Progress on implementation of the 2004 initiative has been slow, requiring a complex framework of legislation and regulatory instruments, together with the application of new technologies, to replace the fragmentation of Europe's air traffic management operated by member states. The current system is costly, inefficient for airlines, disruptive to passengers and environmentally damaging. Recent issues include post-COVID workforce shortage, IT system outages and strikes. The latter has continued to be a disruptive issue, most notably with the frequency of air traffic controllers strikes in France.

RECOMMENDATIONS

Irish tourism and aviation are symbiotic. As an island nation there are self-evidently no access transport options other than ferries which are anticipated to grow but cannot meet the full needs of the Irish tourism economy. Therefore the aviation needs of the country must be addressed for tourism needs, as well as FDI, exports and the broader economy.

The Irish Tourism Industry Confederation make 6 recommendations as part of this bulletin:

1.

The passenger cap at Dublin Airport must be lifted without delay.

The cap is a barrier to growth and means that Irish tourism will not be able to prosper in the years ahead which will have a direct impact on jobs, exchequer revenue and economic activity. Airlines risk being turned away from Dublin and commencing services between countries other than Ireland.

2.

Maximising the underutilised capacity and unrealised demand at Cork and Shannon airports.

The Irish Government could be significantly more generous with state aid for capital expenditure at these 2 key state airports whilst staying within EU state-aid rules. This would allow Cork and Shannon to meet safety, security and capital costs which are notably more burdensome for regional airports.

These airports are well placed to facilitate growth in Ireland's air service network in the short-term.

3.

Incentivising the use and development of Sustainable Aviation Fuel.

Ireland has a proud record in aviation entrepreneurship. SAF is vital to allow aviation decarbonise and the State should support the sector by introducing tax incentives to produce and use SAF. It is welcomed that there is a taskforce in this regard and its work should be supported.

4.

Assist and enable the decarbonisation of Irish aviation.

As well as incentivising the use and production of SAF, the on-the-ground operations of Dublin, Shannon and Cork airports are already making great strides to decarbonise and they should be encouraged and enabled to do so.

5.

Align Ireland with other island nations in the EU in relation to aviation needs.

The likes of Malta and Cyprus are seeking flexibility from the EU in relation to aviation to allow these destinations time and space to decarbonise aviation. The same must be done for Ireland and the Irish state should move to join these countries in common cause.

6.

Support moves to consolidate air traffic control across the EU.

The liberalisation of aviation across the EU is incomplete and each member state has their own air traffic control which causes delays and routing difficulties which is bad for the environment, airline and consumer. This must be remedied.