|

| |||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

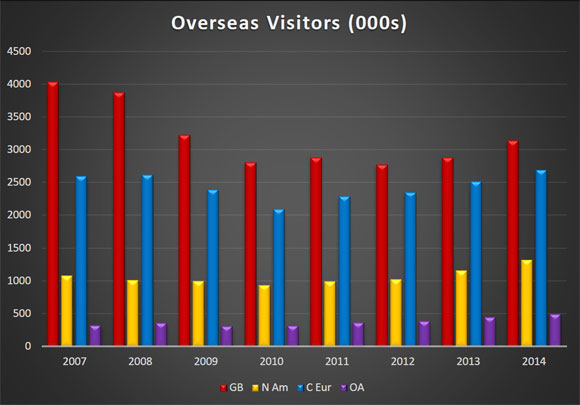

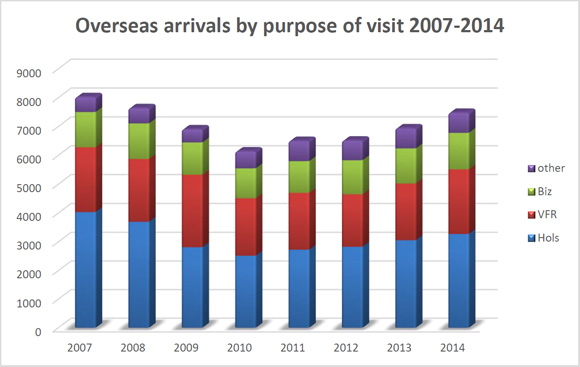

It's hard to imagine a more favourable set of circumstances for tourism – an improved economy in most source markets fuelling a strong demand for travel, increased capacity on air and sea services to Ireland, falling fuel prices, and a stronger US dollar and pound sterling coupled with the good value for money to be had in Ireland. That was the story in 2014 which led to a marked recovery for the sector which had been challenged for much of the past 5 years. 2014 delivered growth in the volume and value of overseas tourism to Ireland. Best estimates indicate that arrivals from overseas topped 7.3 million, up 9% on 2013, based on the latest data from the CSO. More importantly, best estimates for expenditure by overseas visitors suggest it rose by 9% in current terms to €3.55 billion, with a further €1 billion earned by Irish carriers. To put this performance in context, visitor volume in 2014 is almost back to the record year of 2007, although earnings from visits are still below the levels achieved in the last decade.

The number of holiday visitors increased by 8% to almost 2.7 million, while those coming to visit friends and relatives (VFR) grew by 14% to just under 1.7 million. Business visits were up 4% to almost 950,000.

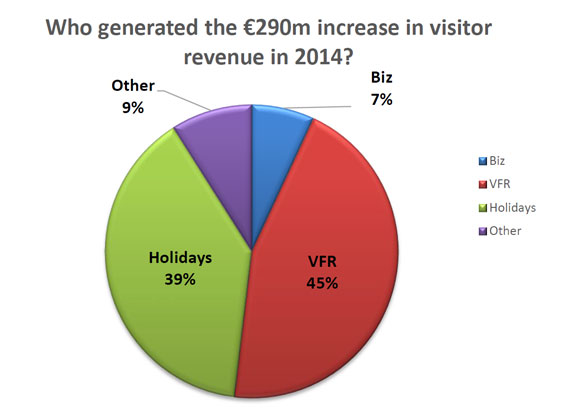

An analysis of the increase in tourism revenue is interesting. Expenditure by visitors to Ireland is estimated to have increased by €290 million in 2014 compared to the previous year. Estimates of expenditure by purpose of visit shows that VFR visitors generated €130 million more than in the previous year, while expenditure by holiday visitors increased by an estimated €115 million. Business visitors were the source of an estimated additional €20 million.

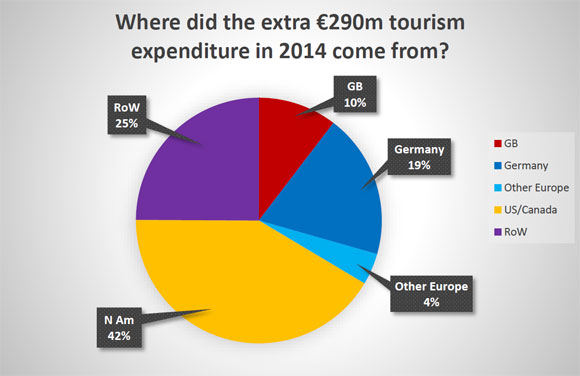

A breakdown of the incremental revenue earned suggests that the long haul markets were the source of two thirds of the extra €290m earned. North American visitors led the way generating an estimated €120 million more than last year, while spending by visitors from new and developing long haul markets increased by approximately €70m. Of the short haul markets, Germany showed the highest rate of increase, with the largest source market Britain contributing approximately 10% of the incremental earnings in 2014.

Bed nights spent in the country by overseas visitors are estimated to have increased 9% to 43.7 million, for the period January to September compared to the same period in 2013. This represents an increase of 3.5 million bed nights. The distribution of bed night demand by category of accommodation is interesting, showing that demand grew more strongly for non-hotel accommodations. Hotel demand is estimated at 11.7 million bed nights, up 2% compared to a year earlier, resulting in its market share slipping 2 percentage points to 27%. The number of bed nights spent with friends and relatives in non-commercial accommodation increased by 16% to almost 13 million bed nights. In the paid accommodation sector rented accommodation grew by 16% to 6 million bed nights, while demand for guesthouses and B&Bs grew by 13% to 4.25 million bed nights. |

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

Tourism outlook for 2015 The target of 440,000 or 6% increase in overseas visitors in 2015 is realistic given the relatively benign state of source market economies, the increase in access capacity into Ireland and strength of the pound sterling and the US dollar. However, growth is not guaranteed, there is still much work to be done to ensure that 2014/15 is not ‘as good as it gets’ for Ireland’s tourism industry. Businesses across the country have done well with their hard work and determination in the face of many challenges over recent years. But there is still a lot of work to do in order to ensure that Ireland remains competitive. The industry needs continued investment and innovation to build on the success of 2014. The health of the tourism industry, as is the case of the Irish economy, is heavily determined by the wider global economic environment, particularly the UK, Eurozone and US economies.

The UK economy is forecast to grow by at least 2.5% per annum in 2015 and 2016, following a forecast 3% growth in 2014, the highest rate of growth since 2007. Consumer spending is expected to remain the main growth driver, but its contribution to GDP will fall, particularly after the expected rise in official interest rates. While the services sector continues to be the main contributor to growth, manufacturing and construction are back in positive territory. Sterling is expected to stay strong against the euro, as interest rates rise in 2015. Recent data show that the Eurozone economy is very weak, with the recovery in economic activity remaining anaemic and fragile. GDP rose by a meagre 0.2% in the third quarter after growth of just 0.1% in the second quarter, while the latest data suggest that the economy remained depressed in the final quarter of the year. As a result the European Central Bank slashed its GDP forecasts, with the economy now expected to grow by 1% in 2015 and 1.5% in 2016, some 0.5% lower than it had predicted in September. Not surprisingly, then, pressure is mounting for further easement measures to counter low inflation and further kick start the Eurozone economy, particularly in the underperforming economies such as France and Italy. Once again Germany is expected to be the engine of growth, with the Germans’ appetite for travel undented.

While the outlook for growth in all major economies around the world is being revised downward, only the U.S. economy is now expected to grow faster than previously anticipated at close to 3% for 2015. Lower energy costs will boost broad economic activity in the near term and fiscal policy becomes more supportive of growth. After rising about 5% against a basket of currencies this year, the US dollar could gain another 5% in 2015. A stronger dollar means cheaper overseas travel and cheaper imports for Americans. The good news is that more seats will be available on air services, a primary driver of tourism demand. Capacity on transatlantic services in the peak months of 2015 will be 13% ahead of last summer, with an increase in capacity on short haul services of up to 5%. The principle additions to air service routes and frequency which will benefit inbound tourism include:

In addition to the above, Ryanair and Aer Lingus are adding services on a number of established routes; while there will be some tweaking of frequency on other services.

Ferries Stena Line increases capacity between Holyhead and Dublin A larger ship, Stena Superfast X, will replace the Stena Nordica on the route in early 2015. Stena Superfast X, a sister ship of the Stena Superfast VII and VIII ships which the company currently operates to/from Belfast, has capacity for up to 1,200 passengers and provides almost 2 km of lane space to accommodate a mix of car and freight traffic. Stena Nordica, the company’s second ship on the route, catered primarily to freight traffic while accommodating up to 400 passengers, it did not cater to foot passengers.

2014 saw investment by Irish Ferries in adding a new ship, Epsilon, which increased the line’s frequency and capacity on the Dublin to Holyhead route as well as launching a new weekly service linking Dublin with Cherbourg.

Best estimates indicate that employment in the industry has recovered to at least 205,000 and is responsible for sustaining several thousand more in employment. The sector has amply demonstrated its ability to create employment and help reduce the high levels of unemployment in the country, with the prospect of a further 8,000 jobs being created in 2015, according to Fáilte Ireland. It is hoped that the new Tourism Policy will address the issues surrounding skills challenges facing the sector. There is a need for the modernisation of the education and training system appropriate for the industry to meet its demands for suitably qualifies labour in order to continue to enhance Ireland’s reputation as a hospitable and competitive travel destination.

The resilience of the tourism sector is well documented as is evident from the results achieved when competitiveness of the sector is restored. The global recession hit world travel and tourism hard, but it is important to remember that Ireland’s tourism economy was becoming structurally uncompetitive a decade ago due to the rising costs of doing business in Ireland. Many businesses within the sector failed, and up to 50,000 jobs were lost. But businesses have remodelled and are now more efficient, while Government has shown confidence in the sector by addressing competitiveness measures. In its latest report the National Competitiveness Council is once again highlighting the need for vigilance with regard to cost competitiveness. A range of indicators suggest that Ireland is already beginning to slip in terms of cost competitiveness, particularly in relation to labour and energy costs. Policy decisions on income tax, PRSI structures and USC charges impact overall labour costs and employment patterns. In addition, property costs including commercial rates and other state imposed charges continue to threaten the competitiveness of the sector.

While State finances continue to be under pressure, a programme of sustainable Government funding for tourism is essential if the industry is to prosper and grow further. Stable investment in international marketing of the destination is a ‘sine qua non’ if Ireland is to remain competitive. A continuing erosion of the level of marketing investment across the key markets, which has occurred in recent years, can only eventually result in a loss of awareness in the market. This will lead to an inevitable decline in demand, resulting in loss of market share. Investment in world quality infrastructure - transport, communications, air and sea ports – is also essential to remaining competitive and maximising the potential for growth in a globally expanding industry. The continued provision and upgrading of key tourism attractors is vital to the future success of the industry. ITIC has already outlined the case for state support for the sector indicating that a 5 year €250 million programme of investment support over the 2016-2020 period is needed to ensure that growth in tourism is sustainable. Amongst the challenges facing the industry is that of enterprise development and innovation in the range of tourism products and experiences to meet the needs of a changing international market. Tourism, as an indigenous sector, has the export capacity alongside the food and agri-sector to deliver sustainable growth. Indeed there is a synergy between the food and agi-sector and tourism which has considerable unfulfilled potential. |

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

ITIC’s agenda includes the following key goals for the year ahead as part of its ongoing advocacy role on behalf of businesses and other stakeholders engaged in tourism.

Following the publication of the Government’s Tourism Policy, a priority for the industry is the development of a new strategic action plan to deliver the policy goals. It is expected that industry will have strong representation on the Tourism Leadership Group (TLG) which will oversee the formulation of an action plan including setting specific targets and defining development and marketing priorities. ITIC will seek to influence the promotion and support of policies and actions by the TLG, which will benefit the industry’s growth and development. ITIC’s objective will be to ensure the production of a comprehensive and integrated action plan for the delivery of development and marketing programmes against set targets. This will provide a clearly defined investment environment within which businesses can invest in growth.

Following on the success of the industry initiated Tourism Recovery Taskforce (TRT), ITIC will continue to actively participate with Tourism Ireland’s Marketing Partnership Groups as the principal opportunities to interface with the state agencies on tourism programmes. Recent experience and fast changing market conditions suggest the need to improve the effectiveness of the role and operation of the market focused forums. ITIC’s objective will be ensure that the forums provide an opportunity for real dialogue and exchange of views, informed by research and operators’ experience.

Following the successful launch of the new branded tourism experience, which has effectively opened up the western seaboard to increased visitor traffic, ITIC will work to ensure the sustainability of the initiative. A good start has been made but substantial additional investment will be required to maximise its long term potential. The goal will be to ensure that the investment maximises the potential to attract ever increasing numbers of tourists and deliver economic benefit to towns and communities on the route.

ITIC, in welcoming the appointment of Michael Carey as Chair of the Dublin Tourism Alliance, looks forward to an early implementation of the findings and recommendations of the Destination Dublin report including the launch of a new brand identity for the city, supported by significant marketing investment. The re-branding of the city is a core component of the new strategy which will only be successful if there is ‘buy-in’ from the resident and business communities. Meanwhile the rate of growth of tourism demand to the city continues to outpace demand for other parts the country. For many visitors Dublin is the single attraction in visiting Ireland, with much of Ireland’s growth driven by demand for visits to the capital. However, the city faces a number of challenges which threaten to slow the growth, including high accommodation occupancy levels; lack of investment in international marketing; and hygiene factors such as security and infrastructure. ITIC will actively campaign to address these issues to ensure that the potential for further significant growth in demand, jobs and revenues is not jeopardised. |

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

The new awards scheme is aimed at heightening awareness of quality and best practice within the industry and generating publicity for the sector. The biennial Awards will showcase the country’s most successful and innovative tourism products, services and experiences. For many years the industry has lacked a system to recognise achievement, and the new awards are being organised and presented by ITIC and its members, including Fáilte Ireland, and Tourism Ireland. The Awards give recognition to and promote people, companies and organisations – overseas and at home – that have made significant contributions to the development and marketing of visitor experiences in Ireland and to increasing the number of visitors from overseas. Winners will receive an award, specially commissioned by Irish Design 2015, together with promotional branding for use throughout the year. The inaugural 2015 Irish Tourism Industry Awards will be presented at a Black Tie Gala Dinner on 24th April 2015. Go to www.irishtourismindustryawards.ie for full details and updates. |

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||