Context

Ireland, in common with most other destinations, has enjoyed a speedier and stronger than anticipated recovery in overseas visitors in 2022. The post pandemic rapid recovery in international travel has been driven by extensive pent-up demand, including deferred trips, and amassed personal savings, following the lifting of travel restrictions. However, the recovery remains fragile with the volatile and challenging geopolitical and macroeconomic, together with the risk of a new outbreak of COVID, threatening continued recovery into 2023.

The ongoing war in Ukraine, energy challenges, soaring cost of living, and higher interest rates represent a growing risk of recession across Ireland’s tourism source markets. In addition, supply side constraints, rising input costs and a tight labour market combine to threaten the sustainability of many tourism and hospitality businesses struggling to recover from the pandemic shutdown.

It is timely to look forward to the outlook for Irish tourism, the country’s largest indigenous industry and biggest regional employer. The Irish Tourism Industry Confederation (ITIC), in this bulletin, looks at inbound tourism from overseas markets and estimates how 2022 will end up in terms of the volume of international visitors. We project 3 different scenarios for how future years might unfold, the most likely of which suggests a softening in visitor numbers in 2023 followed by a gradual climb back to pre-pandemic levels. The challenges and risks facing the Irish tourism and hospitality sector are analysed as are the economic outlooks of our key source markets and we share Fáilte Ireland’s latest analysis on domestic tourism’s performance.

Tourism is universally susceptible to economic cycles and geopolitical instability which now threaten the continuation of an upward recovery trajectory in 2023. Hence many forecasters are revising downwards their outlook for international travel.

Past experience shows that people tend to adjust their travel behaviour in difficult economic times, either by reducing the number of trips, down trading, reducing length of stay to cut costs, and substitution of domestic for international travel. Typically, short leisure breaks tend to reduce in frequency, to protect the main annual holiday. Ireland’s past experience has been a deeper downturn in demand, and a longer period of recovery, than many other European destinations.

Most research points to a significant pent-up intention to travel, however, the extent to which this will carry over into 2023 is unknown. While there are recession-proof segments of the market which can be expected to travel despite the economic conditions, the ‘squeezed middle’ are perhaps the most exposed to the economic downturn and would have to rely on savings to maintain their travel behaviour.

Undoubtedly 2023 will be more challenging, despite the sharp recovery in 2022 which exceeded expectations.

2022 Overseas Tourism Review – Year to Date

Recovery of overseas demand surpassed expectation

ITIC estimate that 5.8 million visitors arrived over the first 8 months of the year, with Ireland now on course to welcome in the region of 7.5 million tourists (staying at least one night) in 2022 compared to 9.6 million in 2019.

The early months of the year were subject to ongoing travel restrictions, varying across jurisdictions with Ireland adopting a more conservative approach to the easing of restrictions. The pattern of recovery of visitor arrivals very much mirrored the easing of testing requirements in the early part of the year, with the lifting of testing for entry into the USA and Canada in June giving a boost to transatlantic travel.

Recovery has been driven by significant pent up demand, including a volume of deferred bookings from 2020 and 2021, together with significant savings accumulated during the pandemic. Ireland’s robust recovery owes much to Ryanair’s aggressive expansion of service on short haul routes and Aer Lingus’ restoration of 93% of its 2019 transatlantic peak capacity.

Anecdotal evidence would indicate that VFR visits were amongst the first to rebound, with leisure trips dominating from late spring through the summer, while business travel appears to have been slower to recover.

Despite robust recovery, 2022 has been far from a typical tourism year. The extraordinary rebound of post pandemic demand does not necessarily point to a progressive trajectory of recovery into 2023, especially in light of the rising costs of energy and food and increasing fears of an imminent recession across all major source markets.

Recovery has not been without its challenges

In common with many other destinations Ireland experienced a number of challenges in recent months due to the fast rebound of demand for international travel. These have included airport congestion, labour shortages across all service businesses, car hire supply, and rising prices.

In addition, Ireland experienced a number of specific supply-side issues, most notably a reduction in available stock of visitor accommodation. A number of properties, mainly hotels, were contracted to cater for the influx of refugees from Ukraine and asylum seekers from other parts of the world.

The immediate impact has been a reduction in available hotel rooms on offer to cater for tourist demand across the country. It is estimated that the number of hotel rooms withdrawn in Dublin could be as high as 5,000 out of the city’s 21,000 stock, while hotel capacity in a number of resorts along the western seaboard has been lost to tourism this year. This has not only resulted in higher hotel prices, as demand exceeded supply, but a reported frustration of demand.

Reports point to a loss of business for Ireland due to the lack of availability in the mid-range and budget hotel categories, while some itineraries were inconvenienced by enforced changes in planned accommodation. The ongoing use of visitor accommodation stock for humanitarian purposes effectively caps Ireland’s capacity to make a full recovery in tourism to pre-pandemic levels.

Staffing continues to be a critical challenge for businesses in the sector in a tight labour market. The sector lost staff during the pandemic and has had difficulty in recruitment on reopening. This has forced many businesses to curtail trading thereby reducing the choice for tourists and effectively placing a limitation on capacity.

As a touring destination Ireland has struggled this year, along with other destinations, to cater for the demand for car hire and coaches – sectors which have been hard hit by supply chain issues and rising fuel costs.

Despite the challenges, and widespread local media coverage, preliminary indications suggest that Ireland has not suffered reputational damage and has succeeded in delivering a fulfilling and quality experience to the visitor.

Challenges & Risks facing the industry into 2023

At this time the outlook for tourism to Ireland over the coming year is clouded by evolving geopolitical and economic uncertainties. The industry faces a number of headwinds which could seriously derail the current momentum for recovery to pre-pandemic levels.

The risk of a downturn in demand in international travel could have serious implication for Ireland’s tourism industry, threatening the viability of businesses still struggling to recover from the impact of the pandemic shut down.

While recession in at least some of Ireland’s main source markets remains a possibility, the prospect of any sustained downturn in demand for travel could have serious implications for tourism businesses and the broader economy. The experience of the past has been that in times of sharp economic downturn Ireland has experienced a deeper fall-off in demand and recovered more slowly than many other destinations. Following the global financial crash in 2008, tourism to Ireland did not fully recover by regaining its competitiveness until 2015. A key risk over the coming year would be any loss of competitiveness should prices in Ireland get out of line with those in competitor destinations.

Outlook for 2023

The risk of global recession in 2023 is increasing amid simultaneous interest rate hikes, according to the latest report from the World Bank (September 15, 2022). The study reports that the global economy is now in its steepest slowdown since 1970 with consumer confidence already down more sharply than in the run up to previous recessions. The world’s three largest economies—the United States, China, and the euro area—have been slowing sharply. Under the circumstances, even a moderate hit to the global economy over the next year could tip it into recession.

Key challenges facing tourism in 2023

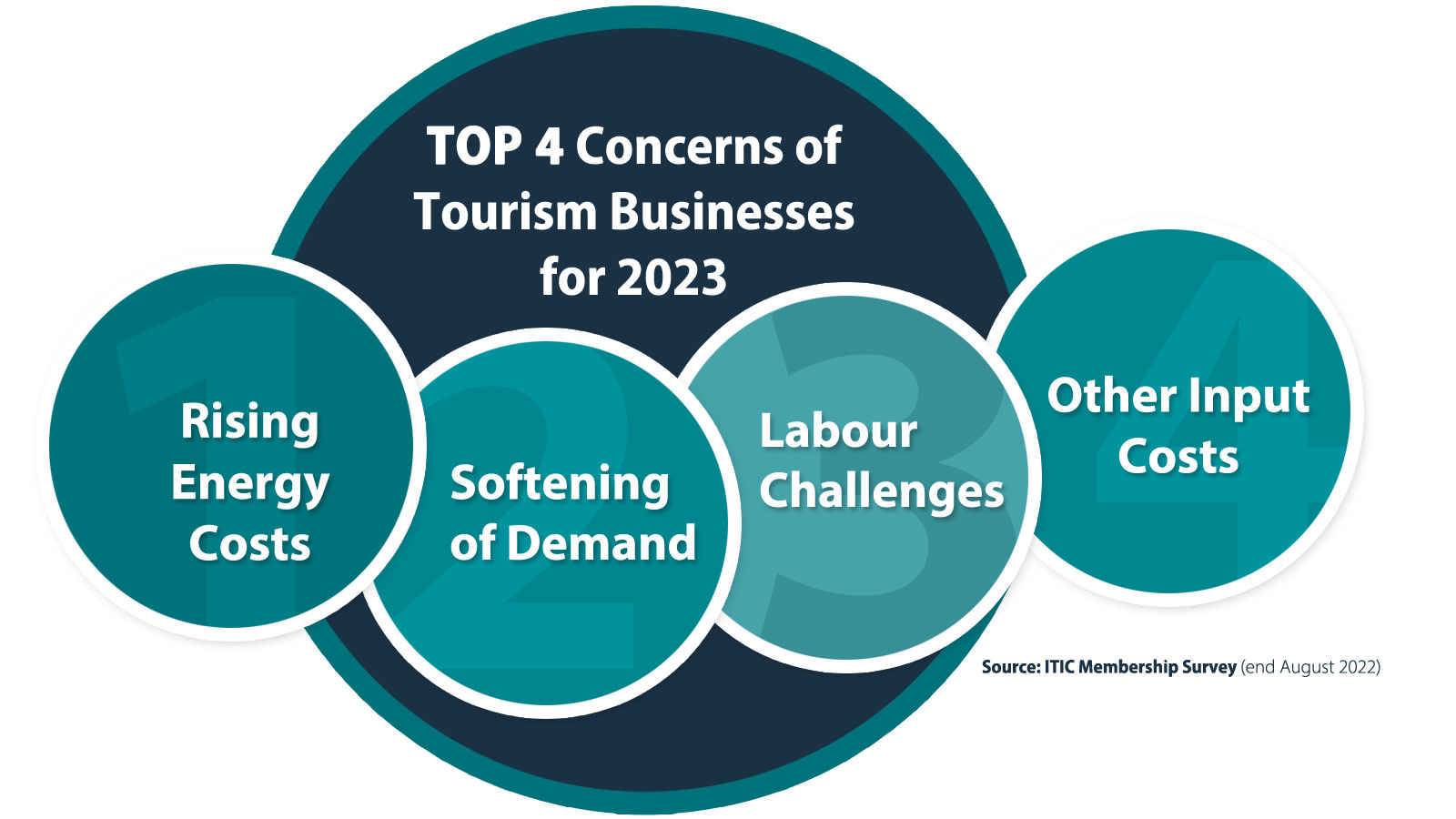

Rising energy costs, a softening of demand, and labour supply and costs are the top concerns of the industry facing into 2023. In addition, the rising input costs, the prospect of a 13.5% VAT rate and borrowing costs, have been identified as challenges in a recent ITIC survey of its members.

On the supply side, few if any businesses can escape the rising energy costs and the tight labour market situation, while an increase in VAT is of particular concern to accommodation, food and beverage providers.

Projected price level increase in 2023

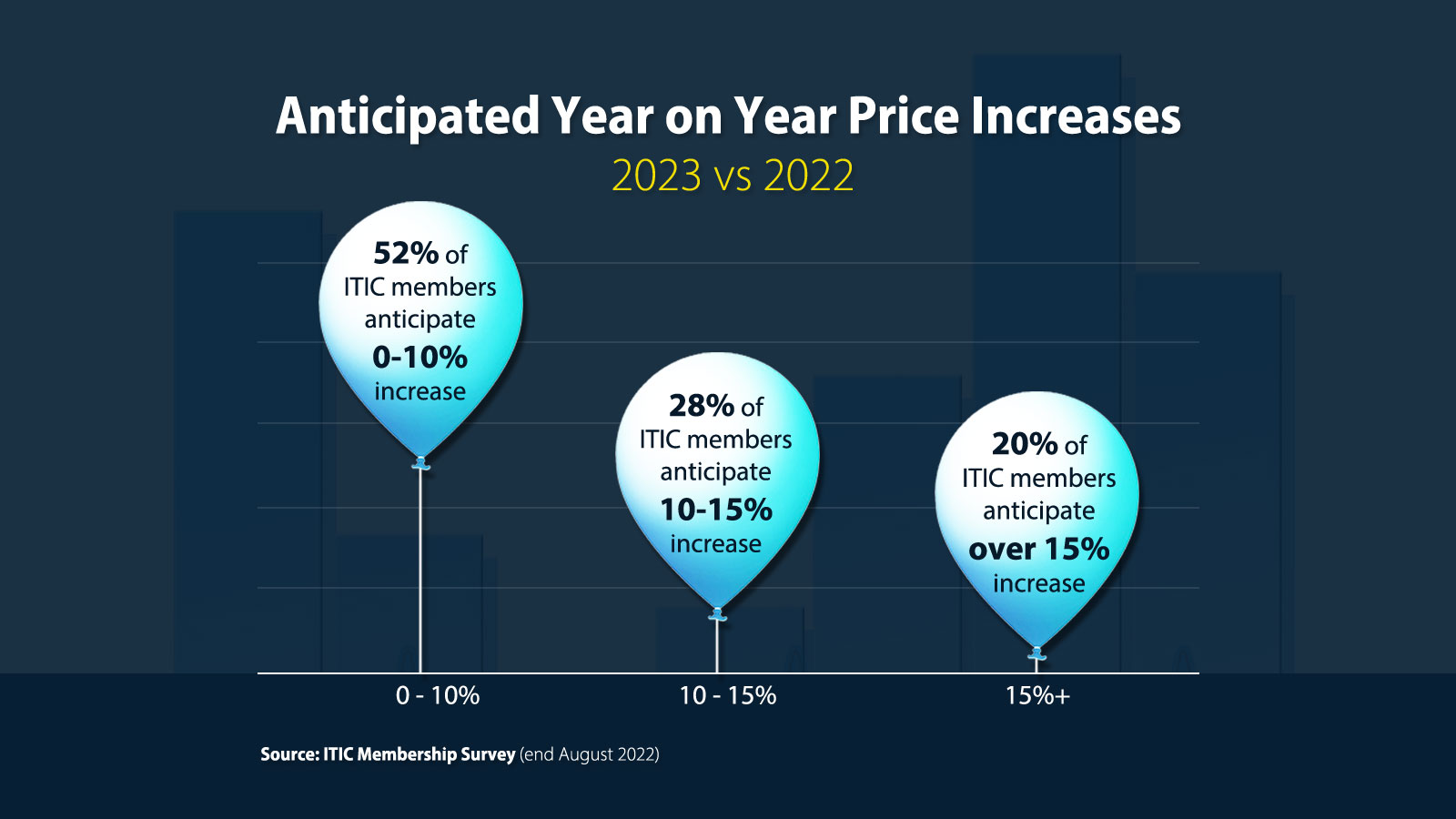

Prices are expected to rise to cover increased input costs that businesses are facing. The majority of sectors indicate an average year on year price increase in the region of 10%, it is apparent that pricing for 2023 and 2024 is very challenging. Tour operators are anticipating price increases of the order of 15% to 20% for business not yet contracted.

Tourism sectors’ expectation of sales in 2023

Due to the range of challenges on the supply and demand sides facing businesses it is perhaps not surprising the majority of those surveyed do not anticipate an increase in revenue next year compared to 2022 despite price increases. Less than two out of five respondents expect an increase in sales for their sector.

Overview of demand in Ireland’s main source markets

Mainland Europe

Key economic outlook

- GDP: forecast for the eurozone has been cut to less than 1% in 2022, with the increasing likelihood of recession. Germany, Europe’s largest economy, is on track to contract for three consecutive quarters in the third and fourth quarters this year and first quarter 2023 with GDP slowing to 0.1% in 2023.

- Inflation: consumer prices expected to exceed 10% in the autumn with a forecast of 6.2% in 2023 with food and energy costs and the weakness of the euro embedded in the projections.

- Interest rates: The European Central Bank has raised interest rates by unprecedented 0.75 of a percentage point to 1.25% to combat soaring inflation, following a July increase of a half-point. The ECB has indicated that it is prepared to increase rates again in October to bring inflation down to its 2% target.

- Unemployment: dropped to a new low at 6.6% in July across the eurozone, with jobless rate in Germany at 2.9% and in France at 7.4%.

- Household spending: soaring energy prices and deepening cost of living crisis are expected to depress consumer activity.

- Currency: The euro has been steadily falling for most of 2022, down by more than 12% against the US dollar to hover around parity recently, as well as sliding in value against other major currencies. The currency has been hit by impact of the energy crisis and the extent to which the ECB’s monetary tightening can halt or reverse the currency’s slide.

Consumer sentiment

Consumer morale in the eurozone’s two biggest economies, and Ireland’s top mainland European source markets, diverged starkly in August, as French consumers benefited from fresh government measures while concerns over rising energy bills hit their German counterparts.

The consumer confidence index for Europe’s largest economy fell well below previous troughs either during the Great Recession in 2009 or at the start of the pandemic in 2020, as Germany faces an energy crisis and inflation hit a near 50-year high of 8.8% in August, which could reach double digits before the year end. Households in Germany are facing higher energy costs with a levy from October to help utilities cover the cost of replacing Russian supplies, forcing many households to put money aside for future energy bills and cut back on discretionary spending.

The French government introduced a series of measures aimed at helping the population withstand rising inflation over the past year. France’s INSEE official statistics agency said its consumer confidence index rose to 82 in August from 80 the previous month – the first rise in consumer morale in seven months. At 6.8% in July, French inflation remains the second lowest in the eurozone after Malta. Consumer spending is expected to grow by 2% annually in 2023 and 2024.

Travel demand

Following a slow restart, the recovery of demand in 2022 from across mainland Europe appears to have been strong, with some market by market variances. The current outlook for 2023, while challenging, is underwritten by an established positive appeal and pent up intent demand. Access to Ireland continues to expand with Ryanair the market leader. The risks to improvement on 2022 levels include a difficult economic period for consumers over the winter/spring period, especially in Germany, Ireland’s top European source market; availability and price of accommodation and ground transportation, particularly for group visits; and negative perceptions of higher prices in Ireland.

Great Britain

Key economic outlook

- GDP: Britain expected to enter into recession in the fourth quarter with the downturn lasting into 2023. Bank of England’s upside forecast is for 0.2% growth in 2023 and 1% in 2024. How the British economy fares in the short to medium term is difficult to predict in advance of the clarity on the new Government’s economic policy initiatives.

- Household consumption forecast is for growth of 3.8% in 2022, growth of 0.3% for 2023 and 1.1% in 2024. Government initiatives, including the capping of energy costs, could boost household spending across the economy.

- Unemployment rate fell to 3.6% this summer, the lowest rate since the early 1970s. The Bank of England warned that a shrinking workforce will make price and wage pressures more persistent.

- Inflation (CPI): The consumer prices rose at an annual rate of 9.9% in August, slowing the July rate. The Bank of England last month forecast inflation to peak above 13% in Q4 2022, before falling to 5% by the end of 2023. The recently announced energy price freeze could stop inflation rising much further in 2022.

- Interest rates: expected to rise to 2% by Q4 2022, and then to 3% in Q4 2023 through 2024 at the same level.

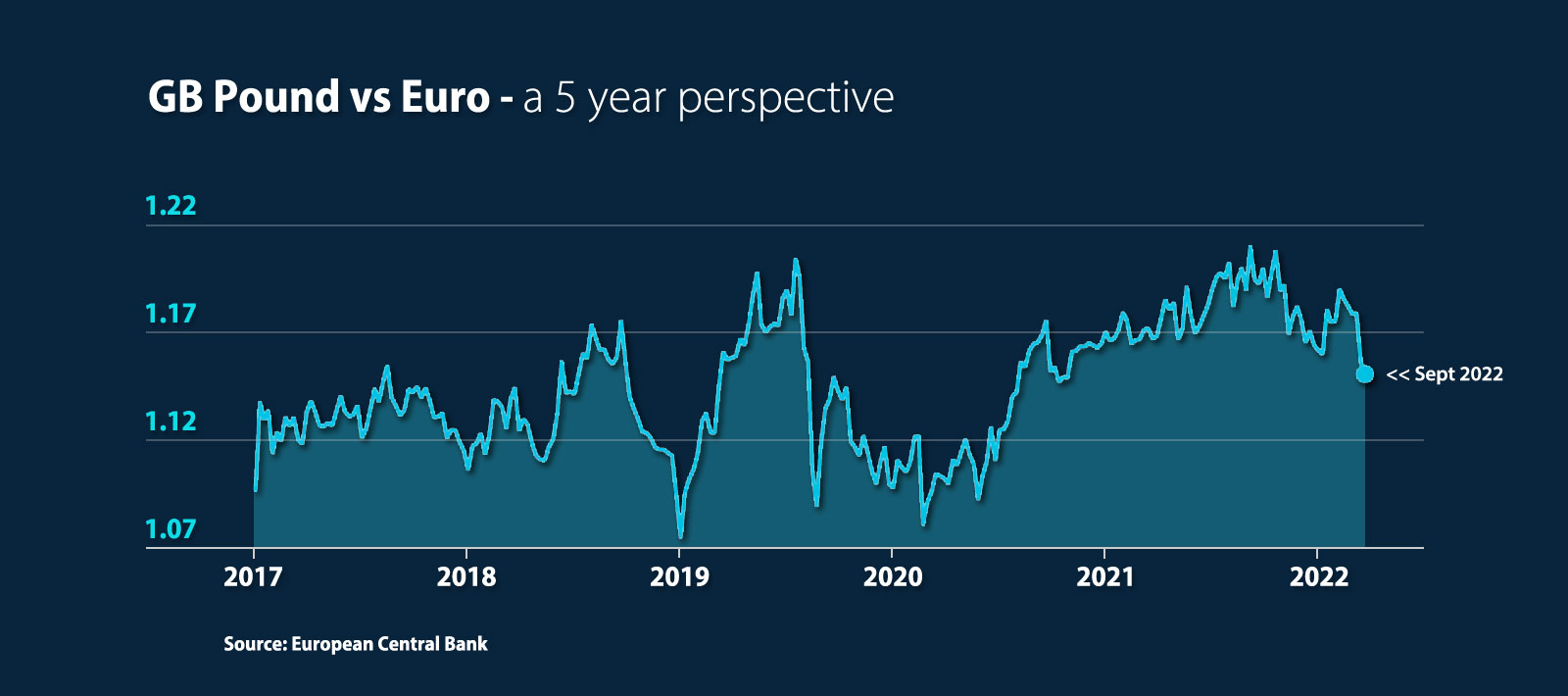

- Currency: Sterling’s weakness is evident against other major currencies, with the pound forecast to trade at record lows against the US dollar in 2023, while predictions for the Pound vs euro shows a fair range with some analysts seeing back towards €1.20, other anticipating a move below €1.10 over the next 12 months.

Consumer sentiment

Although the UK is technically yet to enter recession, consumer confidence in the UK is gloomier than at any time over the past 50 years. The relatively upbeat mood as Britain emerged from lockdown in 2021 had been replaced by deepening pessimism as inflation spirals into double digits and the cost of living reaches a 40-year high.

The latest consumer sentiment barometer for August showed consumers more pessimistic about the outlook for their own finances in the year ahead as a further sharp increase in the energy price cap looms in October, but even more pessimistic about the prospects for the economy.

Higher costs are reducing discretionary spending ability, with retail and hospitality sectors reporting a drop in demand, a trend which is expected to accelerate over the autumn and winter months. The latest flash estimates of consumer spending released from the Office for National Statistics showed that while restaurant numbers did not change in mid August, payments by credit and debit cards decreased by seven percentage points.

Outlook for travel

The prospect of a period of recession in Britain would result in a challenging market for outbound, particularly to non-sun destinations and for short trips outside of the main holiday.

Demand for Ireland, which appears to be lagging the rate of recovery from other European markets in 2022, is facing a difficult year ahead in attracting British visitors. Visits to Ireland include a high incidence of short break leisure trips – a segment of the market which is likely to be depressed and more price sensitive. In addition, demand could be depressed by constraints on availability and price of mid-range accommodation in popular destinations, including Dublin.

Recovery to pre-pandemic levels of leisure and business visits is likely to be protracted over several years.

United States

Key economic outlook

- GDP: Growth forecast at 1.3% in 2022, slowing to 0.2% in 2023. Economists differ on whether or not the US will technically enter into recession, but all forecast that economic weakness will intensify and spread more broadly throughout the US economy in the closing months of 2022.

- Inflation: the pace of consumer price growth unexpectedly rose in August with headline inflation now running at 8.1%. The latest inflation data, higher than forecast, prompted a sharp sell-off on Wall Street and lowering the prospect of a soft landing for the economy.

- Interest rates: the Federal Reserve has raised interest rates four times so far this year in an attempt to cool the US economy and reduce inflation. The goal has been to do this without sparking a recession, thereby creating a so-called “soft landing” for the economy and American consumers.

- Unemployment: Job numbers are expected to remain high in an extremely tight labour market with unemployment in August at 3.7% above market expectations of 3.5%. Near record low unemployment is expected to remaining in the range of 3.6% to 3.8% into 2022 and 2023.

- Consumer spending: consumption is expected to continue to soften in the third quarter due to rapidly rising interest rates and elevated inflation to show a marginal year on year decline by Q4 2022, before recovering to resumption of growth in the second half of 2023.

- Currency: The US dollar is currently at a two decade high against the euro, trading at close to parity. While the ECB’s recent interest rate increase is expected to see the euro push above parity, the short to medium term outlook for the US dollar is still bullish, with forecasts pointing to $1US buying close to €1.05 in mid-2023.

Consumer sentiment

Consumer confidence in the US picked up more strongly than first thought in August, led by an improved outlook for the economy one-year ahead, although the overall sentiment remains extremely low by historical standards. The University of Michigan’s consumer confidence index increased from 51.5 at the end of July to 58.2, across all cohorts thanks to the slowdown in inflation.

However, The Federal Reserve recently warned that American households and businesses should brace for “some pain” as the central bank’s efforts to bring inflation under control were “likely to require a sustained period of below-trend growth.” Consumers are nervous, with polling showing that 70% of Americans are worried about an imminent recession.

Outlook for travel

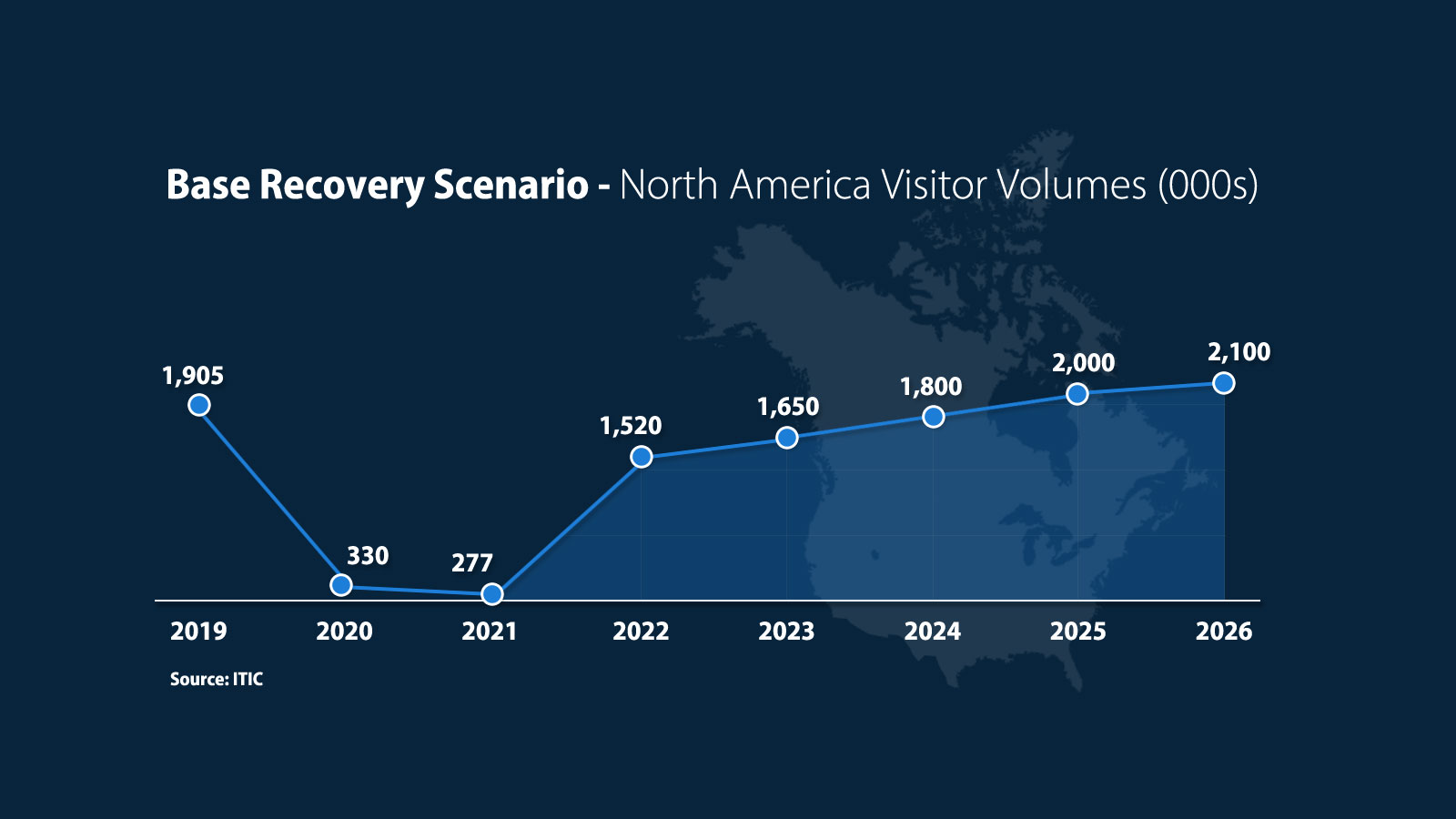

Almost all indicators point to a continuation of a strong demand for travel to Europe, supported by and pent-up demand, a strong dollar, and almost total reinstatement of transatlantic airline capacity and aggressive marketing. A key risk to demand would be marked stock market declines, a broadening of the conflict in Ukraine and any re-emergence of COVID concerns.

Ireland is well positioned to benefit from this demand, with airlift approaching full restoration to 2019 levels and competitive fares. Availability and competitive pricing of hotels, car rental and coaches will be critical to Ireland winning a share of the expected outbound travel to Europe.

Currently the North American market looks like the best growth prospect for tourism in 2023 – a high value source market with broad regional distribution of tourist expenditure.

Projected scenarios for overseas demand

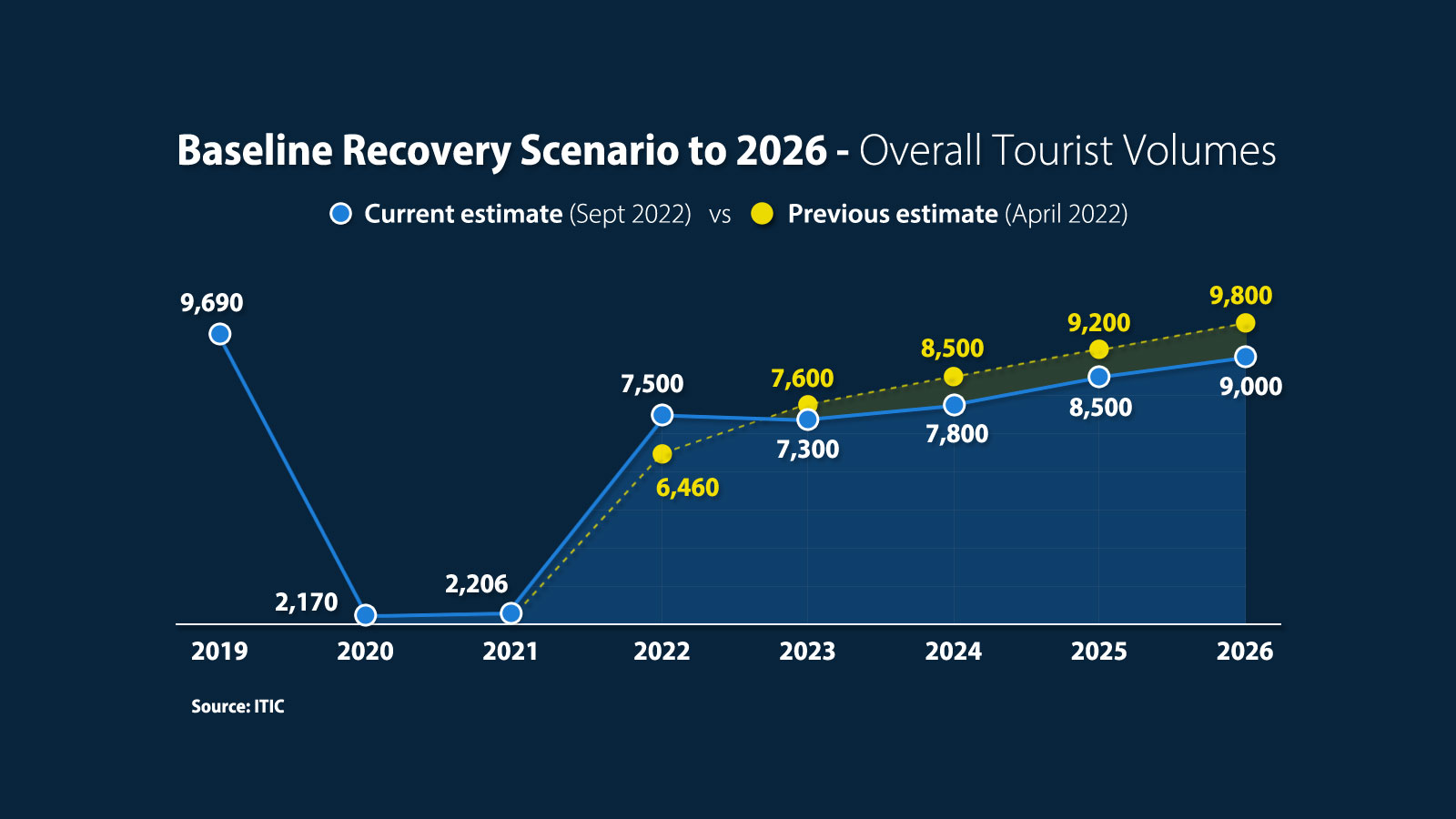

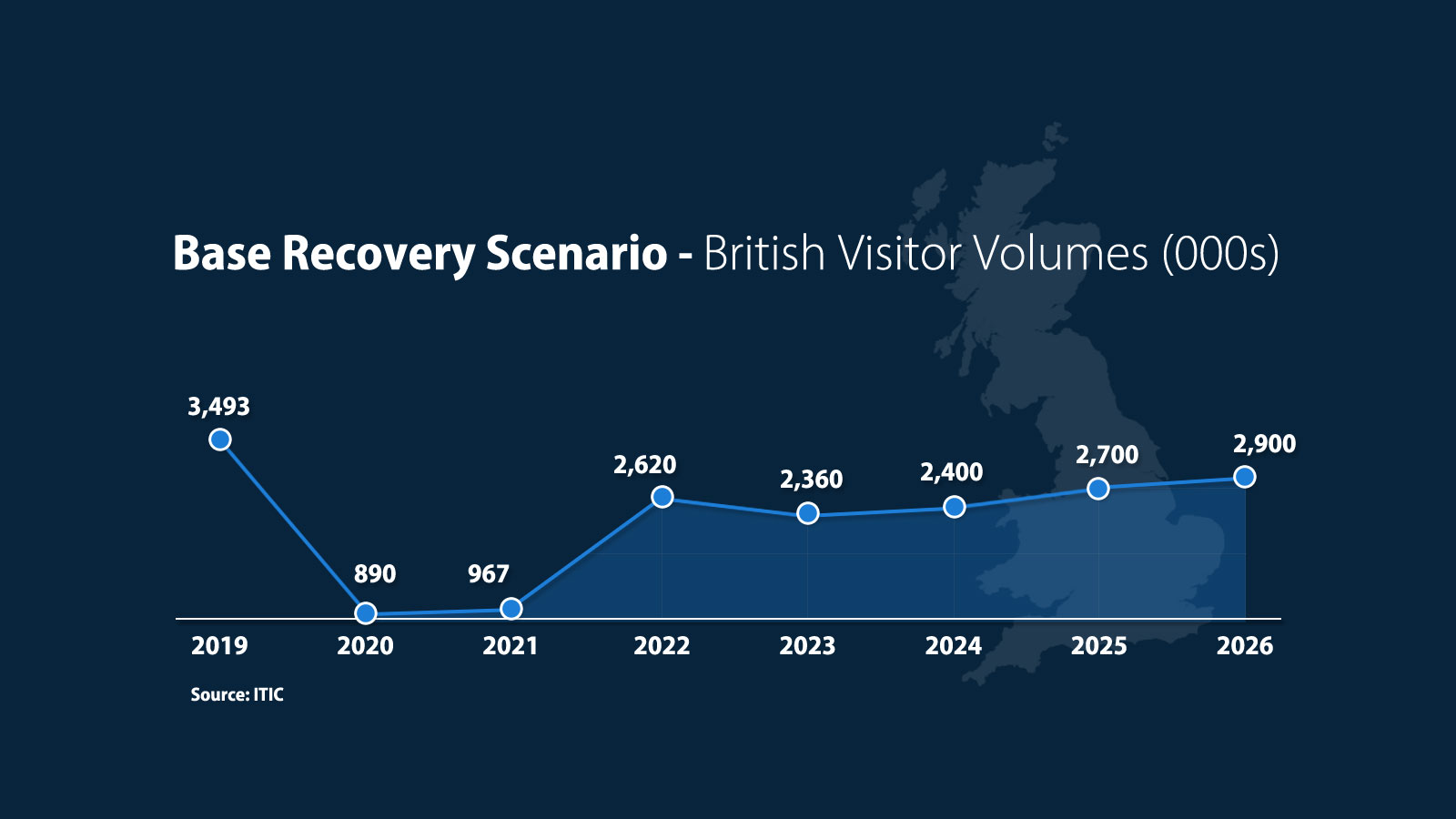

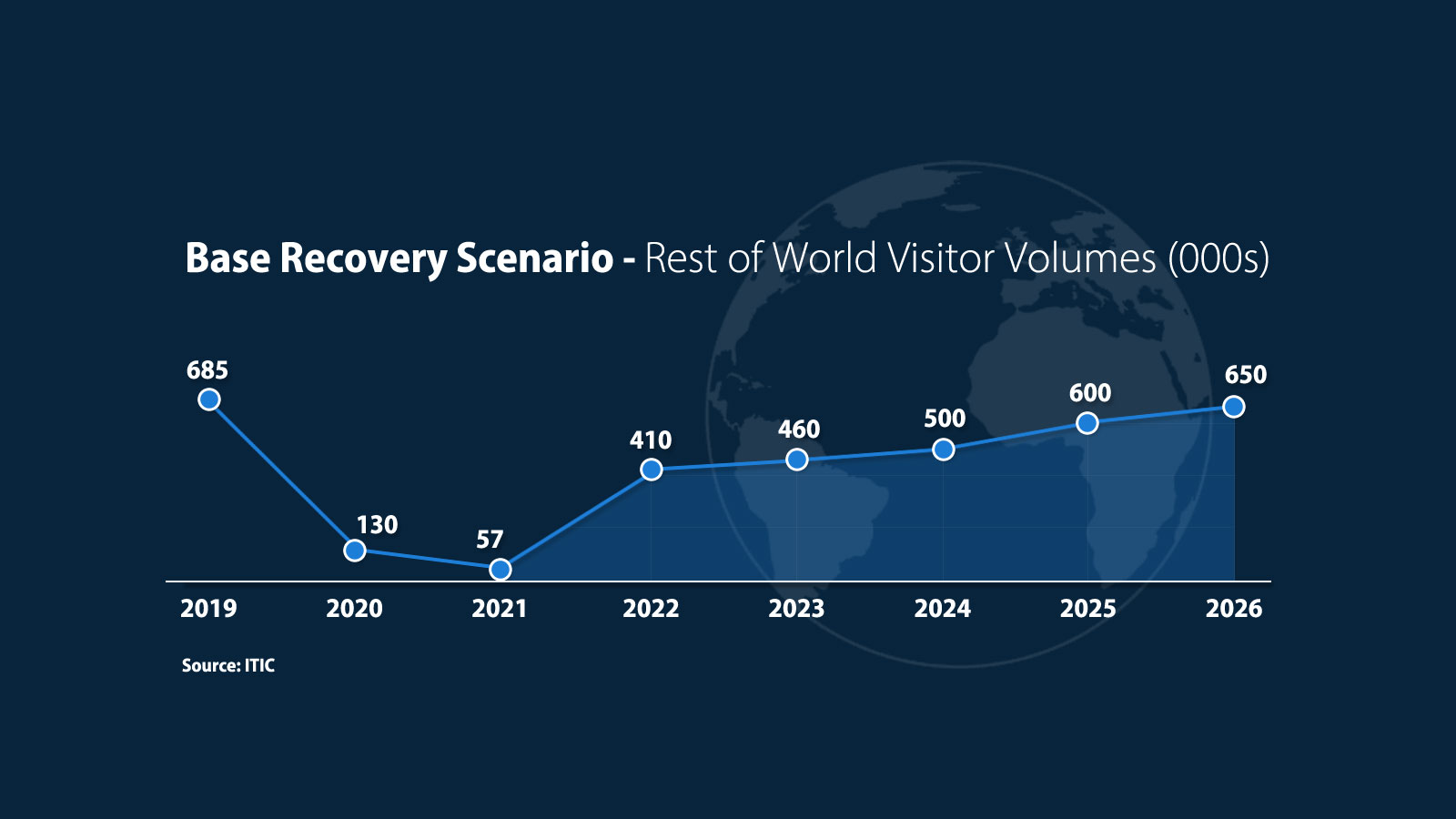

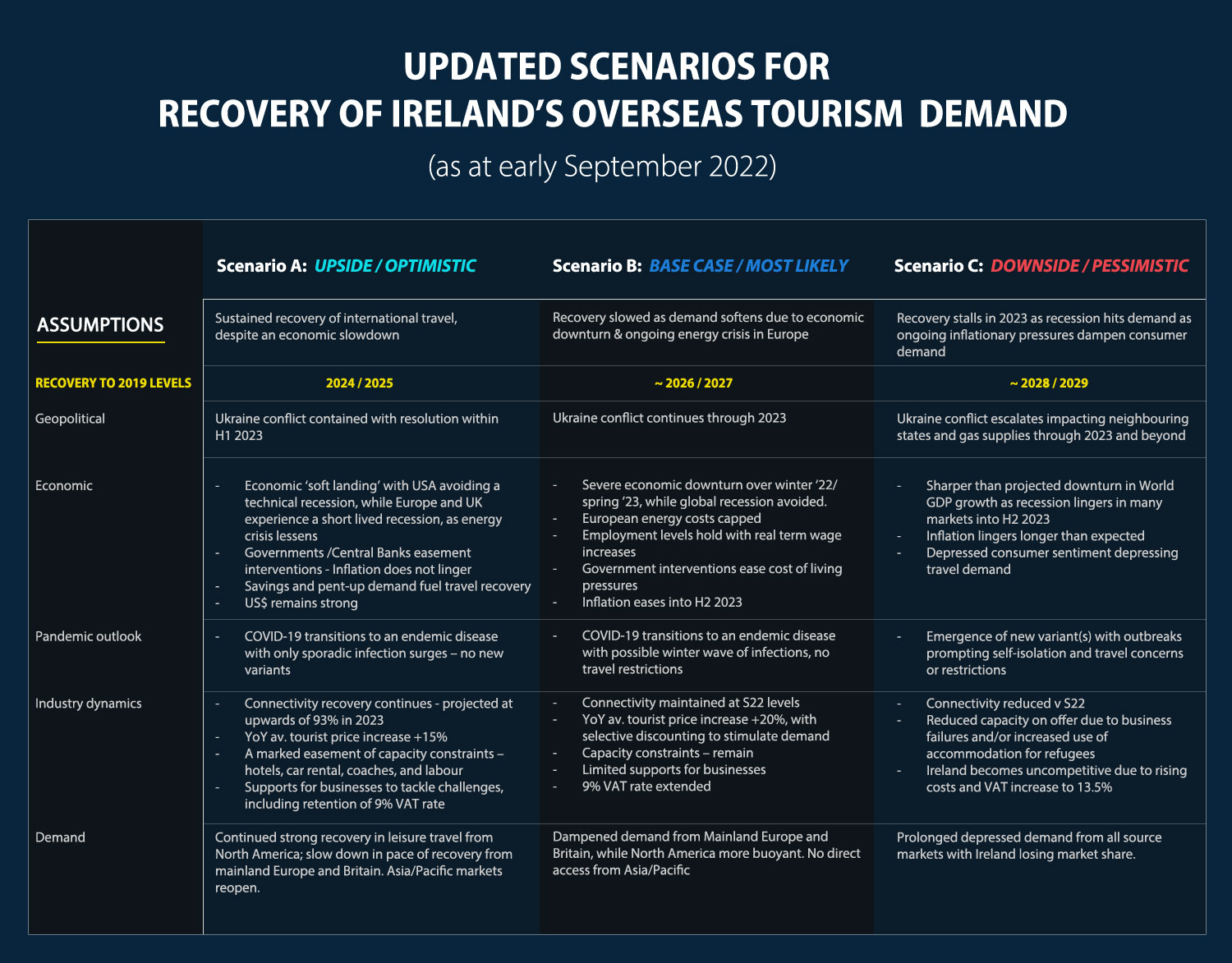

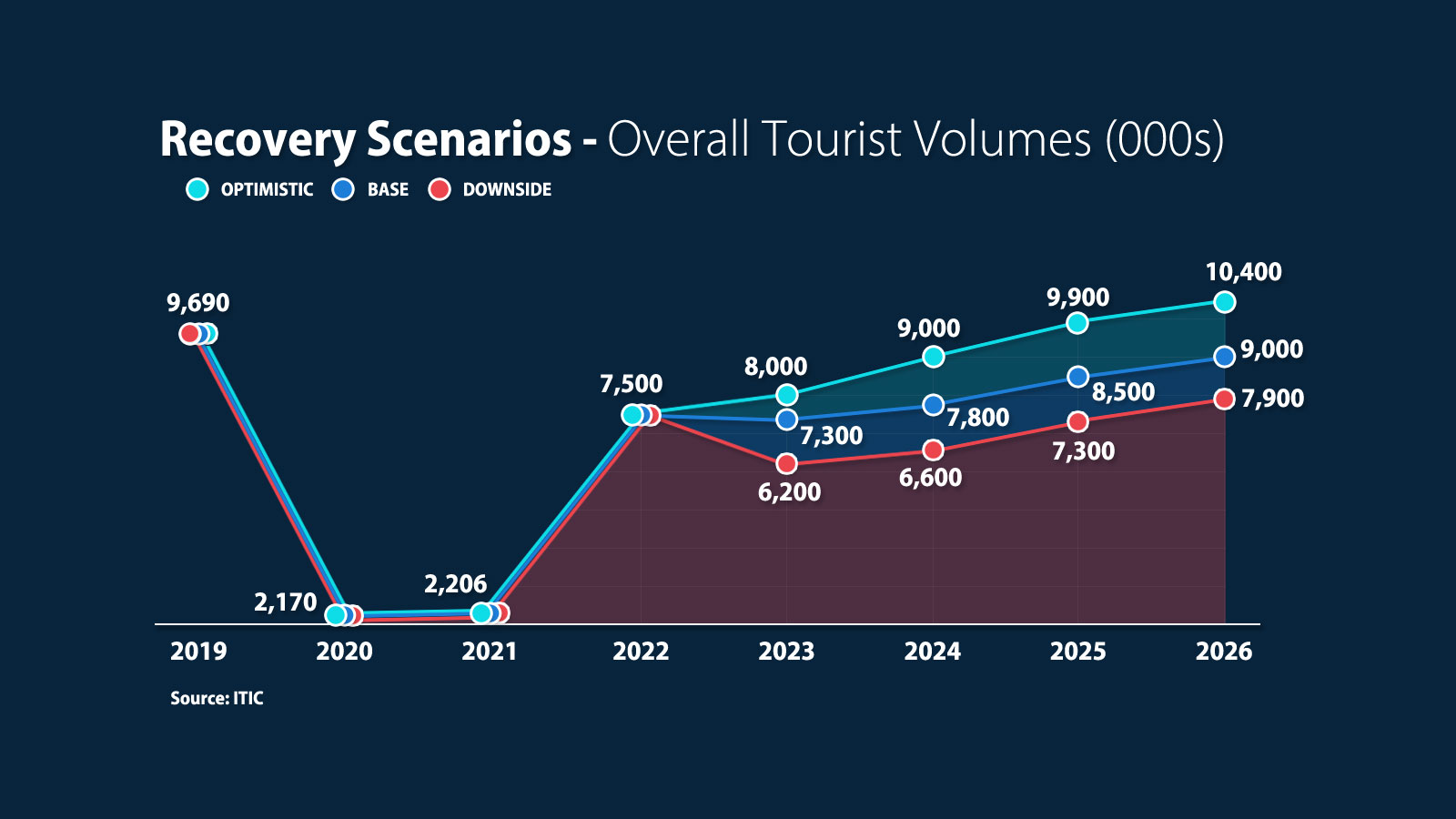

As the prospect of recession looms across most major markets, it is difficult, if not impossible, to forecast the outcome for next year. Hence the outlook for 2023 and the years ahead focus on a number of scenarios with projected demand estimates for tourist arrivals. In its re-calibrated scenarios ITIC is using the base case scenario as the most likely outcome.

Since ITIC’s last estimates in April we now anticipate that 2022 will finish with a significantly higher volume of overseas tourists due to the very strong nature of pent-up demand, deferred bookings and restored air access. However the recalibrated outlook for next year shows a fall of 4% in volume and a slower recovery in subsequent years. Looking at key source market breakdowns ITIC estimates that North America will continue to grow next year but GB and European markets will drag overall recovery down. Full recovery of inbound tourism is not expected until 2027.

Although the base case scenario outlined above is the most likely scenario in ITIC’s opinion as of September 2022, other scenarios have also been considered:

- Upside scenario: provides a more optimistic outlook accounting for economic and marketing consideration across main source markets.

- Base case scenario: reflects the current economic geopolitical trends and expected consumer response based on current indicators.

- Downside scenario: accounts for protracted impacts from the macro-economic and geopolitical events as well as ongoing supply side challenges.

The assumptions underlying the scenarios for the year ahead reflect the context prevailing in early September 2022. Recognising the volatility of the current macro-political and economic environments, the scenarios are subject to change as the demand and operating environments evolve. A more pessimistic outlook reflected in a deeper and longer impact on the global economy and protracted conflict in Ukraine.

A note on Domestic Tourism – Fáilte Ireland analysis

Introduction

This section is credited to Fáilte Ireland and presents a possible path ahead for the domestic market, i.e., trips taken in Ireland by residents of the Republic of Ireland and Northern Ireland.

The assumptions underlying the scenario for the period ahead reflect the context prevailing in September 2022. Recognising the volatility of the current macro-political and economic environments, the situation is subject to change as supply side factors, visitor demand, and operating environments evolve. And COVID remains a major risk consideration.

The Context

The importance of domestic visitors is particularly evident regionally and seasonally.

- Regionally, 84% of all Republic of Ireland domestic trips are to destinations outside Dublin. 75% of Northern Ireland trips here are taken outside Dublin. And 66% of all nights spent in paid accommodation outside Dublin come from the domestic market.

- The home market also has excellent seasonality characteristics, with short trips well spread across the year. 42% of all domestic short trips are taken between the off-season months of October and March.

On the back of strong growth during the last decade, 2019 was a record year for the domestic tourism market, with earnings of €2,548.6 million and total trips of 12.9 million taken in Ireland by residents of the island of Ireland. While not as adversely affected as overseas tourism, the domestic market was badly affected by the pandemic.

Reflecting developments on the inbound side, the outlook for the domestic market has weakened in recent months due to (a) the cost-of-living challenge facing consumers and (b) supply side difficulties impacting operation capacity.

The Scenario

Based on CSO data for Ireland covering 2020 and 2021, trips and earnings both fell sharply during the pandemic and have yet to recover. There is, as yet, no comparable data from NISRA for trips to Ireland by residents of Northern Ireland but the pattern is expected to be the same.

Going on indicative data for 2022, it appears that the home market will again fall short of 2019’s peak. While people’s ability to take trips was heavily curtailed by travel restrictions in 2020 and 2021, the major issue this year is the unprecedented scale of pent-up demand for foreign travel by residents.

The expectation for 2023 is that the global tourism recovery slows as demand softens due to an economic downturn and the ongoing energy crisis in Europe. Recovery to pre-pandemic levels is delayed to 2025 in terms of sectoral revenues.

Core Working Assumptions

- Geopolitical: Russia’s war on Ukraine goes on through 2023 and Ireland continues to receive an inflow of displaced people. Once again, this impacts on the availability of visitor accommodation.

- Economic

- There is an apparent economic downturn over winter 2022 and spring 2023. While a technical recession is avoided because growth remains positive, it does not feel like that to most consumers. The real spending power of wages is eroded by high inflation and consumers feel worse off.

- European energy costs continue to rise, but the worst effects are mitigated by government intervention to control price hikes.

- Economy wide employment levels hold with wage increases, albeit below the rate of inflation.

- Government interventions ease cost of living pressures.

- Inflation eases from the latter half of 2023 onwards.

- COVID: It transitions to an endemic disease with possible winter waves of infections, but importantly there are no travel restrictions within the domestic market.

- Supply Side:

- Accommodation: 5+% of the accommodation base is unavailable for use in 2023 by tourists as it is given over to house displaced Ukrainians and others seeking protection in Ireland.

- Staff: The industry’s staffing challenges are largely resolved over the course of 2023.

- Demand Side: Reduced spending power hits tourists’ ability and willingness to spend on tourism, which delays recovery to pre-pandemic levels.