Tourism – Ireland’s most important indigenous industry

08 APRIL 2025

INTRODUCTION

The recent global economic shock caused by President Trump’s tariffs has caused significant uncertainty to Ireland’s export industries and FDI model. Whether there is a negotiated settlement between the EU and US or retaliatory tariffs are imposed in an escalating trade war, there is increasing nervousness about the coming months. The Irish tourism sector, although not subject to tariffs, will be impacted as the American economy struggles to adjust with dollar fluctuations and stock market volatility likely to affect travel decisions by US consumers. The Irish Tourism Industry Confederation (ITIC) will be monitoring the situation closely in the coming weeks, discussing pipeline of business with members and conducting scenario planning.

The Irish Government, like many others, will be anxious to minimise the fallout from this new economic environment. To that end there is a strong argument for a renewed focus and attention on indigenous Irish industries – nurturing them, bolstering their competitiveness, and ensuring that policies are in place to support them during these challenging times.

Ireland’s tourism and hospitality sector has long been known as the country’s largest indigenous industry and biggest regional employer. This is underpinned by a variety of data sources including recent bespoke research by Jim Power Economics for ITIC.

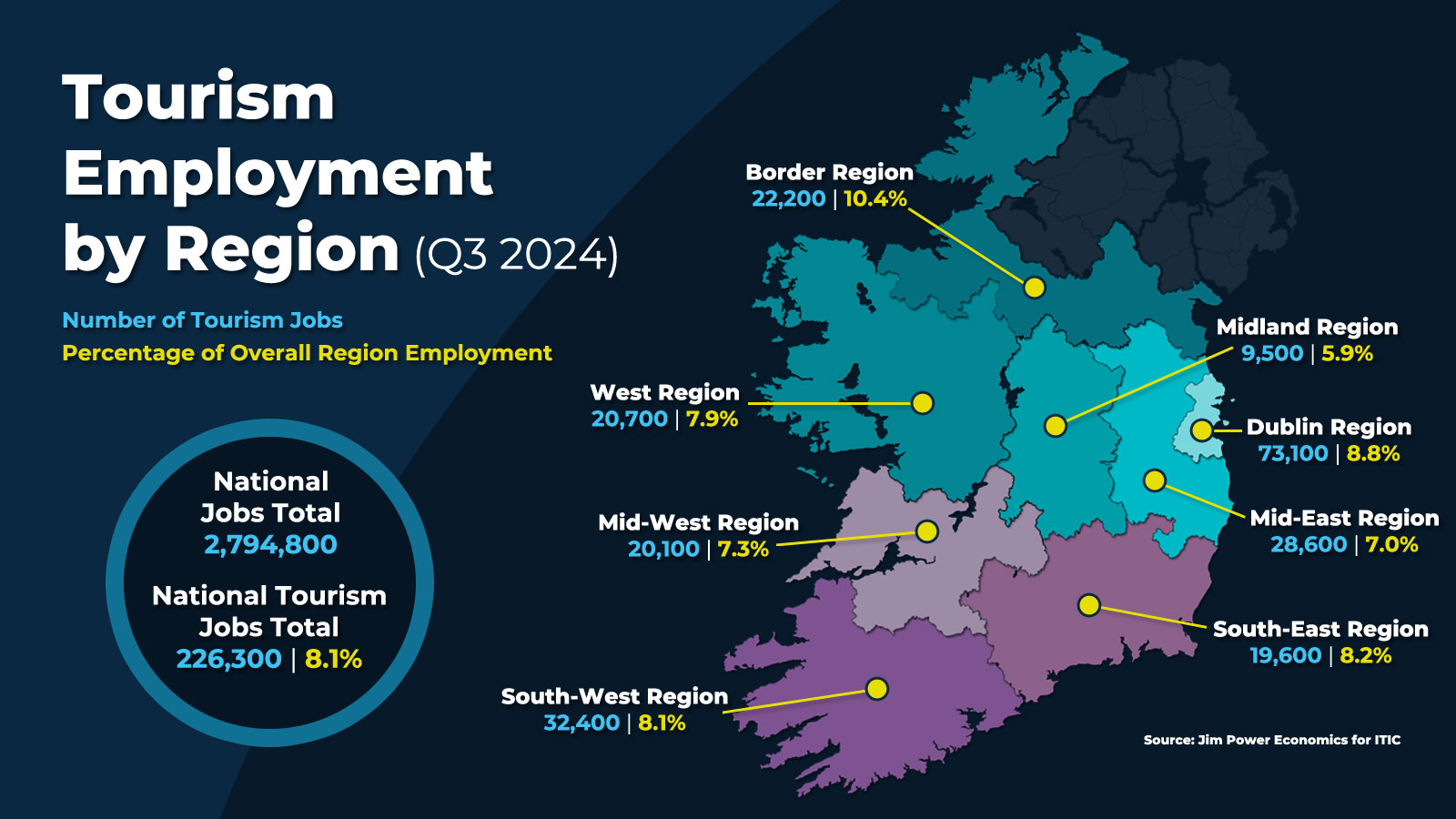

Indigenous industries, which are predominately made up of SMEs, have arguably become more important to the Irish economic model now that new tariffs risk undermining our FDI success. Tourism has always been a very important component and driver of economic activity in Ireland. Its real significance is that of a major engine of employment at a regional level. The industry can provide jobs in parts of the country that other sectors can’t reach and is consequently an important driver of the balanced regional economic growth. The revenue generated by both domestic and foreign visitors during their trip contributes to both the balance of payments and national accounts data.

Analysis for Fáilte Ireland, by Indecon Economic Consultants, estimates that for every €1 spent by inbound and domestic visitors, 29c comes back to the Exchequer, once taxation from the wider impacts of tourism is considered, i.e. allowing for direct, indirect and induced spending. It is estimated in 2024 that the sector – both domestic tourism and international visitors – was valued at over €10 billion suggesting that the exchequer benefits to the tune of €2.9 billion. It should be noted that Budget 2025 allocated €251 million for tourism services – the return on investment in tourism by the Government is self-evident and incontestable.

Ireland’s most important indigenous industry

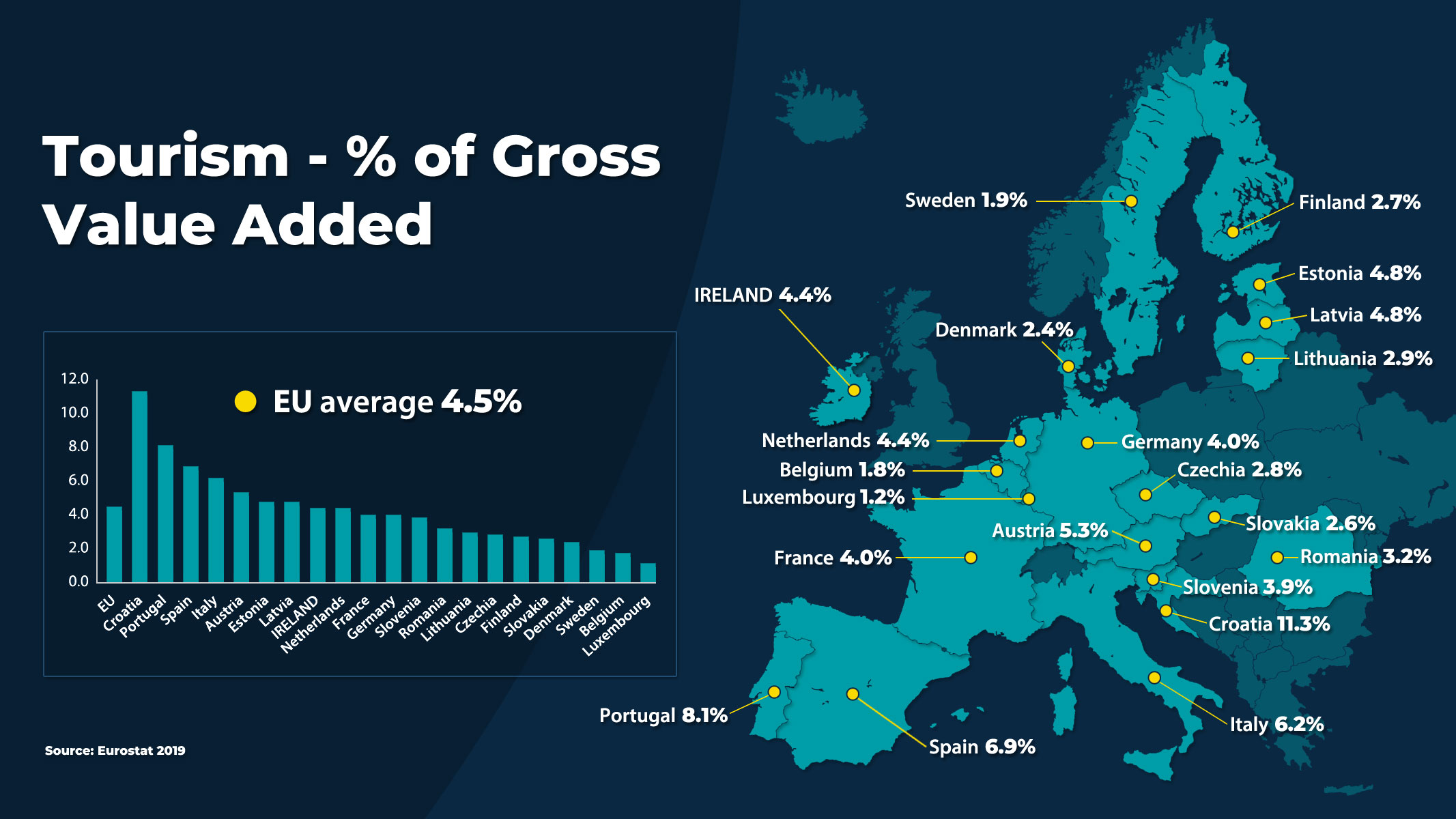

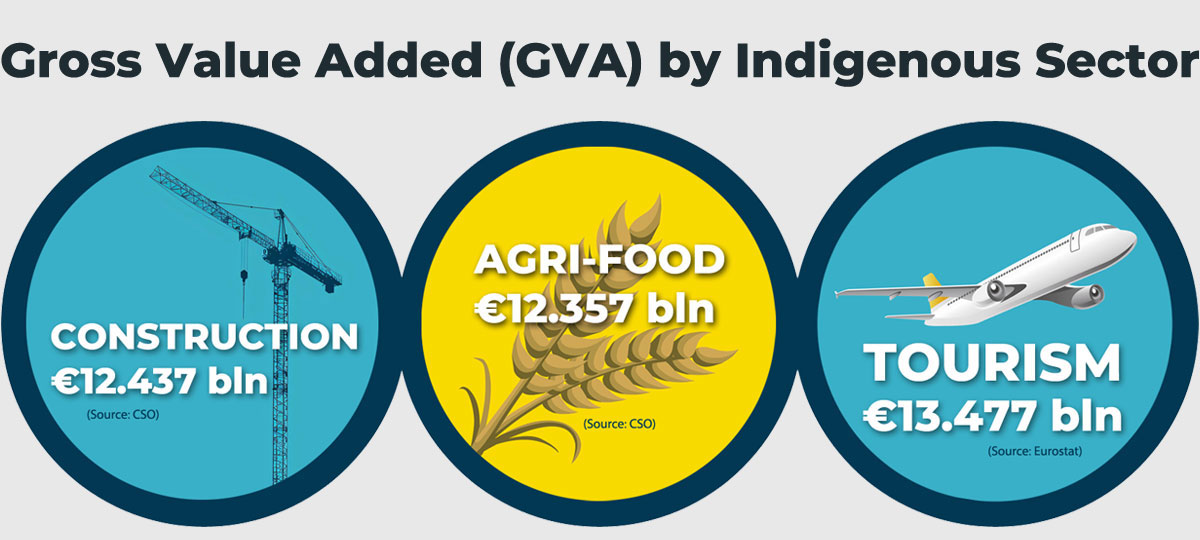

Although up-to-date comparisons can be complicated for a variety of reasons, using Eurostat and CSO data Jim Power Economics identifies tourism (inclusive of fares to carriers) as being Ireland’s most valuable indigenous industry.

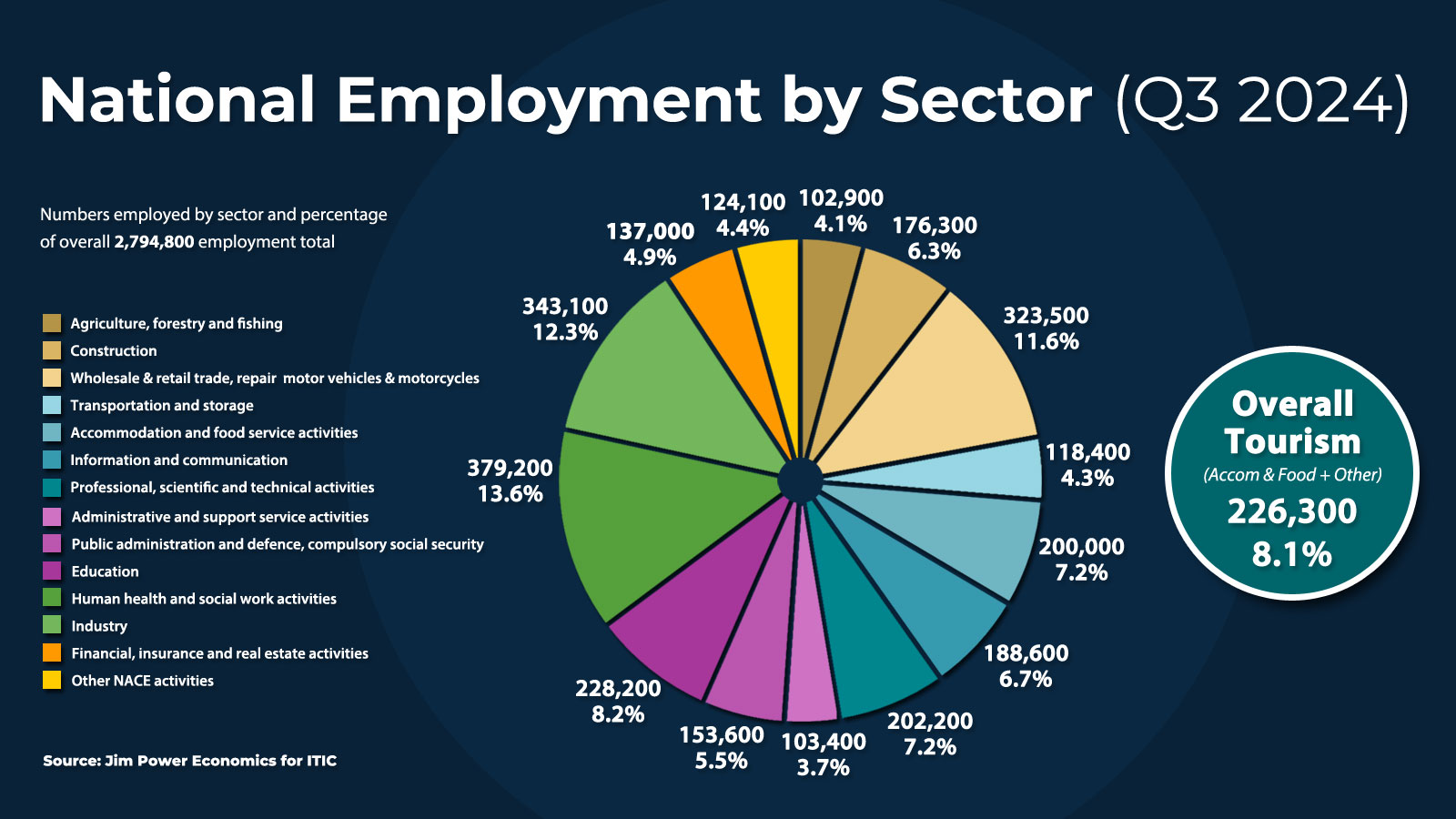

This is further supported by the CSO’s most recent Tourism Satellite Account which albeit in 2019 identified a labour intensive sector such as tourism and hospitality contributing 13% of jobs nationally compared to constriction at 6% or agriculture at 4%.

Meanwhile latest available comparable data from Eurostat shows that Irish tourism’s % of Gross Value Add was 4.4%, comparable to the EU average, and more than France and Germany.

Tourism’s magic power – employment numbers

The Central Statistics Office (CSO) produces an estimate of employment that differs from the traditional Labour Force Survey (LFS). It utilises the Revenue Commissioners’ PAYE Modernisation tax data to develop a timely, objective employee headcount. Estimates are available for what the CSO refers to as ‘Tourism Industries’, a more inclusive measure to that of Accommodation & Food Services derived from a list of activities developed by the statistical office of the European Union, Eurostat. Fáilte Ireland, the National Tourism Development Authority, has adopted this measure as their preferred method of estimated sectoral employment. Tourism Industries’ employee headcount was estimated to be c.226,700 in Q3 2023 and 226,300 in Q3 2024.

Tourism industry employment is derived from a list of activities developed by Eurostat. These include:

Throughout the regions in Ireland tourism’s punches well above his weight.

SME strength

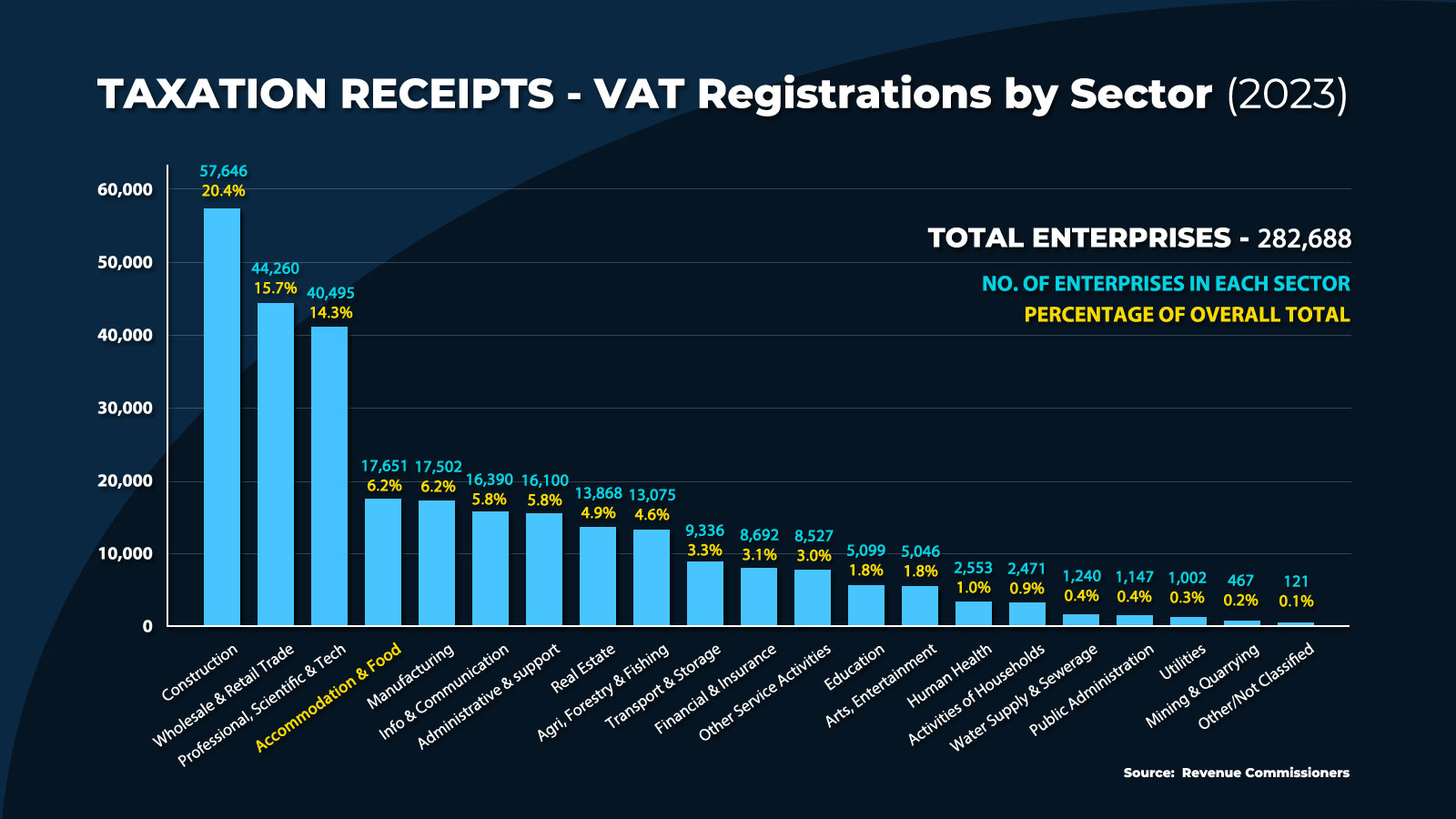

The vast majority of tourism and hospitality businesses throughout the country are SMEs, traditionally thought of as the backbone of the national economy.

The CSO identifies 20,213 businesses involved in Accommodation and Food Services as of 2022. However based on the employment multiplier, it is estimated by Jim Power Economics that in 2022, that around 25,500 enterprises of various sizes were operating in the tourism sector.

Tourism Earnings

According to the CSO average hourly earnings in the accommodation and food services sector are €16.80. The sector is characterised by a high level of part-time and seasonal work, and a lot of students= workers. Average earnings in the overall tourism sector are estimated by Jim Power Economics to be circa €22 per hour.

In the 4th quarter of 2024, 20.9 per cent of workers in the economy were part-time. Part-time workers accounted for 35.2 per cent of workers in the Wholesale & Retail trade, and 43.2 per cent of workers in the Accommodation & Food Services sector. This level of part-time workers is likely to be quite representative of the overall tourism sector.

In the 4th quarter of 2024, 136,200 students were employed across the economy. This is equivalent to 4.9 per cent of total employment in the economy. Out of this total number of students employed, 31.6 per cent were employed in the Wholesale & Retail sector, and 30.5 per cent were employed in Accommodation and Food Services.

Within the Accommodation & Food Services sector, 41,600 students were employed, which is equivalent to 22.6 per cent of total employment in the sector. In the Wholesale & Retail sector, students accounted for 13.2 per cent of total employment.

The role of the tourism sector and the retail sector in terms of providing part-time employment and employment for student is a very positive attribute of those two sectors. As well as providing earnings, it also suits certain lifestyle choices, and exposes employees to customer service at a very young age. This is a skill that proves very beneficial in any subsequent career choice.

Taxation Receipts

There are 17,651 enterprises in the Accommodation & Food Services sector registered for VAT. Jim Power Economics estimate that the overall total in the tourism sector is likely to be around 19,400 businesses.

The Accommodation & Food Services sector accounted for €987 million in VAT receipts. For the overall tourism sector, as estimated by Jim Power Economics, the total VAT contribution is likely to be around €1.09 billion annually.

In terms of corporation tax receipts SMEs account for 15% of net corporation tax receipts of €3,576 million. Accommodation & Food Services accounted for 1.1% of total (€261 million). The overall tourism sector is therefore likely to account for around €285 million in corporation tax receipts or 1.2% of the total.

CONCLUSION

Tourism has been rightly elevated by the new Government and Minister Peter Burke heads up a newly configured Department of Enterprise, Tourism and Employment. As we enter a period of intensive geo political and macroeconomic uncertainty, it is vital that tourism priorities within the Programme for Government are implemented urgently – these include the lifting of the Dublin Airport passenger cap, the restoration of the 9% VAT rate for hospitality, reform of Employer’s PRSI taxes and an SME stress-test for any new labour legislation.

Fáilte Ireland data shows that for every €1 million of tourist expenditure helps to support 22 employees in tourism industries. Tourism is too important to take for granted and all the available data from a variety of sources confirms this. Unlike other industries it can’t be outsourced, offshored or repatriated – it is here to stay and needs to be nurtured and supported.